Amazon Pay is trusted but limited, especially for sellers of digital products. Discover why Whop Payments stands out as the ultimate alternative for global businesses, offering flexibility, fast payouts, and secure transactions.

Key takeaways

- Amazon Pay boosts conversions for Amazon shoppers but limits your audience to those with active Amazon accounts.

- Strict acceptable use policies and limited payment options make Amazon Pay unsuitable for many digital products and services.

- Consider alternatives like Whop Payments for broader payment methods, faster payouts, and more checkout control.

Is Amazon Pay the best payment processor for an online business?

Short answer: Amazon Pay can lift conversion for shoppers already signed into Amazon, but it’s not a one-size-fits-all solution.

It’s fast and familiar, yet limited by eligibility, ecosystem lock-in, fees, and less control over your checkout experience.

In this guide, you’ll learn how Amazon Pay works, where it fits (and where it doesn’t), plus a quick step-by-step setup.

We’ll also compare five strong alternatives, including Whop Payments, which adds 100+ methods (cards, wallets, BNPL, crypto), global payouts, and a seamless checkout you control.

By the end, you’ll know when Amazon Pay makes sense and when to choose a broader, conversion-first stack like Whop.

What is Amazon Pay?

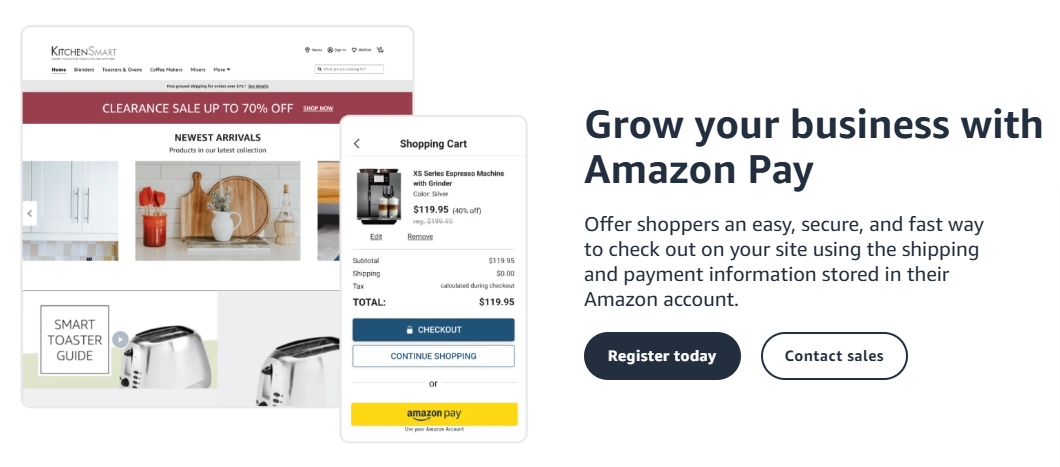

Amazon Pay is a payment processing solution that can be embedded into a third-party ecommerce site. This allows customers to pay for items using the details stored in their Amazon account.

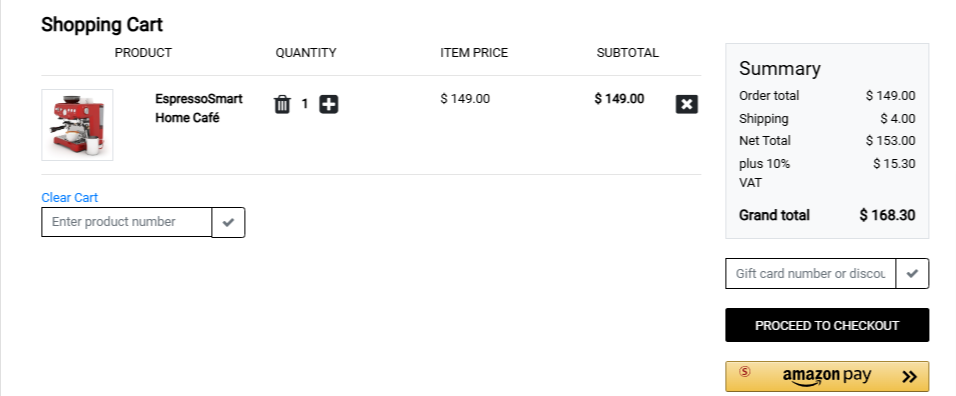

For example, if you have a Shopify store, you can add an Amazon Pay button to your product pages. A customer sees this option and can choose to complete their purchase in one click.

The payment method they have on file with Amazon will be charged, and the money will be transferred to the seller (minus any fees).

Amazon Pay can be used for:

- Physical products

- Recurring monthly subscriptions

- Digital products

- One-time payments

- Charitable donations

- Pre-orders

- Cross-border payments (in one of the 12 accepted currencies)

- Paying utility bills (only with participating service providers)

- Buying goods in selected physical stores (via a QR code)

Another way to use Amazon Pay is to embed it directly in a website checkout page via an integration with Stripe.

Amazon Pay: What sellers need to know

Amazon Pay gives sellers access to one of the most trusted names in ecommerce. It’s easy to integrate, works with major platforms (and even Stripe), and can boost conversions by letting shoppers check out with their existing Amazon credentials.

The catch: only Amazon customers can use it. That means expired cards or outdated details on their Amazon account can trigger failed payments.

Sellers also have to apply and pass Amazon’s “acceptable use” review before approval.

Payouts can take up to five days unless you qualify for Express Payout, and the system is primarily built for physical-product transactions, not digital offers or memberships.

In short, Amazon Pay can reduce cart abandonment and add convenience for shoppers – but for digital creators and businesses, it doesn't offer complete control, faster payouts, or broader payment options.

Pros and cons of Amazon Pay

| Pros | Cons |

|---|---|

| ✅ Trusted by customers | ❌ Customers need an Amazon account |

| ✅ Integrates with online retail platforms | ❌ Retailers need to apply for Amazon Pay |

| ✅ Stripe integration | ❌ Credit/debit card payment only |

| ✅ Zero set-up or monthly fees | ❌ Transaction/processing fees apply |

| ✅ Easy to integrate | ❌ Long payment times / complex process |

Want to dive deeper into Amazon Pay? Keep reading.

How does Amazon Pay work for businesses?

Businesses located in one of the eligible countries can apply to register for Amazon Pay.

Even previously approved Amazon sellers have to register their businesses separately to use Amazon Pay. This is because of the restrictions on certain products - known as the "acceptable use policy" (more on this below).

At the time of writing, the eligible countries are:

- U.S.

- U.K.

- Austria

- Belgium

- Cyprus

- Denmark

- France

- Germany

- Hungary

- India

- Ireland

- Italy

- Luxembourg

- Netherlands

- Portugal

- Spain

- Sweden

- Switzerland

- Japan

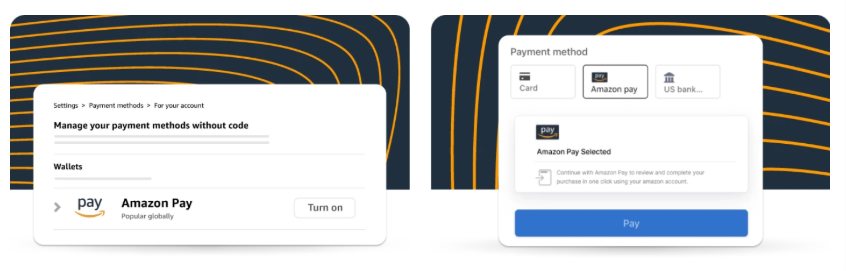

Once sellers have been approved for an Amazon Pay merchant account, they can embed the Amazon Pay button on their product pages and checkout or enable the option in their Stripe account.

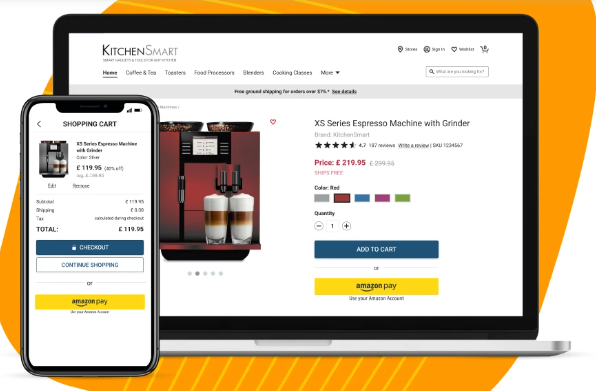

As well as websites, Amazon Pay works on mobile.

Whop Payments works in 190+ countries, supports 100+ payment methods, and offers faster global payouts — all with simpler, lower fees.

How do customers enable Amazon Pay?

To use Amazon Pay, customers just need an active Amazon account with at least one valid debit or credit card linked.

Their saved payment and shipping details are used automatically at checkout—no need to re-enter card information.

Amazon Pay is free for customers and doesn’t require a separate signup. They simply click the “Amazon Pay” button wherever it appears.

Although business availability is limited to certain countries, buyers worldwide can use Amazon Pay.

The only catch? It supports debit and credit cards only (Amazon gift card balances can’t be used). For security, full card details are never shared with the seller, only with the payment processor (Visa, Mastercard, AMEX, etc.).

How popular is Amazon Pay among customers?

Amazon Pay’s visibility is high, but its usage remains relatively modest compared to other digital wallets.

In the U.S., 21% of shoppers who made digital payments used Amazon Pay as of 2022. While that number provided early traction, more recent figures show that adoption has grown mainly through increased transaction volume rather than user share.

By 2023, Amazon Pay’s global transaction volume surpassed $100 billion, reflecting steady growth, though it still trails leaders like PayPal and Apple Pay in everyday use.

In many markets, Amazon Pay accounts for roughly 1% of online vendor transactions, highlighting that awareness outpaces active use.

What is Amazon Pay’s acceptable use policy?

Amazon Pay has a detailed Acceptable Use Policy that restricts a wide range of products and services. Below is a summary of the main prohibited categories:

| Category | Examples of Prohibited Items |

|---|---|

| Illegal or offensive content | Sexually explicit material, drugs, weapons, explosives, or anything deemed offensive by Amazon |

| Regulated goods | Tobacco, alcohol (if unlawfully sold), or other restricted products |

| High-risk services | Crowdfunding sites, gambling, or investment schemes |

| Misleading or unsafe products | “Miracle cures” or unsupported health claims |

| Geographical restrictions | Products made in or shipped from restricted countries or regions |

| Controlled substances | Products containing marijuana or CBD, even if legal locally |

There is a wide net of prohibited items that may prevent a seller from enabling Amazon Pay for their customers, even if the goods are being sold legally.

As part of the registration process for an Amazon Pay account, Amazon will look at the seller’s website to ensure it adheres to the accepted use policy.

To be clear, this list relates to what’s sold on external sites, not on Amazon. If you want to sell directly on Amazon, there is a separate list of prohibited items.

Amazon Pay's top features

Now you know how Amazon Pay works, let’s take a closer look at the various features. We start with one of the most important, namely the integrations.

Integrations:

Amazon Pay has developed partnerships with a number of ecommerce platforms. The main ones are:

✅ Shopify

✅ WooCommerce

✅ PrestaShop

✅ BigCommerce

✅ Adobe Commerce

Eligible sellers who have built stores on these platforms can integrate Amazon Pay.

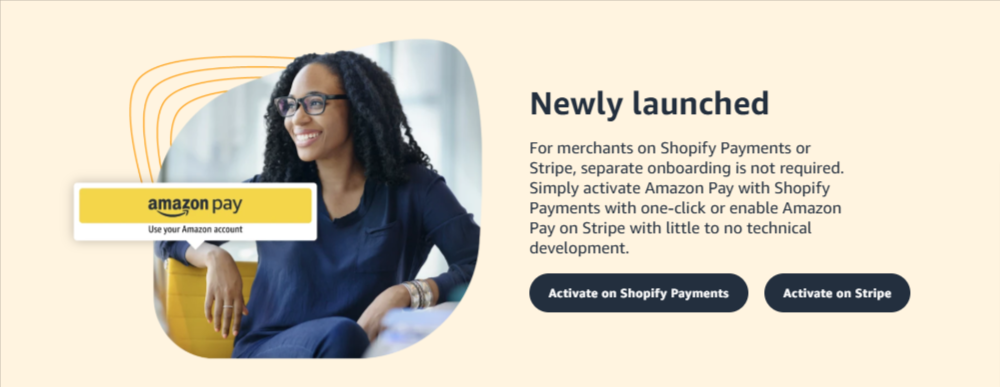

Another key integration is Stripe, one of the leading names in the world of online payment services. This opens up Amazon Pay to a range of other sellers, such as online marketplaces and WordPress websites.

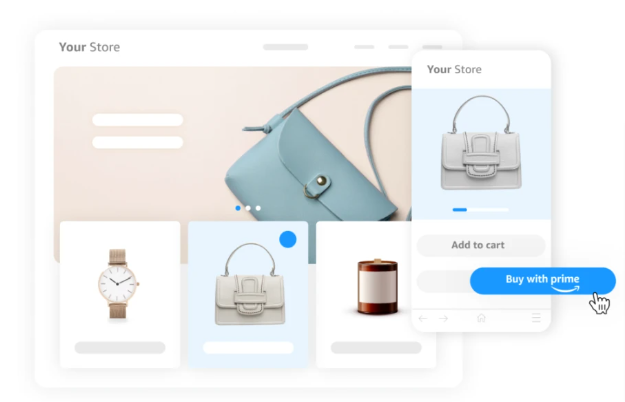

Buy with Prime:

Certain online sellers who use Amazon Pay can take advantage of Amazon Prime through a Buy with Prime account. This lets customers who are Prime members enjoy the benefits, such as fast, free delivery on a third-party website.

To offer Buy with Prime, sellers don’t have to sell items directly on Amazon. However, they must open a Multi-Channel Fulfillment account with Amazon and keep goods at Amazon fulfillment centers.

This is to make sure orders are fulfilled on the same terms as all Prime orders. Subscriptions and recurring payments aren’t currently supported on Buy with Prime.

Amazon Pay with Affirm:

Amazon Pay has partnered with buy now, pay later (BNPL) provider Affirm to give sellers the ability to offer their customers the option to pay in installments.

This has limited availability, including that it can only be used for one-time payments to buy physical goods. Sellers also need to have the latest version of the Amazon Pay checkout installed on their site (currently Amazon Pay Checkout V2).

Did you know you can offer BNPL with Whop? It's just another reason thousands of creators trust us.

Other features of Amazon Pay

Sellers who sign up to use Amazon Pay can tap into a range of other features, such as:

- Alternative payment methods: This lets customers shop with their Amazon and Prime Visa and store cards at online retailers that use Amazon Pay.

- Express Payout: U.S. retailers who use Amazon Pay and one of the partner banks can opt into this service to receive their payments from shoppers quickly.

- Pay Invoices with Amazon: This is a WordPress plugin that lets businesses offer Amazon Pay as a payment option to settle invoices.

- Fraud protection: Amazon Pay incorporates fraud protection technology to identify suspicious behavior and high-risk transactions.

- Payment Protection Policy: Under certain conditions, Amazon Pay will protect merchants from charge disputes (or “chargebacks”).

Using Amazon Pay for your business: Step-by-step guide

Let’s take you through the process of signing up for Amazon Pay.

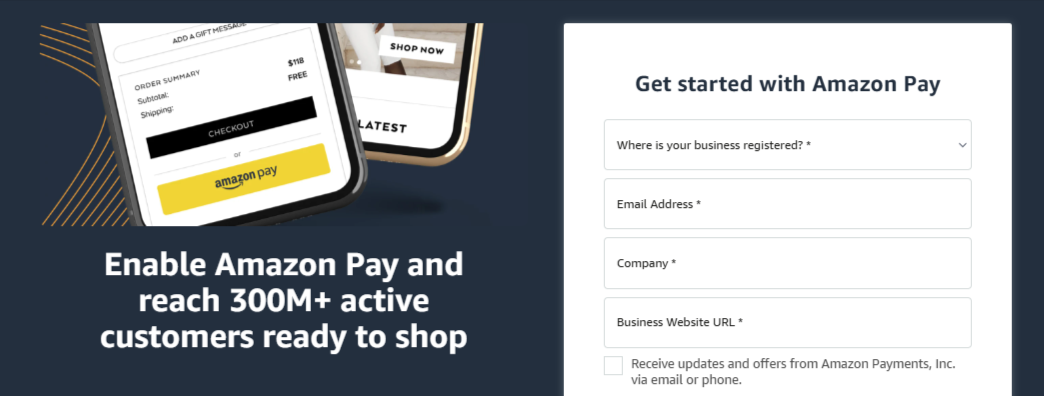

1. Apply for an Amazon Pay merchant account

This involves filling out a form, which Amazon will review before approving the application. Details to provide include the location of the business to make sure it’s in one of the eligible countries.

2. Provide the required documentation

To use Amazon Pay, U.S. merchants must submit documents confirming their business location and identity, including one or more of the following

- U.S.-based phone number

- credit card issued by a U.S.-based bank

- checking account with a U.S.-based bank

- business taxpayer ID

- employer identification number

- personal social security number

3. Activate or integrate Amazon Pay

Once approved, you can start adding Amazon Pay to your ecommerce site. The integration process differs slightly depending on the type of payment (one-off, recurring, etc.) and the platform.

The Amazon Pay button can be added to checkout pages and product pages, with customization options available, such as adding the customer’s name.

For Shopify and Stripe users, getting started is as simple as activating Amazon Pay.

4. Keep track of Amazon Pay payments & disbursements

Merchants who use Amazon Pay get access to a Seller Central dashboard, where they keep track of payments, refunds, and other account details.

One important thing to do is to set up your account to receive the money from your customers’ orders. This requires setting up an ACH-enabled checking account and submitting details of a valid credit card number.

Good to know: ACH stands for Automated Clearing House. It’s a U.S. network that allows bank-to-bank transfers. Most (but not all) of the country’s banks are ACH-enabled, plus some payment processors, such as PayPal and Stripe.

You’ll also need to set your “Capture” preferences. This determines when the payment is collected from the buyer. You’ll typically want to capture the full order amount at checkout. However, there will be exceptions.

The Capture process holds the money in your Amazon Pay account. You can then request a payout (disbursement) from Amazon. Payment times range from 1 to 5 days.

Sound like a hassle? Get your money asap with Whop Payments instead.

How much does Amazon Pay cost businesses?

Amazon Pay charges fees on a per-transaction basis, which vary slightly depending on where your business and customers are located.

For U.S. businesses, the current rates are:

- 2.9% processing fee: For domestic transactions

- 3.9% processing fee: For cross-border transactions (where the customer’s card is issued outside the U.S.)

- $0.30 authorization fee: For each transaction

So, for a $10 domestic sale, the total fee would be $0.59 ($0.30 authorization + $0.29 processing). For an international customer, that same sale would incur $0.69 ($0.30 authorization + $0.39 cross-border).

If the customer requests a refund, Amazon keeps the $0.30 authorization fee but refunds the percentage-based processing fee.

Outside the U.S., rates differ slightly by region:

Depending on the country, Amazon Pay’s processing fees generally range between 1.9% and 3.4%, with varying cross-border surcharges.

Amazon Pay’s costs are straightforward but not the cheapest — especially for sellers managing international buyers or frequent refunds.

3 Alternatives to Amazon Pay for businesses

Here are the top 3 Amazon Pay alternatives:

Whop Payments

Whop Payments is built for the future of online business, powering entrepreneurs, educators, and creators in 190+ countries.

“I feel a sense of tranquility regarding payment and the acceptance of Haiti as an eligible country for payments on a platform.”

- Whop seller @bazilegardy

With 100+ supported payment methods, built-in BNPL and crypto options, and global payouts across 241+ territories, it’s the most flexible way to sell and scale anywhere.

“Crossed my first six figures on Whop. Been a pleasure getting to know the platform and the people behind it.

I came from another platform, where they lost their way with how they treat their users. This is how it’s done.”

- Whop seller @carlparnell

Plus, Whop acts as your Merchant of Record (MoR), handling payment processing, compliance, and liability so you can focus on growing your business, not managing admin.

Pros:

- Free to use — only 2.7% + $0.30 per transaction

- Accept 100+ global payment methods (cards, wallets, BNPL, crypto)

- Smart payment orchestration boosts approval rates by up to 11%

- Instant global payouts via ACH, CashApp, Venmo, or crypto

- Built-in store builder, checkout links, and embeddable checkout

- 24/7 human support and Slack Connect access

- Trusted by 27,000+ companies worldwide

PayPal

PayPal is one of the most recognized names in global payments. It supports credit and debit cards, digital wallets like Apple Pay and Google Pay, and its own BNPL option.

Integration is simple across major ecommerce platforms like Shopify, WooCommerce, and Wix, making it a convenient option for small to mid-sized online stores.

However, PayPal’s drawbacks are well-documented. Fees are relatively high (up to 4.99% + $0.49 per BNPL transaction), and sellers often report account freezes or holds that can delay payouts.

Pros:

- Global brand recognition and consumer trust

- Built-in buyer and seller protection

- Easy integration with popular ecommerce platforms

- Supports multiple payment types, including BNPL and digital wallets

Cons:

- High transaction fees and added surcharges for certain payment types

- Frequent account freezes or rolling reserves

- Payouts can take several days to clear

- Limited customization for checkout and branding

Square

Square is known for its sleek in-person payment hardware and straightforward online checkout options. It’s a go-to choice for retail stores, restaurants, and service-based businesses that want to unify in-person and online transactions under one system.

Still, Square’s platform isn’t without friction. Its customization options are limited, account suspensions have been a recurring issue for sellers, and support response times can be slow.

Square also lacks the global reach of competitors – its primary markets remain the U.S., U.K., Australia, Japan, and Canada.

Pros:

- Excellent for in-person and hybrid retail setups

- Transparent pricing (2.6% + 10¢ per swipe)

- Includes invoicing, payroll, and POS tools

- Fast setup and easy-to-use interface

Cons:

- Limited global availability

- Customization and checkout flexibility are basic

- Reports of sudden account holds or terminations

- Customer support can be slow to respond

Get paid faster, easier and more reliably with Whop Payments

Payment processing shouldn’t be complicated or slow. Whop Payments gives you everything you need to sell online, accept 100+ global payment methods, and get paid fast in fiat or crypto.

No extra setup, no hidden fees, no third-party chaos — just one clean system that handles payments, payouts, and compliance behind the scenes.

Keep your focus where it belongs: building your brand and delivering what your customers love.

Start using Whop Payments today and experience a seamless, native payment processor.