Online payments move money from customer to business through gateways, processors, and banks in under a second. Learn the process, players, methods, and fees.

Key takeaways

- Most payment declines are preventable—they stem from data gaps, timing issues, or missing context rather than actual fraud or inability to pay.

- Smart retry logic combined with dunning communications can recover 45-70% of failed subscription payments.

- Offering local payment methods, currencies, and smart payment routing removes friction that causes cross-border transactions to fail.

Every year, billions of dollars in legitimate online payments fail - not because customers can't pay, but because of gaps in data, timing, or how payment systems communicate.

For businesses selling online in 2026, understanding how payments work isn't just a technical concern, it's a revenue one.

This guide covers everything you need to know about accepting online payments: how they work, why they fail, how to optimize them, and how to choose the right setup for your business.

What are online payments?

Online payments are electronic transactions that move money from a customer to a business over the internet. Instead of paying with cash or in person, customers use methods like credit or debit cards, digital wallets, bank transfers, or local payment options.

Although an online payment feels instant, it relies on multiple systems working together to verify the payment, protect sensitive data, and transfer funds securely. These checks happen in the background, usually in under a second.

Online payments are used by ecommerce stores, SaaS businesses, marketplaces, and creators to accept one-time purchases and recurring subscriptions at scale.

How online payments work, from start to finish

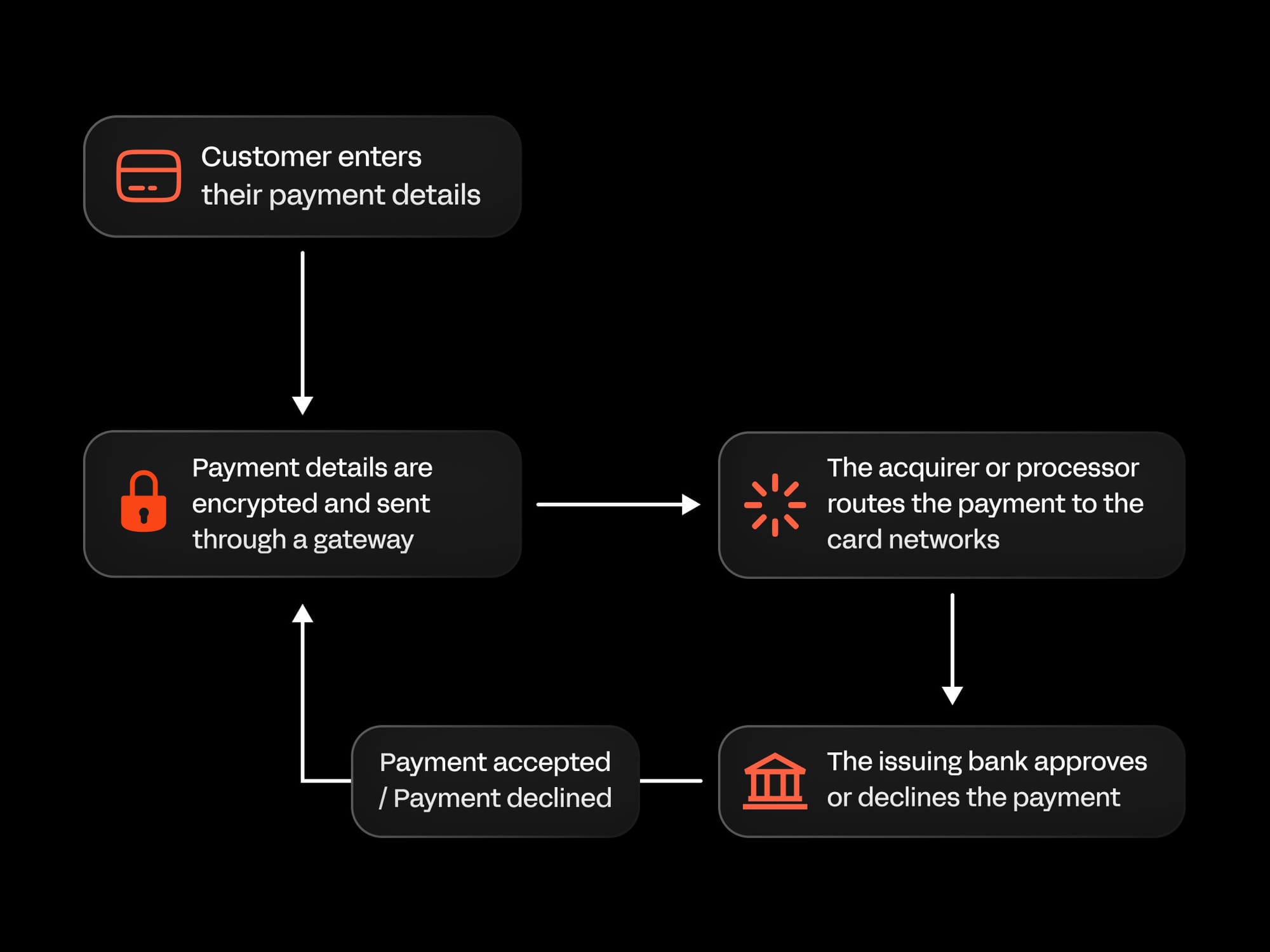

When a customer pays online, their payment details are securely passed through several systems - usually in under a second - to check funds, approve the payment, and move money to your business.

Understanding how online payments work, from who is involved to how payments flow, will help you choose the right payment setup for your business.

Key players in online payment processing

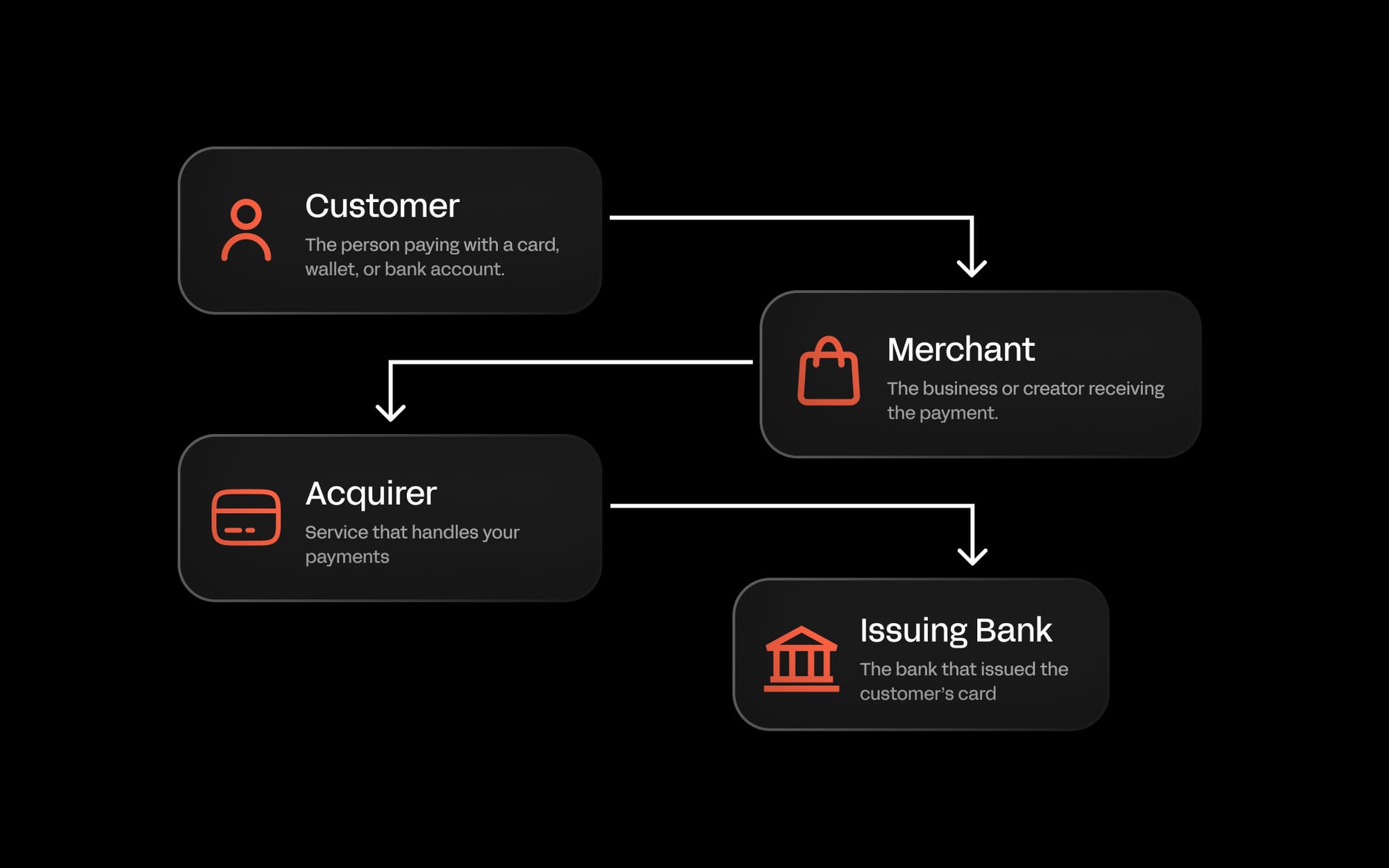

Every online payment involves a few key players:

- Customer: the person paying with a card, wallet, or bank account.

- Merchant: you, the business or creator receiving the payment.

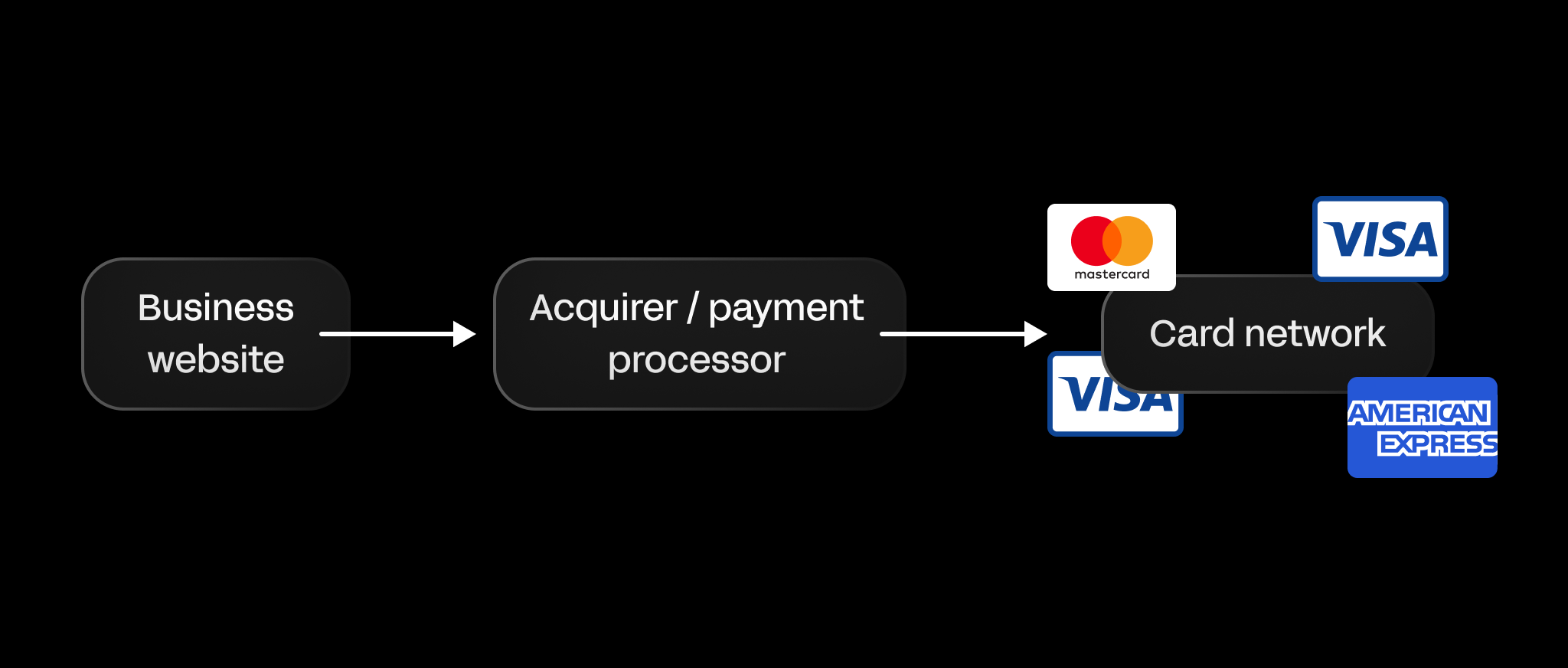

- Acquirer / payment processor: the bank or service that handles your payments, routes them through the card networks (like Visa, Mastercard, Amex), and makes sure the money gets to your account. Some providers combine these roles into one service.

- Card network: card networks (like Visa) sit between your payment provider and the customer’s bank.

- Issuing bank: the bank that issued the customer’s card and approves or declines the payment.

To accept online payments, you need to work with each of these players, either through a single provider or by building your own integrations.

Accepting online payments

What do you need to accept online payments?

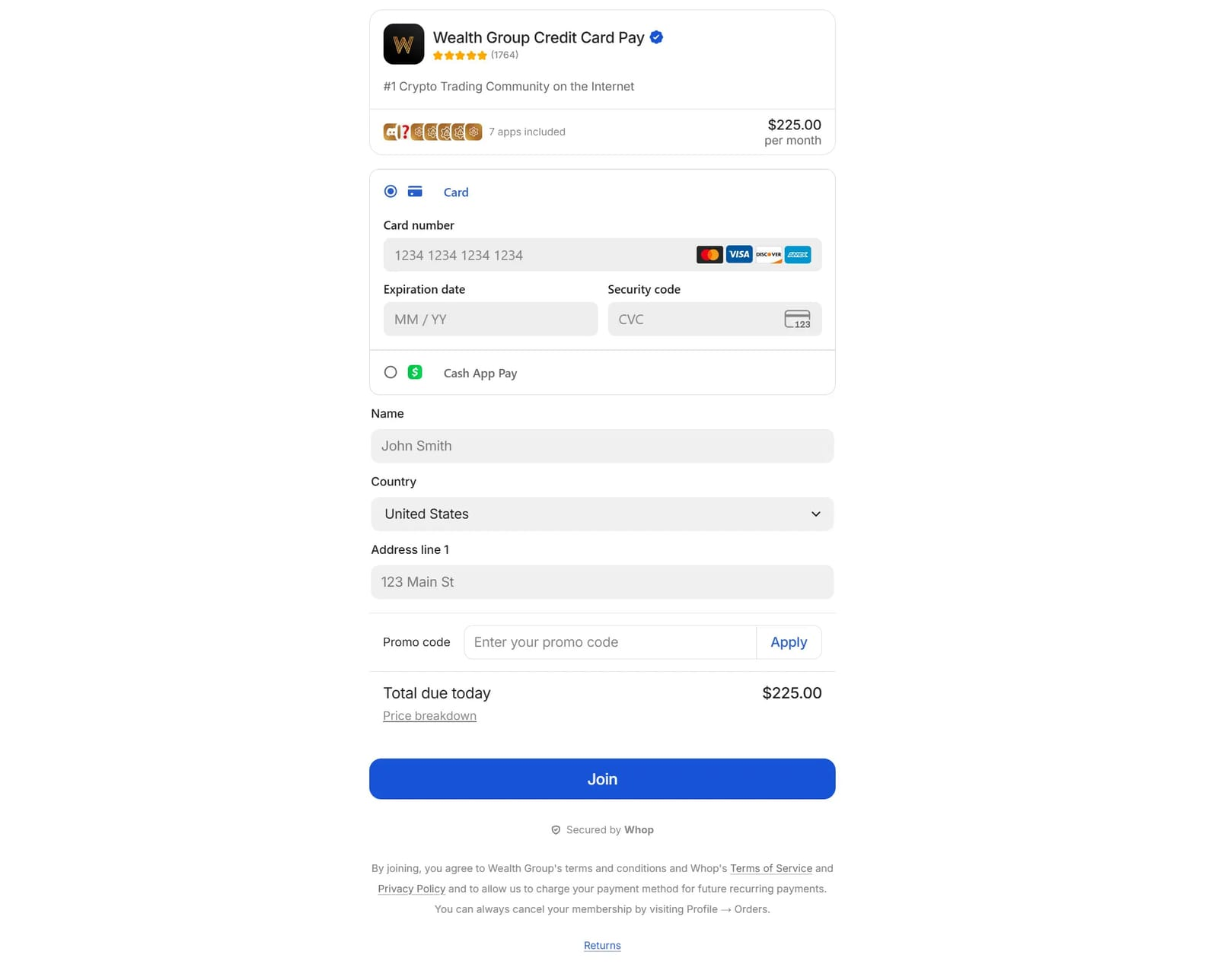

To accept online payments, most businesses only need a few core pieces in place.

At a minimum, you need:

- A business bank account to receive funds

- A payment provider to process transactions and communicate with banks and card networks

- A checkout or payment form where customers enter their payment details

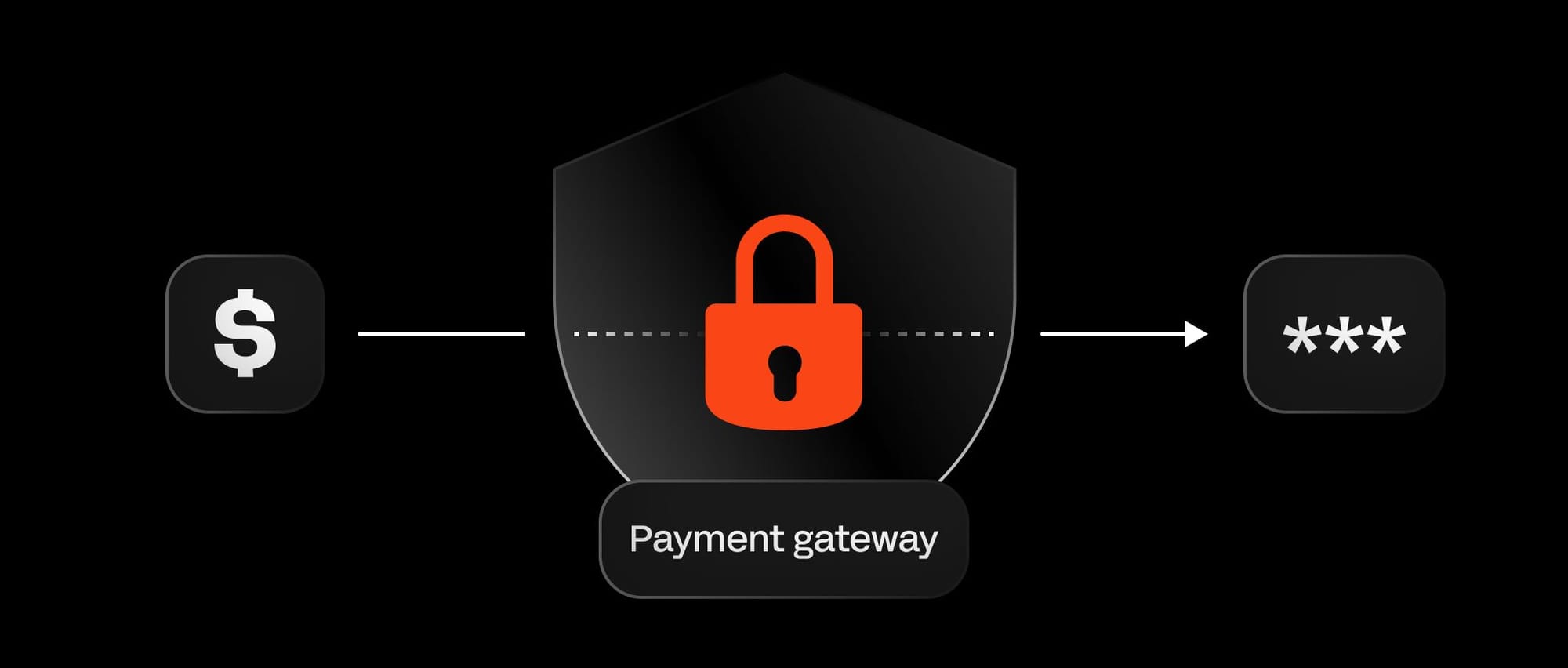

Many businesses also use a payment gateway to securely collect payment information.

The gateway acts as the secure handoff between your checkout and your payment provider, replacing sensitive card details with encrypted tokens so real card numbers never touch your systems.

This helps reduce security risk and keep you compliant with PCI standards.

Once you have these pieces in place, a payment moves through the system in a predictable sequence.

Easiest way to accept online payments

If you want the simplest setup, use a payments platform with a ready-made checkout.

With this setup, you don’t need to build anything yourself or handle sensitive payment data. The platform takes care of processing payments, keeping customer information secure, and sending money to your bank account.

You connect your bank account, choose which payment methods you want to offer (like cards or digital wallets), and start accepting payments right away. This works well for ecommerce stores, SaaS businesses, and creators who want to launch quickly.

As your business grows, you can switch to more advanced integrations for greater control. But for most businesses, a ready-made checkout is the fastest and simplest way to get paid online.

Once everything is set up, here’s what happens when a customer clicks 'pay.'

The online payment flow

When a customer completes an online purchase, their payment moves through many different steps, usually in less than a second, before the money reaches your account.

Payment approval happens instantly, but the money usually settles into your account later (often hours to a few business days).

- Customer enters payment details (card, wallet, or bank account).

- A secure service passes those details so you never store sensitive data.

- The processor routes the payment to card networks, which communicate with the issuing bank.

- The issuing bank approves or declines (sometimes with 3D Secure).

- The result returns to your site; if approved, funds settle later.

This is how a one-time online payment works.

If you’re charging internationally or using subscriptions, you’ll need extra steps: working with local banks, handling recurring billing, managing failed payments, and adjusting for proration when customers change plans.

What happens when an online payment fails?

When an online payment fails, the transaction is stopped somewhere between the customer’s checkout and their bank.

From the customer’s perspective, this usually looks like a simple error message, but behind the scenes, failures happen for a few common reasons.

Most failed payments fall into two categories:

- Hard declines, which can’t be retried (for example, an invalid card number or a closed account)

- Soft declines, which are temporary and often recoverable (such as insufficient funds, suspected fraud, or a network issue)

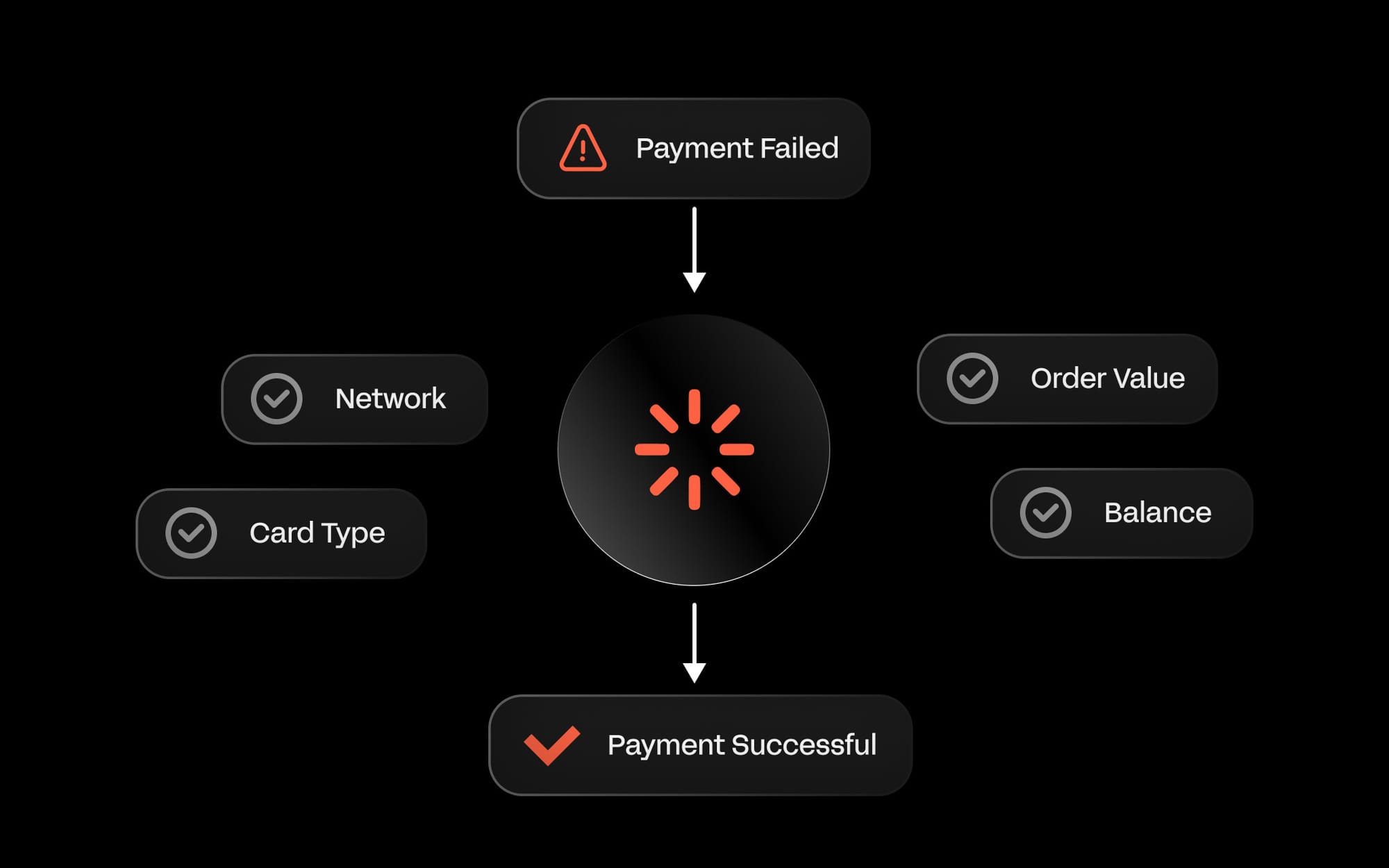

A payment can fail at multiple points in the payment flow. In some cases, the customer’s bank may decline it due to risk checks, missing or mismatched data, or unusual behavior.

In other cases, the payment method may not be supported locally, the currency may be incompatible, or additional authentication may be required and not completed.

A failed payment doesn’t always mean the customer can’t or won’t pay. Many failures are caused by timing, configuration, or issuer-side risk decisions rather than real intent or ability to pay.

I asked Dr. Ignacio E. Carballo, Senior Consultant and Project Manager at PCMI, and an economist with over 10 years of experience in digital finance, about the most common reasons for legitimate online payment declines.

Here’s what he had to say:

In 2026, most ‘false declines’ happen because issuer risk systems still lack context, not because the transaction is actually risky. Even when a merchant follows best practices, mismatches in data quality, device signals, or transaction patterns can trigger automated declines.

The biggest issue is fragmentation, the issuer doesn’t see the full customer journey, only a single moment in time.

In addition, more financial education is still needed on the consumer side in order to prevent mistakes that can lead to declines.

What does this mean? Providing richer data at checkout - complete billing addresses, email, device signals - gives issuers the context they need to approve rather than decline. The more a transaction looks complete and familiar, the less likely it is to be flagged.

Understanding where and why payments fail is the foundation of payment optimization. Most failed payments are preventable or recoverable, if you know what to fix.

Payment optimization: how to maximize success and reduce failures

Even with a well-built payment system, not every transaction will succeed on the first attempt. Cards expire, banks flag transactions, and international payments fail for reasons outside your control. If those failures aren’t handled properly, they turn directly into lost revenue.

Payment optimization is about reducing that loss. It focuses on identifying where payments fail, understanding why they fail, and putting systems in place to recover or prevent those failures before they impact conversion or retention.

This matters because payments aren’t just a backend concern. Every decline affects customer trust and purchase intent, and can stop an otherwise willing customer from completing checkout.

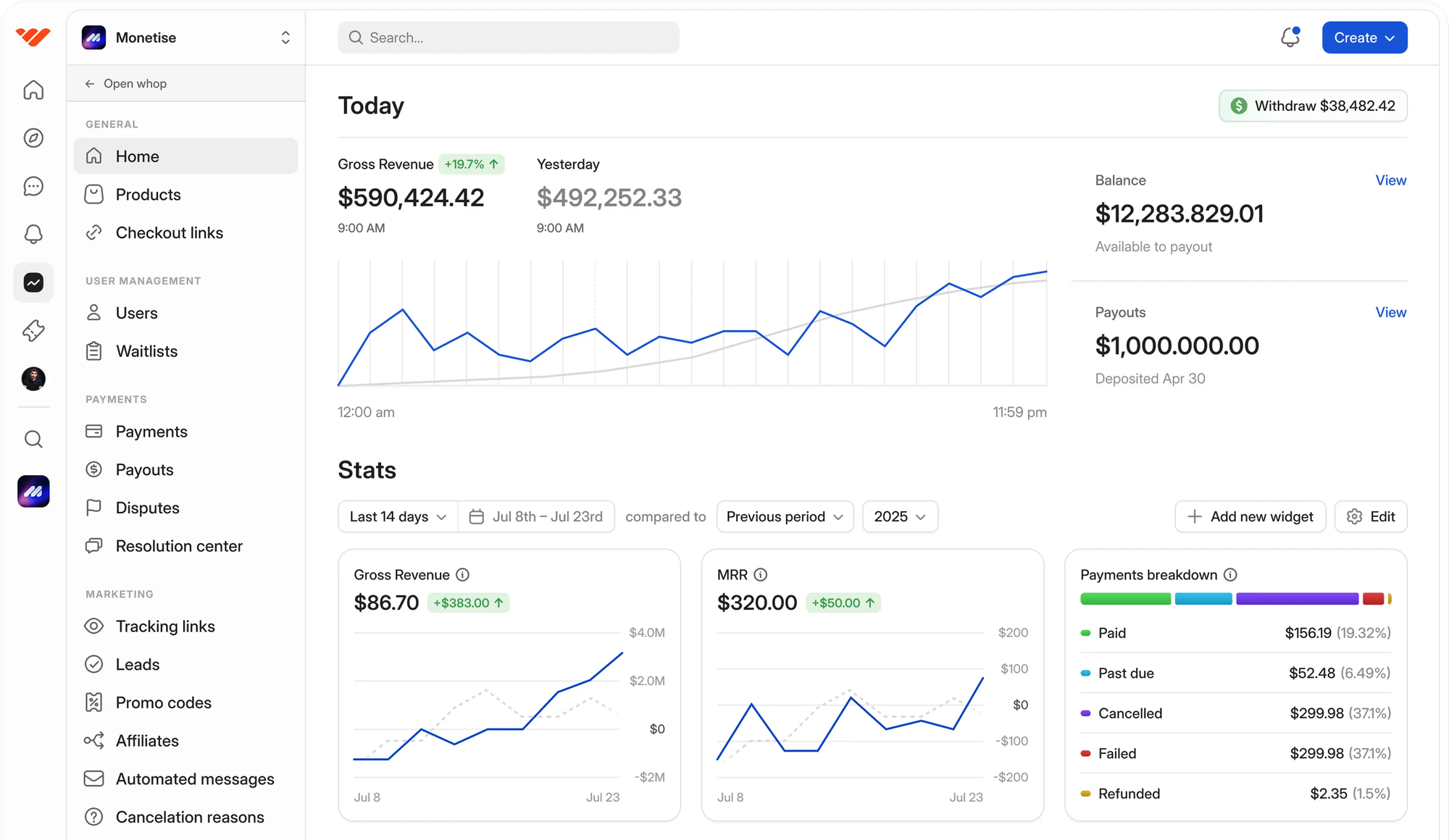

As Derek Wilmer at Whop explains:

Think about seeing an Instagram ad for a t-shirt and you try to buy it. If you try to purchase the product and it doesn't work, the likelihood of you trying again is very low.

If it's cold traffic, you want that payment to work on the first try as often as humanly possible, otherwise the likelihood of getting that sale ever again is very, very low - and that's now a lost customer.

Optimizing payments means treating payment success as part of the customer experience, not just a technical outcome. When you monitor each step and apply the right strategies, you can reduce friction, recover failed transactions, and increase overall authorization rates.

Here's how to optimize your entire online payment process.

Checkout form optimization

Your online payments funnel begins with your checkout experience. A poor experience leads to friction at checkout, and increases the risk of abandoned carts.

In fact, research from Baymard Institute found that the average cart abandonment rate sits at over 70% - with checkout friction cited as one of the leading causes.

The key to optimizing your checkout experience is testing. Walk through all of the steps that a customer has to take and pinpoint exactly where there is friction. Pay attention to the site loading time, amount of fields in your checkout form. Here are the kind of questions you should ask when testing your online checkout form:

- Does your checkout form support autofill or saved passwords?

- Can you tick a box to duplicate the postal address for the billing address?

- Does your checkout clearly show the payment method that you support?

- How many languages does your checkout support?

Explore the online checkout processes of other stores to see what works, what doesn't, and how this compares to your own business' checkout experience.

Retry logic and recovery

One of the most effective ways to recover failed payments is through automatic retry logic.

Many payment declines are temporary: a card may have insufficient funds at the moment, a network may be busy, or the bank may flag a legitimate payment as suspicious.

Retrying these payments at carefully timed intervals can recover a significant portion of your failed transactions.

According to Kaplan Collection Agency, for many subscription businesses, combining automated retries with thoughtful dunning communications (notifications prompting customers to update payment details) can recover 45–70% of initially failed payments.

Even one extra attempt, timed intelligently, can turn a lost payment into revenue, and significantly improve your subscription retention rates.

Improving authorization success

How you collect and transmit payment information plays a large role in whether a transaction succeeds.

Including complete customer details, like billing address, email, and CVC, increases the likelihood of approval.

This extra context reduces the chance of the transaction being flagged as suspicious, which in turn increases the likelihood that the payment will be approved on the first attempt.

Essentially, the more accurate and detailed the data you provide, the smoother the verification process becomes.

Another way to improve authorization success is to offer multiple payment methods.

If a card is declined, customers can switch to a digital wallet, another card, or a bank transfer without leaving your site.

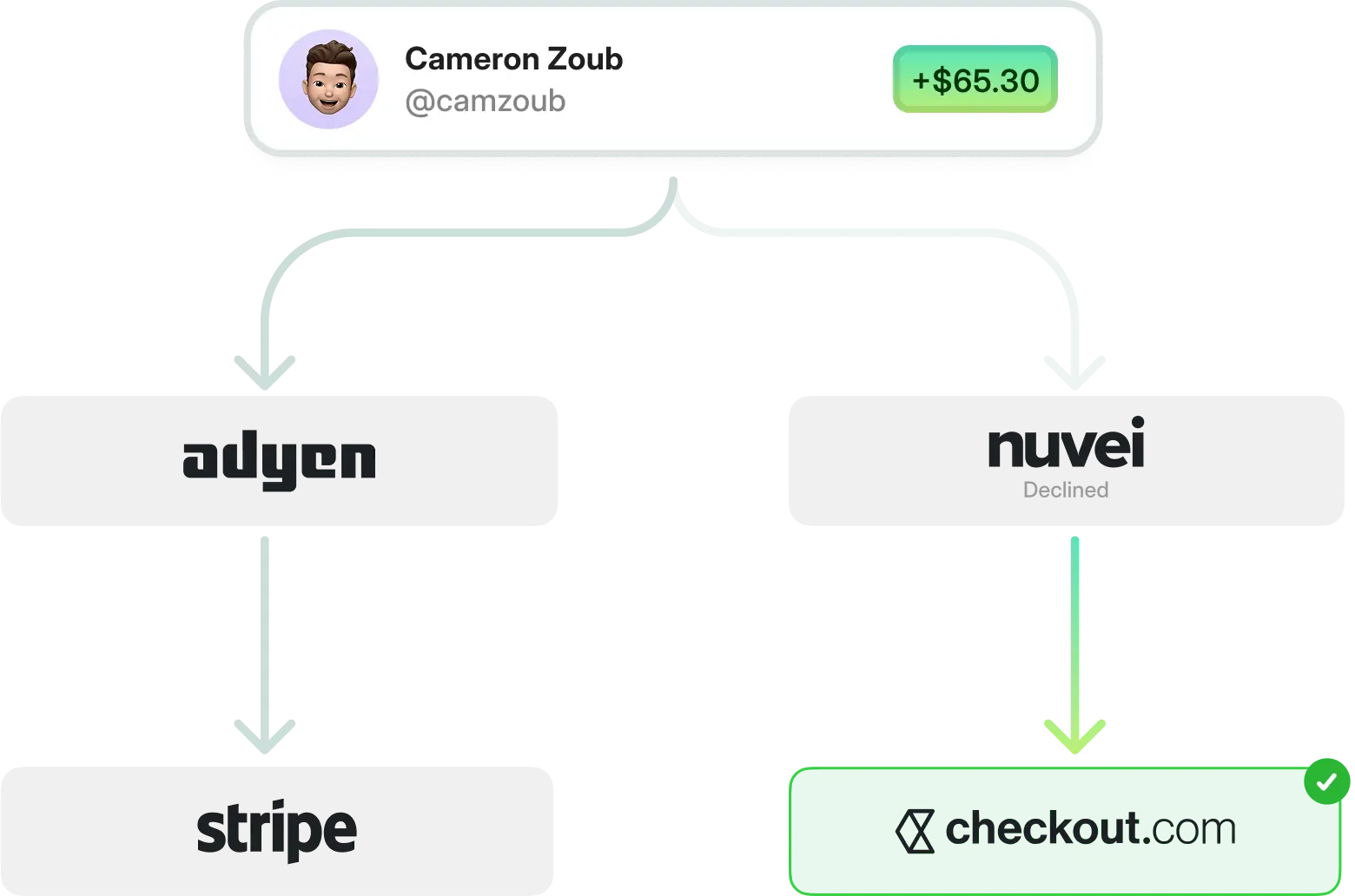

You can also use smart payment routing, which automatically sends each payment through the path most likely to be approved.

Instead of every transaction taking the same route, the system chooses the processor or network with the highest chance of success.

This can improve approval rates by several percentage points without the customer doing anything differently.

"When the first 4 numbers of the card are entered (the BIN) we recognize the BIN and see 'ok it's a Chase card, in the UK, for $3000 - based off historical data it's going to be best if it goes to 'this bank', and then it gets routed to that one".

International and cross-border considerations

Selling globally introduces even more complexities to your online payment system.

Payment can decline simply because a customer is trying to pay in a currency that their bank doesn’t accept, or with a method that isn’t supported locally.

Therefore, using local payment methods in key markets - for example, iDEAL in the Netherlands, Alipay in China, or EFTPOS in Australia - dramatically increases the likelihood of completed transactions.

You have to also consider the customer, not just the bank. Customers are more likely to complete purchases when they see prices in their local currency.

Dr. Ignacio E. Carballo breaks down why cross-border payments fail, and why making transactions feel local matters more than adding friction.

Cross-border payments fail more frequently because issuers lose familiarity, with the merchant, the acquiring bank, and sometimes even the payment behavior itself.

Approval rates improve most when transactions look ‘local’: local acquiring, local currency, familiar payment methods, and richer data all matter. Strong authentication helps, but reducing perceived foreignness is usually more powerful than adding friction.

In practice, this means prioritizing local acquiring in your highest-volume international markets rather than routing everything through a single global processor. Even one or two key markets with local processing can meaningfully improve your overall authorization rate.

You also need to stay compliant with regional rules when you sell internationally. Payment regulations vary by country, and getting this wrong can create real business risk.

What rules matter most:

- Payment authentication: In Europe, businesses often need to follow Strong Customer Authentication (SCA) rules under PSD2, which can require extra verification like 3d secure.

- Anti-money laundering (AML): Many regions require businesses to monitor for suspicious activity and, in some cases, verify customers or sellers (especially for platforms and marketplaces).

- Taxes and reporting: Depending on where you sell, you may need to collect and report sales tax, VAT, or GST, and keep clean records for reconciliation and audits.

Balancing customer experience, bank requirements, and legal compliance is key to running a global payment system that’s both seamless and secure.

Balancing fraud prevention with customer experience

Fraud prevention is a necessary part of any payment system, but overly strict controls can cause legitimate payments to fail.

You can use machine learning, risk scoring, and behavior analysis to detect suspicious activity while minimizing false declines, and techniques like velocity checks - which monitor how many attempts are made with a single card - help catch fraud without frustrating genuine customers.

Maddie from Whop tells us "You have the best customer and user experience when there are really seamless fraud checks. When fraud checks are working properly, you hardly even know they're there, and you're only going to catch the bad actors".

Optimizing payments means finding the right balance between security and conversion.

You want to protect your business and your customers, but not at the expense of lost sales or abandoned checkouts due to overly-complicated processes.

Monitoring and metrics

With all the above strategies in place, continuous monitoring is essential to identify patterns and improve performance.

Tracking metrics like authorization rates, payment success rates, and the reasons for failed payments helps you pinpoint weak points. Are declines coming from expired cards, incomplete customer information, or network errors?

Key payments metrics to track

| Metric | How to track it | Why it matters |

|---|---|---|

| Authorization rate | Check your payment dashboard for approved vs attempted payments | Shows how often payments go through; low rates can signal issues with banks, payment methods, or your setup |

| Payment success rate | Compare successful payments to total attempts | Reveals how much revenue you’re losing to failed checkouts |

| Decline reasons | Review provider reports for why payments failed (for example, insufficient funds or expired cards) | Helps you spot patterns and fix the most common problems |

| Failed payment recovery | Track retries and reminder emails for subscriptions | Shows how much lost revenue you’re able to recover |

| Churn from payment failures | Look at cancellations caused by failed payments | Highlights customers you’re losing due to payment issues, not product issues |

Types of online payment methods that your business can offer

Types of online payment methods include cards, digital wallets, bank transfers, Buy Now, Pay Later, and local payment options.

Understanding the strengths of each payment method helps you offer the right options for your audience and increase successful transactions.

Payment methods compared

| Method | Speed | Fees | Fraud risk | Best use case |

|---|---|---|---|---|

| Credit/Debit Card | Instant | 1.5–2.5% + $0.10 | Medium | One-off purchases, subscriptions, agencies, marketplaces |

| Digital wallet (Apple Pay, Google Pay, Venmo) | Instant | 2–3% | Low | Mobile-first ecommerce, subscriptions, tech-savvy customers |

| Bank transfer / Direct debit | 1–3 days | Low (varies by bank) | Low | Recurring subscriptions, B2B payments, marketplaces |

| Buy Now, Pay Later (Afterpay, Klarna) | Instant | Merchant pays fees (~2–6%) | Medium | High-ticket ecommerce, premium services, flexible payments |

| Local payment methods (iDEAL, Alipay, EFTPOS) | Instant | 1–3% | Low | International ecommerce, marketplaces, global SaaS |

| Cash-based / Voucher payments (OXXO, Boleto, Konbini) | 1–2 days* | Low (~1–2% depending on provider) | Low | Unbanked customers, LATAM ecommerce, emerging markets, convenience-store payments |

Card payments

Credit and debit cards remain one of the most widely used online payment methods across the world because they’re familiar, fast, and accepted in almost every market - you’ve almost certainly used one yourself.

In fact, several sources report that card‑based payments still account for a large share of online transactions globally, with combined credit and debit card usage representing around 40–48% of online purchases in recent data.

Cards work well for almost any business, especially for one‑off purchases and subscriptions, but they do come with fees and occasional declines that you’ll need to manage as part of your payment strategy.

Best for:

- Agencies and freelancers taking project payments

- SaaS and subscription businesses

- Ecommerce stores with one-off or repeat sales

- Marketplaces that need multiple seller payouts

Digital wallets

Digital wallets like Apple Pay, Google Pay, and Venmo allow customers to pay instantly without entering card details, streamlining the checkout process. These payments are often faster and reduce friction - especially on mobile, when customers usually do not have their card details to hand.

According to Fortunly, 90% of U.S. consumers cite 'ease of use' as their primary reason for using Apple Pay in 2024.

Best for:

- SaaS subscriptions and recurring payments

- Ecommerce mobile-first stores

- Agencies with tech-savvy clients

Bank transfers and direct debits

Bank transfers and direct debits let customers pay directly from their bank accounts.

These work really well for recurring payments, like subscriptions or memberships, because the setup ensures money comes in automatically each billing cycle.

For one-off payments, they can take a bit longer to process, but they’re a reliable option for customers who prefer not to use cards or wallets.

Best for:

- SaaS and subscription businesses

- Platforms and marketplaces with recurring billing

- B2B agencies handling large invoices

Buy now, pay later (BNPL)

Buy Now, Pay Later services like Afterpay or Klarna let customers split payments over time instead of paying everything upfront.

Businesses use BNPL to make higher-ticket products more accessible, which can increase conversions and sales.

As a business using BNPL you do not take on the risk of non-payment - the service provider manages the instalment plan, not you.

Best for:

- Ecommerce stores with mid- to high-ticket products

- Agencies offering premium services to consumers

- Marketplaces where buyers may need flexible payment options

Local and alternative payment methods

Every region has its own preferred ways to pay, like iDEAL in the Netherlands - which accounted for about 72% of online payment volume in 2024 - or mobile wallets like Alipay and WeChat Pay in China, where alternative payment methods made up around two‑thirds of ecommerce transactions.

Choosing a provider that supports local acquiring - where the transaction is processed through a bank or processor in the customer’s country - can improve approval rates, reduce declines caused by cross-border restrictions, and provide a smoother experience for international buyers.

Best for:

- Global ecommerce and SaaS businesses

- Marketplaces with international sellers and buyers

- Platforms looking to scale globally

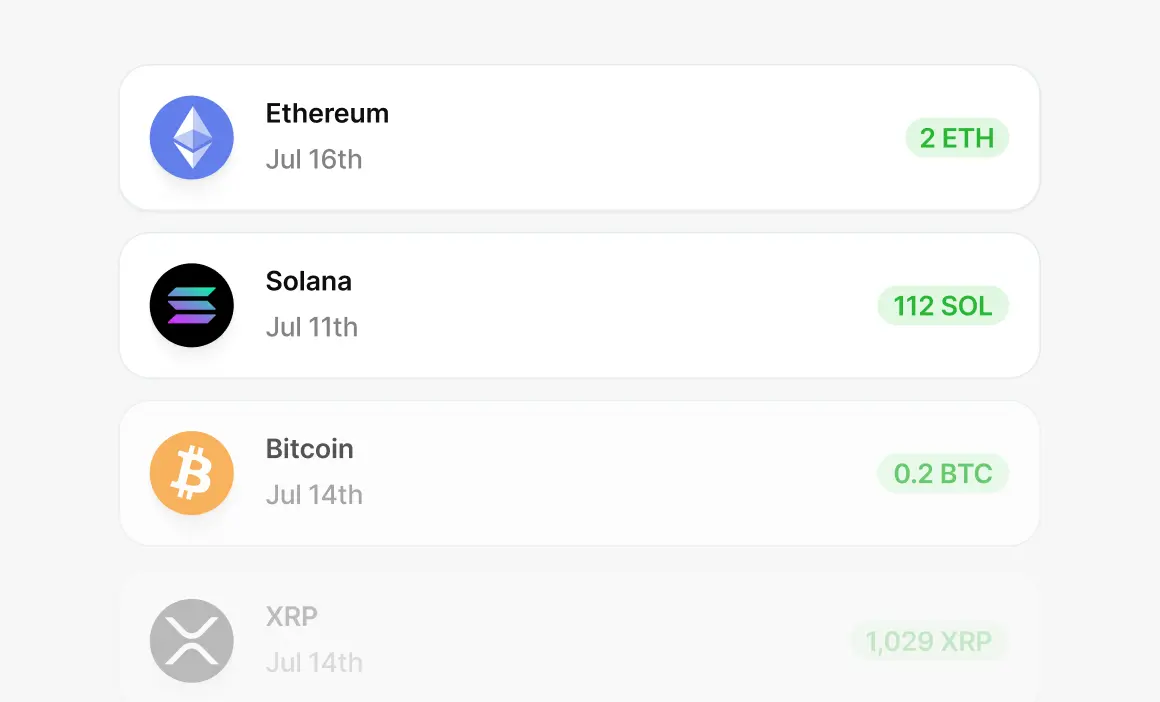

Crypto payments

Crypto payments let customers pay using cryptocurrencies like Bitcoin, Ethereum, or stablecoins instead of traditional cards or bank transfers. Payments are settled on blockchain networks, often without intermediaries like card networks or issuing banks.

Businesses use crypto payments to reach global customers, reduce cross-border friction, and offer an alternative for buyers who prefer decentralized or wallet-based payments.

Depending on the setup, crypto payments can settle faster and carry lower fees, but price volatility and adoption vary by currency.

Some providers convert crypto to fiat instantly, so businesses don’t need to hold or manage cryptocurrency directly.

Best for:

- Global online businesses with international customers

- Digital products, memberships, and creator-led businesses

- Businesses serving crypto-native or privacy-focused audiences

Thinking of integrating crypto payments? Check out this Coinbase review

Cash-based and voucher payments

Cash-based vouchers let customers pay for online orders in cash, even if they don’t have a card or bank account. Popular options include OXXO in Mexico, Boleto Bancário in Brazil, and Konbini in Japan.

With a cash or voucher-based payment, a customer selects a voucher at checkout, your site generates a barcode or reference number, they pay at a store or bank, and the voucher provider confirms the payment digitally so you can fulfil the order. So it is a way to pay online without having a credit or debit card.

These methods are essential in regions with low card penetration or unbanked customers, and can help reduce checkout drop-off. OXXO vouchers cover roughly 40% of online purchases in Mexico.

Best for:

- Ecommerce and digital businesses in LATAM or Japan

- Platforms serving unbanked or cash-prefering customers

- Marketplaces or global businesses looking to boost approval rates in card-light regions

Leading online payments platforms

Once you know which payment methods your customers prefer, the next step is choosing a platform that supports them reliably.

Choosing a payments platform shapes how easily customers can pay, how reliably payments go through, and how much complexity you manage behind the scenes.

Here are five widely used online payments platforms, each built for different business models and stages of growth.

| Platform | Best for | Strengths | Notes |

|---|---|---|---|

| Stripe | SaaS, subscriptions, ecommerce | APIs, global payments, billing | Developer-friendly |

| PayPal | Ecommerce, small businesses | Brand trust, wallets | Consumer-facing |

| Adyen | Enterprise, global brands | Local acquiring, optimization | Built for scale |

| Square | Small and omnichannel sellers | Online + in-person payments | Simple setup |

| Whop Payments | Creators, marketplaces, SaaS | Checkout, subscriptions, payouts | All-in-one |

The best platform is the one that fits your business model, supports your payment methods, and scales with you.

How to choose the right online payments platform

There’s no single 'best' online payments platform. The right choice depends on how you sell, who you sell to, and how complex your payment needs are.

Here’s a simple way to think about it by use case:

- If you run a SaaS or subscription business

Look for strong recurring billing, retries, proration, and API flexibility. Platforms like Stripe or Whop Payments are commonly used for subscription-based models. - If you sell ecommerce products

Prioritize fast checkout, wallet support, and customer trust. PayPal, Stripe, and Square are often used for online stores, especially when paired with digital wallets. - If you operate a marketplace or platform

You’ll need seller onboarding, payouts, and compliance support. Systems built for multi-party payments, like Stripe Connect or Whop Payments Network, are better suited for this use case. - If you sell globally

Focus on local payment methods, local acquiring, and multi-currency support. Adyen and Stripe are commonly used by international businesses, Wise is good for freelancers, while Whop Payments simplifies global payouts and retries for online sellers. - If you want the simplest setup

An all-in-one platform with a hosted checkout reduces setup time and ongoing complexity. This is often the easiest option for creators and small teams.

Once you’ve chosen a platform, the next step is configuring it correctly for your specific business model.

Choosing and optimizing an online payment setup for your business

Every business accepts payments in roughly the same way, but the right setup depends on how you sell.

A SaaS subscription, a marketplace, and an ecommerce store all face different payment challenges, from recurring billing to payouts and checkout speed. Setting things up correctly helps payments go through more reliably, improves conversion, and reduces failed transactions.

Here’s how to approach your payment setup for SaaS and subscriptions, marketplaces, and ecommerce.

SaaS and subscription

For subscription businesses, payments aren’t a one-time event. You need to collect money reliably every billing cycle, even as customers change plans, cards expire, or banks decline transactions.

One of the first decisions SaaS businesses face is whether to build their own billing system or use an existing payments platform.

Building gives you more control, but it also means ongoing engineering work and maintenance. Using a payments platform can simplify recurring billing by handling things like retries, invoicing, and reporting for you.

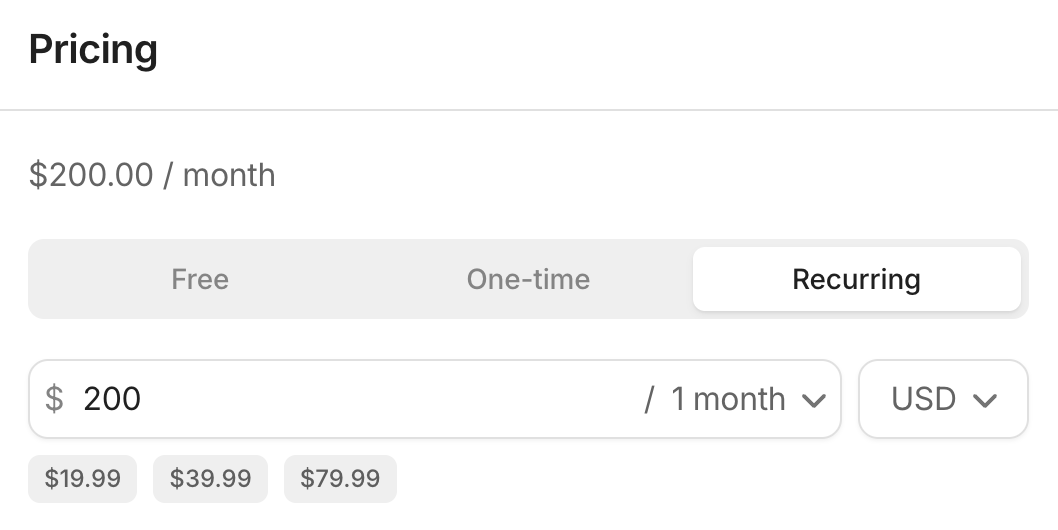

As your pricing evolves, your payment setup needs to do more than charge a flat monthly fee. Many SaaS businesses add tiered plans, per-seat pricing, usage-based billing, trials, or discounts.

Your billing system needs to correctly handle plan changes mid-cycle, apply proration, and ensure future invoices reflect the new plan.

Invoicing is also important, especially for B2B SaaS. Customers often expect formal invoices for accounting purposes, and in some regions invoices must follow specific tax and formatting rules.

Automating invoice creation and delivery becomes essential as volume increases.

Finally, subscription businesses need to manage involuntary churn - situations where customers want to pay, but payments fail due to expired cards, insufficient funds, or outdated details.

At small scale, this can be handled manually. As you grow, automated retries, reminder emails, flexible payment methods, and real-time reporting are critical to recovering lost revenue and maintaining healthy metrics.

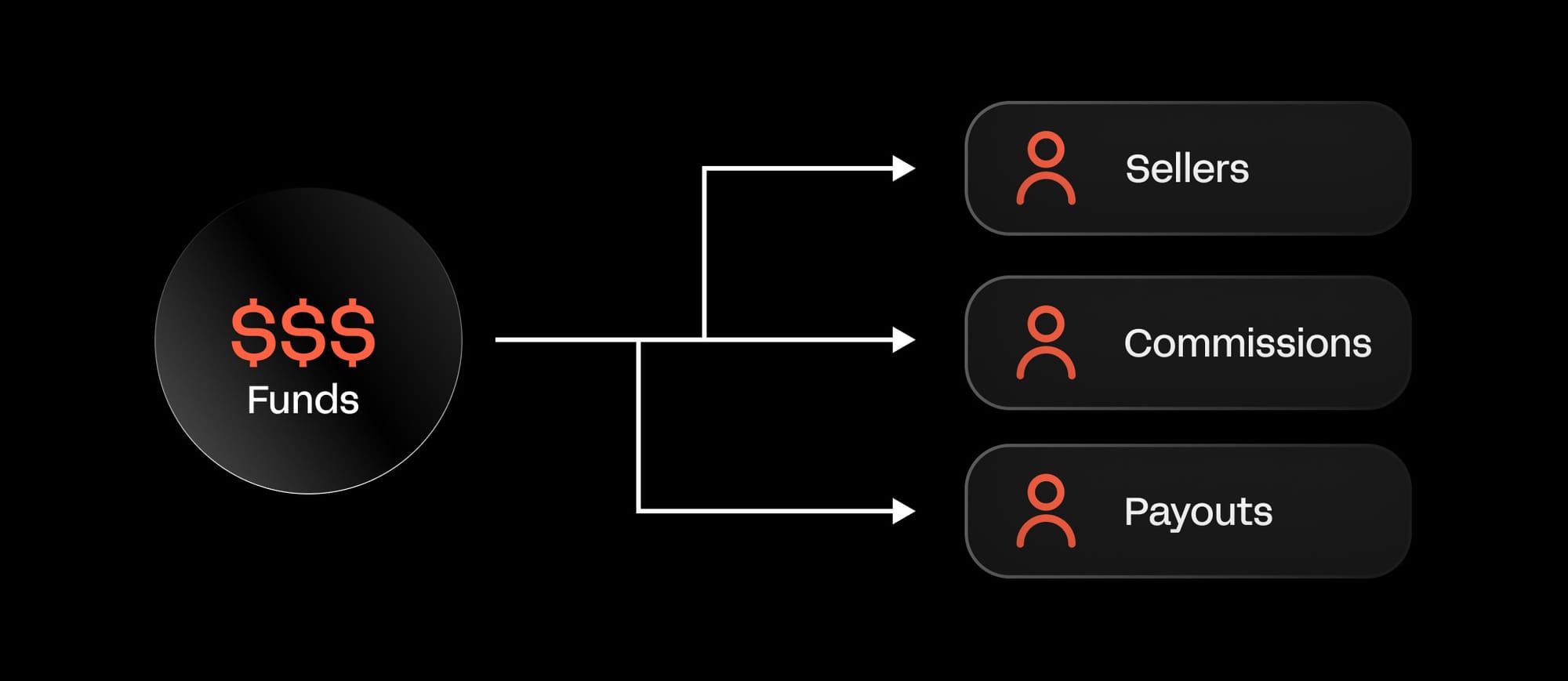

Platforms and marketplaces

Marketplaces introduce a layer of complexity beyond simply collecting payments.

In addition to charging customers, you’re responsible for moving money between parties, managing payouts, and meeting regulatory requirements tied to handling funds on behalf of others.

A marketplace payment setup must support seller onboarding, identity verification, and tax or compliance checks, without creating unnecessary friction.

Once payments are collected, funds often need to be split across multiple sellers, commissions applied, and payouts scheduled.

This requires precise transaction tracking and clear reporting so sellers can see what they’ve earned and when they’ll be paid. Delayed or inconsistent payouts are one of the fastest ways to lose seller trust.

Compliance is another major consideration. Marketplaces operating across regions must account for local regulations related to money transmission, consumer protection, and reporting obligations.

Using a payments provider that handles fund routing and compliance infrastructure can reduce risk and operational overhead.

And, because marketplaces often serve international audiences, supporting local payment methods and local acquiring can significantly improve conversion rates.

Customers are more likely to complete purchases when they can pay using familiar methods, and sellers benefit from higher authorization rates and fewer failed transactions.

Ecommerce

For ecommerce businesses, checkout is where sales are won or lost. As more shopping happens on mobile, digital wallets and mobile payments have become central to online sales.

In 2025, mobile payments accounted for about 51% of global ecommerce transactions, and that share continues to grow as buying behavior shifts online.

A strong ecommerce payment setup focuses on speed, flexibility, and reliability. Customers expect to pay with cards, digital wallets, and Buy Now, Pay Later options, especially on mobile devices.

As you sell internationally, supporting local payment methods becomes just as important. Customers are far more likely to complete checkout when they can pay using familiar methods and currencies.

Why would a Polish bank care about a US business? They don't. In the eyes of different regions and banks around the world, payment systems with local acquiring are looked at in a higher regard and with a higher level of trust.

– Derek Wilmer, Payments @ Whop

Behind the scenes, ecommerce businesses must balance fraud prevention with customer experience. Overly aggressive fraud rules can block legitimate customers, while weak controls can lead to chargebacks and lost inventory.

To keep payments healthy, ecommerce teams track metrics like checkout conversion rate, average transaction value, payment success rate, declines by payment method, and fraud or dispute rates. These signals help identify where customers drop off and where checkout can be improved.

Integration matters too. Connecting your ecommerce platform to a payment provider using APIs, SDKs, or built-in plugins allows payments to process in real time and supports things like automated tax calculations, fraud checks, and clean reconciliation.

And don't forget that checkout experience is crucial for conversions. If a customer can't find an easy way to pay, they will exit the checkout. So simplify flows, remove unnecessary fields, and highlight preferred payment methods first. Test mobile vs desktop constantly - even small tweaks can improve conversion by 3–5%.

Fraud management is an ongoing task. Accepting EMV chip cards and mobile wallets where possible, and reviewing chargeback reports regularly, helps reduce repeat issues and keep risk under control.

Omnichannel: connecting online and in-person payments

What if you're selling online and in person?

Expanding from online to physical sales complicates the entire payments process. When selling online and in person, you’re now responsible for capturing transactions across multiple channels, unified reporting, and creating a clear view of revenue, refunds, and customer activity.

If your system is disconnected then it’s difficult to keep on top of sales data, trends, and inventory.

Unified reporting ensures your finance and operations teams can see the full picture across your entire business..

Platforms that support both online and in-person payments help you to get a clear view of your sales. Orders processed at a store or pop-up automatically flow into your existing dashboards alongside online transactions, giving you one central source of truth.

Online payment fees: what you'll actually pay

Online payment fees aren’t a single flat rate - they’re made up of many parts, each serving a different purpose in the payment ecosystem.

In most card transactions, the biggest cut goes to the customer’s bank (interchange), then the card network, then your payment provider.

Understanding exactly what goes into a transaction fee can help you plan pricing, protect margins, and avoid surprises.

1. Interchange fees

Most online payment fees go to the customer’s bank (called the issuing bank). These fees pay the bank for approving the payment and providing the customer with a card or account.

Examples of common interchange fees:

- Consumer debit card (domestic): 0.5%–0.8% + $0.10 per transaction

- Consumer credit card (domestic): 1.5%–2.5% + $0.10 per transaction

- Cross-border cards: 2.5%–3.5% + $0.20–$0.30 per transaction

These fees vary depending on card type, network, and whether the transaction is domestic or international.

2. Network or scheme fees

Card networks like Visa, Mastercard, and American Express charge network or scheme fees for processing the transaction.

These fee cover the cost of moving the payment through their systems, handling authorization, and supporting cross-border operations.

Examples of network fees:

- Visa/Mastercard authorization fee: $0.02–$0.10 per transaction

- Cross-border fee (Visa/Mastercard): 0.2%–0.5% of the transaction

- American Express fixed per-transaction fee: $0.10–$0.30

Even though smaller than interchange fees, network fees are unavoidable when using card payments.

3. Processor or platform fees

Your payment provider or processor charges fees for managing the transaction, handling encryption and tokenization, providing dashboards, and ensuring compliance with security standards.

Examples of processor/platform fees:

- Stripe/PayPal standard fee (US domestic): 2.9% + $0.30 per transaction

- International/cross-border fee: additional 1%–2%

- Currency conversion fee: 1%–2%

- Premium features: recurring billing, advanced reporting, fraud detection and other advanced features can add $0.05–$0.15 per transaction

Unlike interchange and network fees, which are set by card networks and non-negotiable, processor fees can often be reduced through volume-based negotiations as your business grows.

4. Refunds and chargebacks

Refunds and chargebacks are another important cost. When a customer disputes a payment, you may be responsible for not only returning the payment but also paying processing fees, chargeback fees, and potentially losing goods or services.

Examples:

- Refund: original transaction fees may not be returned, e.g., $2.20 on a $100 transaction

- Chargeback fee: typically $15–$25 per incident

- Lost goods/services: if the product has already been shipped

High-volume or international businesses can quickly see these costs add up, making prevention strategies crucial to curbing wasted spend.

What this looks like in practice

For a $100 online card payment, fees might look like this:

| Fee type | Example cost | Notes |

|---|---|---|

| Interchange | $1.80 | Domestic credit card |

| Network | $0.10 | Visa authorization fee |

| Processor/Platform | $0.30 | Stripe/PayPal standard fee |

| Total | $2.20 | Equivalent to 2.2% of the transaction |

While this may seem small, fees multiply across hundreds or thousands of transactions, and can have a huge impact on your revenue - especially when selling internationally or using multiple providers.

Online payments security and compliance

Security and compliance aren’t optional parts of accepting online payments. They’re built into every transaction, whether you actively think about them or not.

From protecting customer data to meeting regulatory requirements, your payment setup plays a major role in preventing fraud, avoiding penalties, and maintaining customer trust.

For most businesses, the goal isn’t to become a security expert - it’s to choose systems that handle security and compliance by default, so you can focus on growth without increasing risk.

It’s central to trust, compliance, and protecting your revenue - but it doesn't have to be difficult.

Front-end fraud protection compounds. Typically you're building models and algorithms and building upfront protections that will serve many merchants and payouts on the backend and have truly a ten-fold exponential compounding effect, because you build fraud-patterns that capture additional fraud-patterns and they build upon each other and create a really great system.

- Maddie Cohen, Head of Trust at Whop

Protecting payment data

When a customer enters their payment details online, that information becomes one of the most sensitive data points your business will ever handle. Card numbers and bank details are a prime target for attackers, and breaches involving financial data are especially costly.

A clear example of the cost of leaked payment data is the British Airways breach in 2018. Attackers harvested card details from the airline’s booking pages, stealing the names, addresses, payment card numbers, expiry dates, and card verification values (CVVs) of hundreds of thousands of customers.

The UK’s Information Commissioner’s Office (ICO) fined British Airways £20 million (around US $25 million) under GDPR for failing to protect customer data.

That’s why payment systems rely on encryption and tokenization. Instead of storing raw card numbers, payment details are encrypted in transit and replaced with secure tokens that are meaningless outside the payment provider’s systems. Even if intercepted, these tokens can’t be reused to initiate payments or access sensitive data.

For most businesses, using a hosted checkout or secure payment gateway means payment details never touch their servers at all.

This dramatically reduces exposure, lowers security risk, and simplifies compliance obligations, especially as transaction volume and geographic reach increase.

PCI DSS compliance

Any business that accepts card payments must comply with the Payment Card Industry Data Security Standard (PCI DSS). Whether you’re in Australia, Europe, the U.S., or Asia, if you accept card payments, you need to meet PCI DSS requirements - or use a provider that ensures compliance on your behalf.

These standards exist to ensure cardholder data is stored, processed, and transmitted securely.

The level of PCI responsibility you carry depends on how you accept payments. Businesses that store or process card data directly face the highest compliance burden. If you choose to use a compliant payment provider and hosted checkout solution your business will typically fall under much lighter requirements.

In practice, this means that choosing a PCI-compliant payment provider can significantly reduce the time, cost, and complexity involved in staying compliant, while still meeting card network rules.

You can review official PCI DSS documentation on the PCI Security Standards Council site for precise requirements.

Authentication and fraud detection

Not all failed payments are fraud, but fraud prevention still plays a critical role in payment success.

For every $1 lost to fraud, merchants in North America now spend more than $4 managing and absorbing its impact, including disputes and customer friction.

However, as Maddie Cohen tells us, most businesses under-invest in fraud prevention services.

It's widely known that most companies or entities under-invest in fraud prevention until it's too late. You need invest early and often in building out front-end fraud detection before it becomes a problem.

Tools like 3D Secure add an extra layer of authentication by asking customers to verify their identity with their bank, often through a one-time code or biometric check.

And while additional steps can sometimes introduce friction (such as having to complete anti-bot puzzles), they’re often required by regulation and can reduce fraud and chargebacks.

Other fraud controls work behind the scenes, including risk scoring, velocity checks, device fingerprinting, and monitoring unusual payment patterns.

The most effective setups balance protection with conversion, blocking genuine fraud attempts without rejecting legitimate customers.

Regional and regulatory compliance

Payment regulations vary by region, and selling internationally means navigating different rules depending on where your customers are located.

For example, businesses selling to customers in Europe must comply with Strong Customer Authentication (SCA) requirements, which mandate additional verification for certain transactions.

Other regions have their own consumer protection, data handling, and reporting obligations.

Using a payment provider that understands and adapts to local regulations helps ensure transactions aren’t declined due to compliance issues, and prevents your business from unknowingly violating regional laws.

Chargebacks, disputes, and liability

Chargebacks occur when a customer disputes a transaction with their bank, reversing a payment that has already been processed.

While some disputes are legitimate - for example, in cases of fraud or non‑delivery - many stem from confusion over the charge, forgotten subscriptions, or unclear billing descriptors.

Chargebacks are a growing operational and financial burden for online sellers, with global chargeback volumes are expected to rise into the hundreds of millions annually (Mastercard), and businesses globally could lose billions of dollars in chargeback‑related costs as this trend continues.

As Maddie tells us, "When merchants see a dispute, the immediate in-your-face consequence or value of that dispute is the monetary value. But the bigger implications of disputes are how payment networks and card networks look at your dispute rate and assess your account health."

Even for merchants who fight disputes, the costs can extend far beyond the transaction amount. Studies show average chargeback processing costs - including labor, documentation, and operational expenses - can run well above the original sale value, and disputed amounts often range in the low hundreds of dollars per incident.

From a compliance and operational perspective, excessive chargebacks can trigger higher processing fees, stricter monitoring by payment partners, or even account termination by card networks if your dispute rate crosses certain thresholds.

Many processors consider a chargeback rate above about 1% of total transactions as high risk, which can lead to fines, reserves on your account, and increased scrutiny.

Legal and tax considerations

When you accept online payments, there’s more than just processing to think about - taxes, reporting, and financial regulations are key to staying on the right side of the law.

Taxes and reporting

Depending on where your business operates and where your customers are located, you may need to collect sales tax, GST, or VAT. For example:

- In the U.S., online sellers may be required to collect sales tax in any state where they have a tax nexus - even if your business is physically located elsewhere.

- In the U.K. and EU, VAT rules apply to digital goods sold to consumers, with different rates per country.

- In Australia, GST applies to online sales of digital products and services to local customers.

Accurate transaction records and regular reconciliation are critical. A study by Avalara found that small and mid-sized businesses spend an average of 120 hours per year on sales tax compliance alone - errors can easily lead to penalties or lost revenue.

Using a payments platform that automatically tracks tax obligations and produces reports can dramatically reduce the manual burden.

For guidance, you can check official resources like the IRS in the U.S., HMRC in the U.K., or the ATO in Australia.

Identity verification and financial regulations

Many regions require KYC (Know Your Customer) and AML (Anti-Money Laundering) checks to prevent fraud and illegal activity. This means verifying the identity of your customers or sellers and monitoring transactions for suspicious behavior.

Even if your platform handles much of this automatically, as a merchant you remain responsible for ensuring compliance.

Noncompliance can result in fines, frozen accounts, or even loss of the ability to accept payments.

For example, U.S. fintech regulators increasingly enforce strict AML standards, and the EU’s 5th Anti-Money Laundering Directive imposes additional reporting obligations for digital services.

Platform vs merchant responsibilities

Understanding where your payment provider’s responsibility ends and yours begins is critical.

- Payment platforms can manage PCI compliance, card processing, and even some reporting.

- Merchants remain responsible for accurate tax collection, bookkeeping, and meeting local regulatory requirements, including VAT reporting or KYC/AML for their users if operating marketplaces.

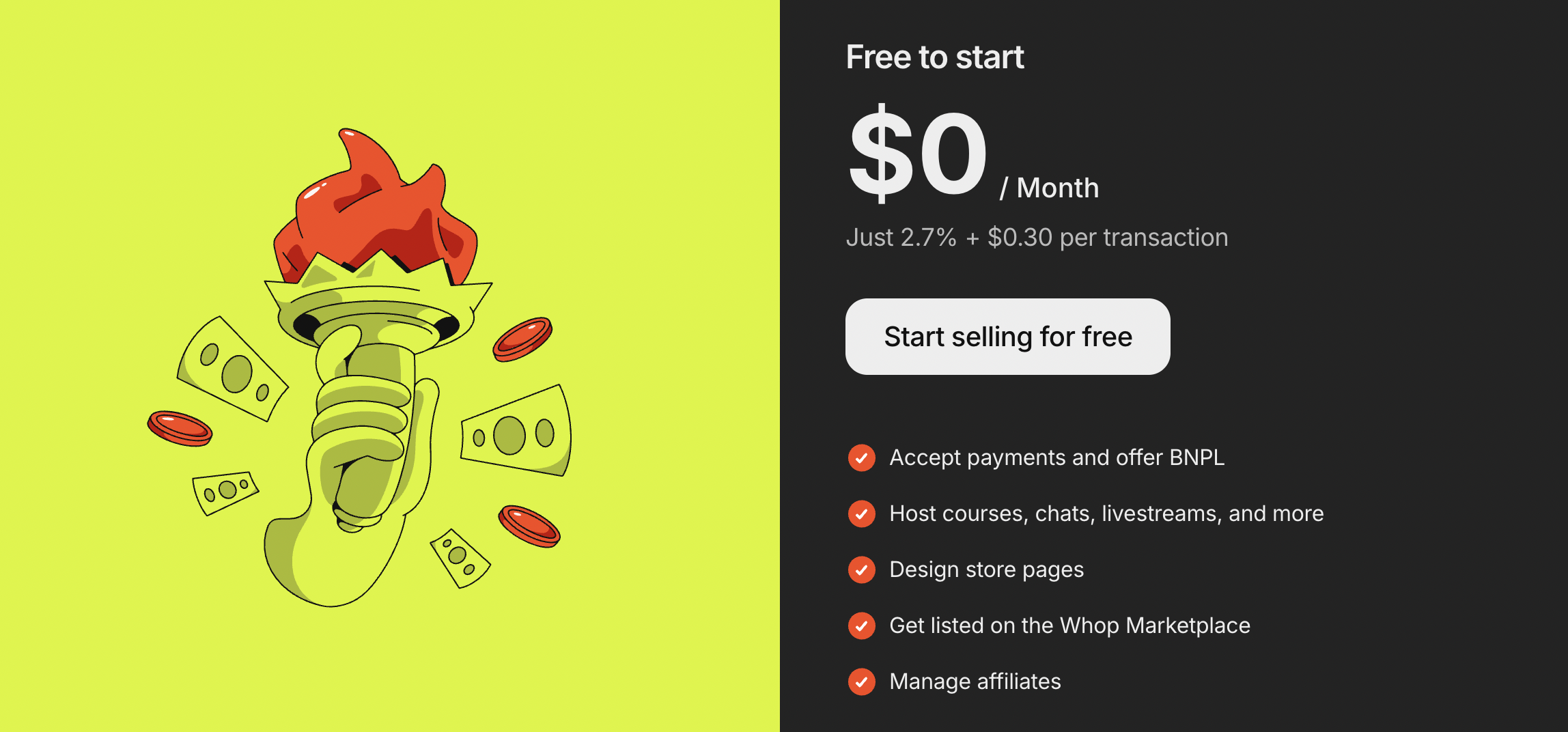

Whop payments: simple, global, and reliable

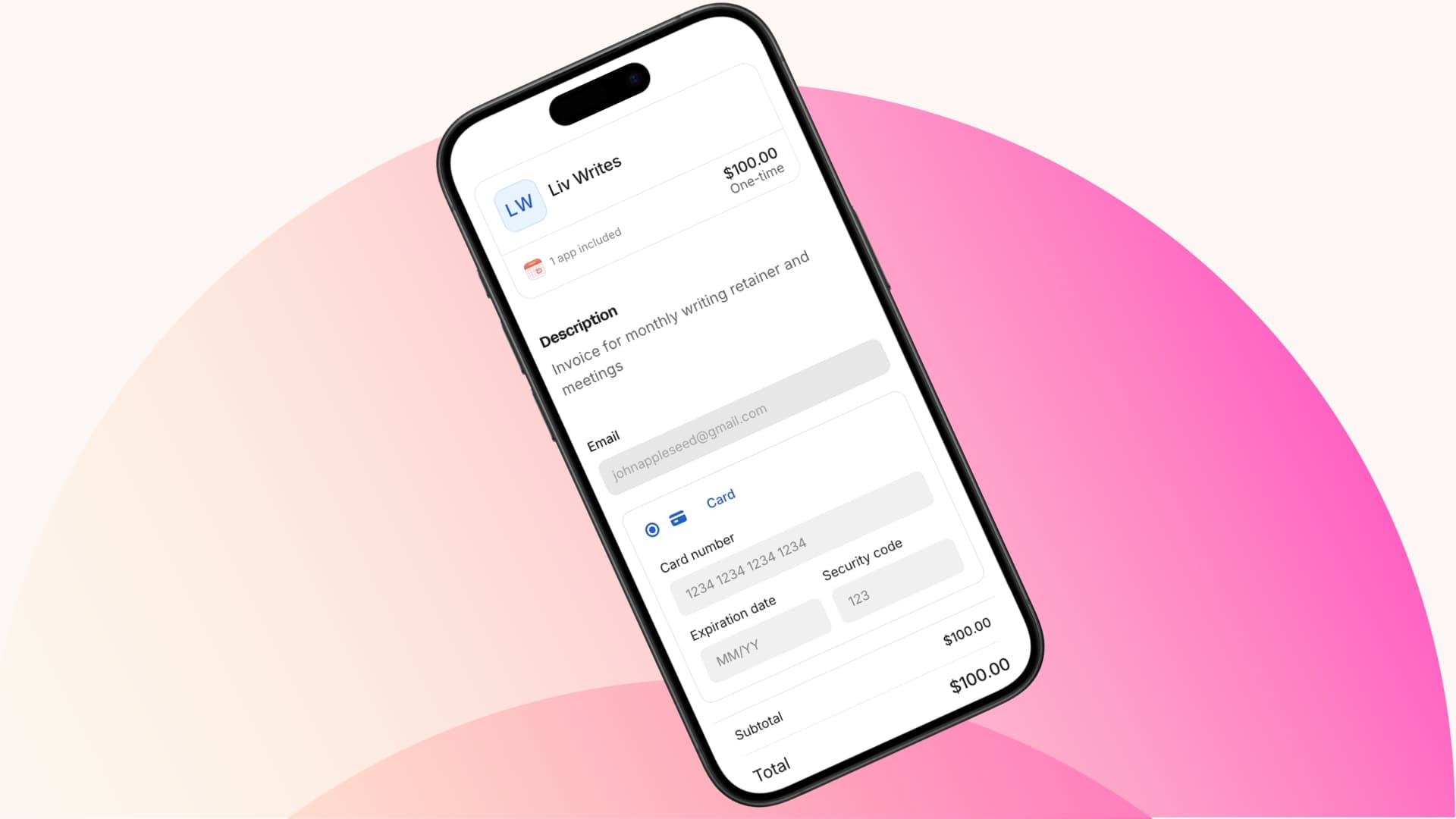

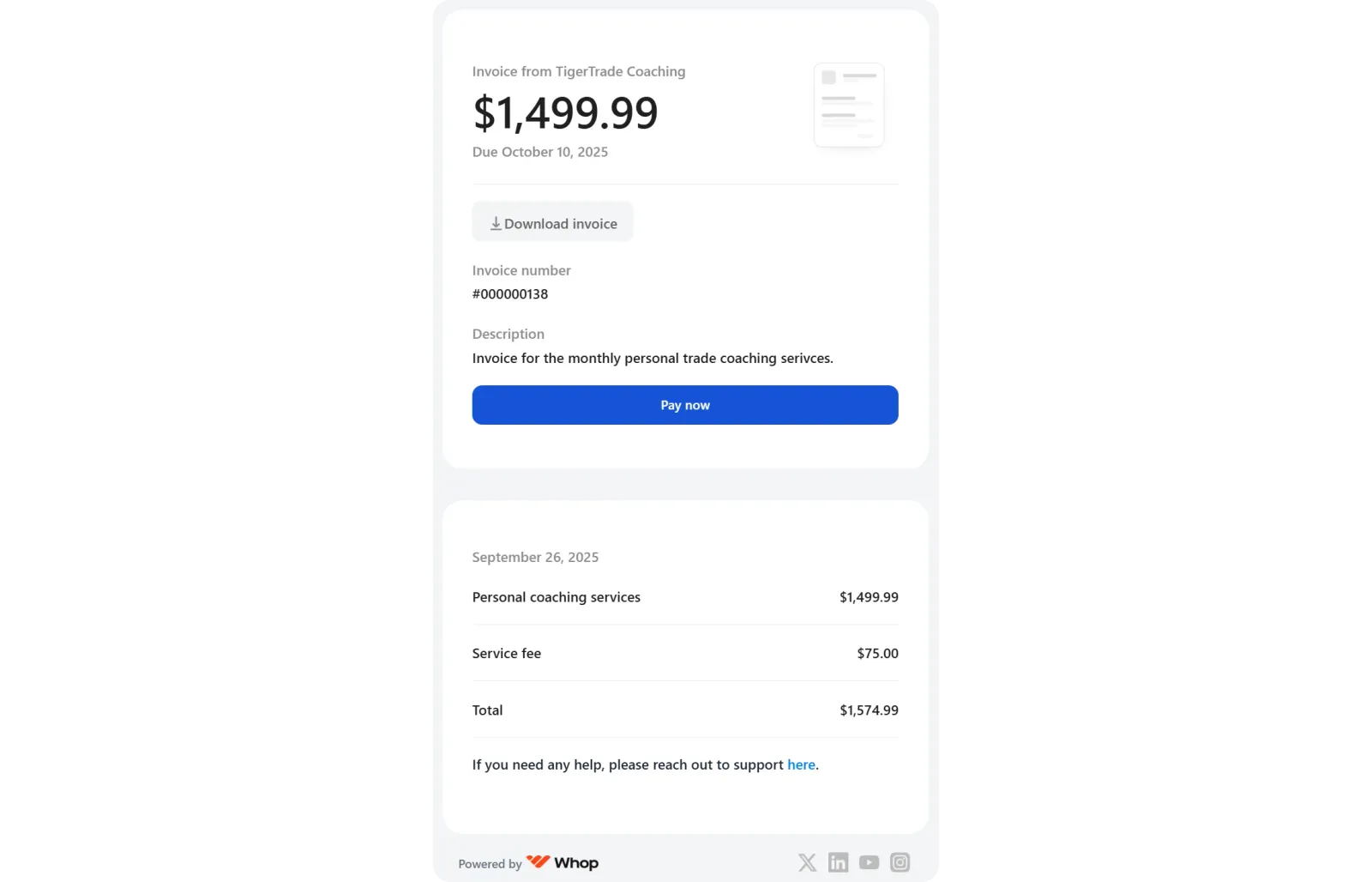

Whop provides built-in tools for accepting online payments, managing subscriptions, and handling payouts, all within a single platform powered by leading payment processors.

Instead of using separate systems for payments, billing, and distribution, businesses can manage these pieces together.

Whop is used by creators and companies selling online offers, including courses, memberships, services, and marketplaces. Payments and recurring billing are handled automatically, which reduces the need for custom payment logic or multiple integrations.

Whop supports over 100 payment methods globally, including cards, digital wallets, local bank transfers, Buy Now, Pay Later options, and crypto. Payouts are available in more than 240 territories through methods like ACH, Venmo, Cash App, and cryptocurrency.

Payment routing and retry logic are built in to reduce failed transactions. If a payment attempt doesn't go through, the system retries or reroutes it to improve the likelihood of approval - recovering revenue without manual work.

For SaaS businesses, marketplaces, and ecommerce sellers, Whop offers a way to manage payments, subscriptions, and payouts in one place, reducing the operational complexity of running multiple tools.

Streamline online payments with Whop

Accept global payments, manage subscriptions and payouts, and offer your customers the payment methods they prefer - all from a single platform.

Online payments FAQs

Can I accept payments from international customers?

Yes. Many online payment platforms, including Whop, support global transactions with multiple currencies and local payment methods, helping you reach customers around the world.

How do I reduce failed online payments?

Failed payments can result from expired cards, incorrect information, or local bank declines. Using smart retry logic, multiple payment methods, and real-time reporting can significantly improve success rates.

Are online payments safe for my customers?

When properly secured with PCI DSS compliance, encryption, tokenization, and fraud detection, online payments are highly secure. Customers can trust their data is protected while paying.

What’s the difference between one-time and recurring online payments?

One-time payments are charged immediately, while recurring payments (like subscriptions) automatically charge customers at set intervals. Recurring payments require proper logic for upgrades, downgrades, and prorated charges.

Online payment terms glossary

| Term | Definition |

|---|---|

| 3d secure (3ds) | An additional verification step some banks require to confirm the buyer’s identity before approving a payment |

| Acquirer (acquiring bank) | The bank or partner that enables a business to accept card payments and receive funds |

| AML (anti-money laundering) | Rules and monitoring designed to prevent illegal financial activity |

| Authorization | The moment a customer’s bank approves or declines a payment |

| Authorization rate | The percentage of attempted payments that are approved by banks |

| Capture | The step that finalizes an authorized payment and marks the funds to be transferred to the business, often occurring immediately or after fulfillment |

| Card network | The network that routes card payments between the business and the customer’s bank, such as Visa, Mastercard, or American Express |

| Chargeback | When a customer disputes a payment with their bank and the funds are reversed |

| Checkout | The customer-facing step where a buyer selects a payment method and completes their purchase |

| Churn (involuntary churn) | Customers lost due to payment failures rather than intentional cancellations |

| Cross-border payment | A payment where the customer and business are located in different countries |

| Crypto payments | Payments made using cryptocurrencies, including stablecoins, often settled on blockchain networks |

| Currency conversion | Converting a payment from one currency to another, often with additional fees |

| Customer | The person making the payment |

| Decline | A payment that is rejected by a bank, card network, or payment provider |

| Decline reason | The explanation for why a payment failed, such as insufficient funds or an expired card |

| Dispute | The process of responding to a chargeback by providing evidence |

| Dunning | Automated messages that prompt customers to update payment details after a failed subscription payment |

| Encryption | A security method that scrambles payment data so it cannot be read if intercepted |

| Failed payment recovery rate | The percentage of failed payments successfully recovered through retries and dunning |

| False decline | When a legitimate payment is incorrectly blocked |

| Fraud | Unauthorized or suspicious payment activity, such as stolen cards or account takeovers |

| Hard decline | A permanent payment failure that will not succeed without new payment details, such as an expired, canceled, or stolen card |

| Hosted checkout | A pre-built payment page managed by a provider that handles security, compliance, and payment processing without requiring a custom integration |

| Issuing bank | The customer’s bank that issued the card and decides whether to approve or decline a transaction |

| KYC (know your customer) | Identity checks used to verify users and reduce fraud |

| Local acquiring | Processing payments through a local bank or processor in the customer’s country to improve approval rates |

| Local payment methods | Region-specific ways to pay, such as local bank transfers or regional wallets |

| Merchant | The business or creator receiving the payment |

| Merchant of Record (MoR) | A company that legally processes payments on behalf of a business and takes responsibility for taxes, compliance, fraud, and chargebacks |

| Online payments | Any method of moving money from a customer to a business over the internet, including cards, digital wallets, and bank transfers |

| Payment gateway | The tool that securely captures and sends payment details from checkout to the payment provider |

| Payment processor | The service that handles the technical steps of processing a transaction and sending it through the appropriate networks for approval |

| Payment provider | The company you use to accept payments online, often bundling processing, gateway, and fraud tools |

| Payment success rate | The percentage of payment attempts that result in a completed transaction |

| PCI compliance (PCI DSS) | Security standards businesses must follow when accepting card payments to protect cardholder data |

| Payout | When a payment provider sends a business the funds it has collected, typically on a daily, weekly, or rolling schedule |

| Proration | Adjusting charges when a customer upgrades or downgrades a plan mid-billing cycle |

| Recurring payment | A payment that repeats on a set schedule, such as a subscription |

| Reconciliation | The process of matching payments, refunds, fees, and chargebacks with bank deposits and reports to ensure financial records are accurate |

| Refund | Returning money to a customer after a purchase |

| Reserve (rolling reserve) | A portion of a business’s funds temporarily held by a payment provider to cover potential chargebacks, refunds, or fraud risk |

| Retry logic | Automatically retrying a failed payment at set intervals to recover revenue |

| Settlement | The process of transferring approved funds from the card networks and banks to the merchant’s account after a payment is authorized and captured |

| Soft decline | A temporary payment failure that may succeed if retried, often caused by issues like network timeouts or insufficient funds |

| Stablecoin | A type of cryptocurrency designed to maintain a stable value, often pegged to the US dollar |

| Strong customer authentication (SCA) | A European regulation that can require extra verification, often using 3d secure, to reduce fraud |

| Token | A secure placeholder that represents payment details without exposing the original information |

| Tokenization | A security method that replaces sensitive payment details with a secure placeholder called a token |