If you're looking to pay off debt, learn to invest, or just get a better handle on all things personal finance, this ultimate list of personal finance books is for you.

Key takeaways

- Financial success depends more on spending habits and mindset than income level.

- Simple investment strategies often outperform complex ones, which primarily benefit sellers.

- Psychology and emotions drive financial decisions more than logic, making self-awareness essential for wealth building.

Most of us have ambitions we are working towards. It’s frustrating, then, that many of the obstacles strewn across the path to success are financial.

Perhaps you have recently graduated from college, with heavy debt to show for it. On top of that, a decent-paying job can seem hard to come by. Worse, when the economy is on the ropes, you could be battling to get work at all.

How are you supposed to free up enough money to afford a home, a wedding, or your eventual retirement?

Now for some heartening news. In many instances, making ends meet is less about how much money you have and more about how you spend it.

So, how should you spend it? The answer is going to be different for each person. That’s why you need to polish up on your financial know-how. Reading many of the best personal finance books is a great way to start.

The best personal finance books

It’s easy to find ‘good’ personal finance books — just look at Amazon reviews. Ideally, though, you want more than just a ‘good’ book, given how long it could take for you to read from cover to cover.

Your time is limited, so it pays (if you will excuse the pun) to be super-choosy.

Inevitably, different books will cover different areas of personal finance. However, the top 20 personal finance books spotlighted below are all impressively broad in their remit.

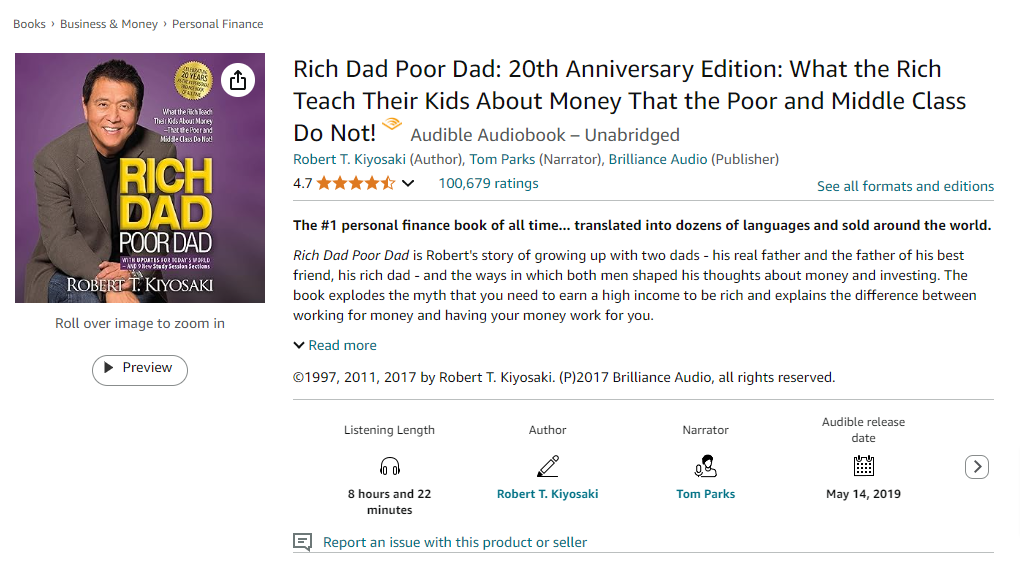

1. “Rich Dad Poor Dad” by Robert T. Kiyosaki

Now established as a classic among personal finance books, Rich Dad Poor Dad has been revised and updated multiple times since its original 1997 publication.

At the heart of the book is a comparison between two dads. One, the author’s real dad, was well-educated but remained a financially flailing employee his whole life.

In sharp contrast, the other dad — the dad of Robert’s best friend — gained most of his finance knowledge outside of a traditional classroom environment. This man became an entrepreneur and eventually scaled the heights of Hawaii’s rich list.

Kiyosaki highlights these differences to illustrate his point that the school system won’t teach kids everything they should know about money matters.

The author also strives to help readers properly distinguish between assets and liabilities. For example, though conventional wisdom class cars as assets, they actually lose value over time and so cannot be sold for a profit.

Kiyosaki has also drawn up what he refers to as ‘the cashflow quadrant’. To maximize your earnings, you really need to be a business owner or investor rather than an employee or self-employed.

📚 Topics covered:

- Kiyosaki’s ‘cashflow quadrant’ model

- Why assets are more financially worthwhile than liabilities

- Why the classroom can’t teach everything about money

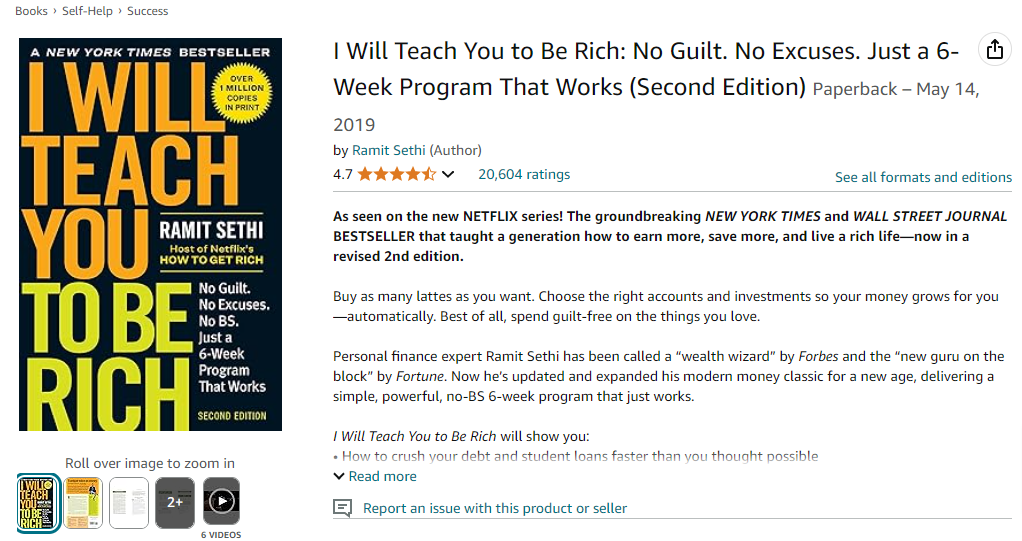

2. “I Will Teach You to Be Rich” by Ramit Sethi

You might have long assumed that keeping on top of your finances must mean ruthlessly cutting out even little luxuries.

Ramit Sethi begs to differ. In 2009, he penned I Will Teach You to Be Rich, which became a New York Times bestseller. In the book’s tenth anniversary year, he released a revised version packed with tips on how to manage your spending.

No, it doesn’t have to mean completely abandoning your favorite latte. One common risk with personal finance is that you set your heights unrealistically high.

Sethi has put together a six-week practical roadmap you can use to rein in your expenditure without going to unsustainable extremes.

If you’ve watched Sethi’s 2023 Netflix series How to Get Rich, you know what kind of detail to expect from his similarly titled book. He even explains word-for-word what to say if you want to negotiate a big raise at work or wriggle out of paying late fees!

📚 Topics covered:

- Clearing debt and student loans

- Setting up high-interest bank accounts without fees

- Automating finances

- Handling big expenses like a car, house, or wedding

3. “The Simple Path to Wealth” by J. L. Collins

Investment can be a reliable way of amassing wealth — if you know the crucial dos and don’ts of going about it. Unfortunately, it’s easy to be confused about the world of investment and much of the jargon surrounding it.

J. L. Collins is here to unravel those tangles. He insists that many people who sell investments make them more complex than they need to be.

That’s because, Collins continues, injecting complexity into investments makes them more expensive for the buyer and more profitable for the seller.

In this book, Collins addresses lingering myths about investing and explains what actually works. For example, he shines a revelatory light on the inner workings of the stock market and provides a beginner-friendly guide to investing in stocks.

As for debt, it’s important to avoid it. However, if you do have it, Collins has advice on what to do. He also touches upon numerous more technical aspects of investing, like ‘dollar cost averaging’ (which he doesn’t actually recommend).

📚 Topics covered:

- The wealth-building and wealth-preservation phases of investing

- 401(k), 403(b), TSP, IRA, and Roth accounts

- Target Retirement Funds (TRFs), Health Savings Accounts (HSAs) and Required Minimum Distributions (RMDs)

4. “Broke Millennial: Stop Scraping by and Get Your Financial Life Together” by Erin Lowry

If you are a millennial, you could be frustrated by how long you have had to contend with unpaid student loans. Even if you have the pleasant distraction of a romance, you should tread carefully when sharing financial details with your partner.

Erin Lowry has published in-depth advice on how to tackle money dilemmas often faced by the millennial generation. Of course, this generation does span quite a large age bracket, but all millennials can potentially benefit from her wisdom.

For example, you could have failed to keep a roof over your head and so needed to move back in with your parents. Meanwhile, older millennials in particular could be planning well ahead for their retirement.

If you fall into any of these categories, rest assured that Lowry knows how you can #GYFLT (‘get your financial life together’!).

📚 Topics covered:

- Credit card debts

- Investing

- Budgeting

5. “You Are a Badass at Making Money: Master the Mindset of Wealth” by Jen Sincero

In 2013, Jen released the book You Are a Badass: How to Stop Doubting Your Greatness and Start Living an Awesome Life. It has shifted more than five million copies and spawned a number of follow-up books.

Among those are You Are a Badass at Making Money: Master the Mindset of Wealth. As this 2017 book’s title and Sincero’s own background suggest, there is a big focus on the psychological aspect of managing money.

Many of the tips she provides are borne out of her own personal experience, too. One day, she lived a cash-strapped existence in a converted garage. Within just a few years, she had transformed herself into a jet-setter embracing the high life.

If you are financially stricken, your mindset could be largely to blame. Indeed, according to Sincero, financial success is an inside job.

With her help, you, too, can start affording those glamorous vacations. Subsequently, you could build on that milestone by making money while traveling.

📚 Topics covered:

- Overcoming doubts, fears, and excuses

- Changing the way you see money

- Avoiding playing victim to circumstance

- Gaining as much wealth as you want

6. “Your Money or Your Life” by Vicki Robin & Joe Dominguez

Originally published in 1992, this book has often been credited with inspiring the FIRE (Financial Independence, Retire Early) movement.

FIRE is basically a multi-pronged technique where, by minimizing your outgoings and maximizing your incomings, you can enable yourself to retire in your 30s or 40s.

Even if you don’t intend to go that far, there’s still a lot to like about Your Money or Your Life. Its latest iteration was released in 2018 and strives to help readers strike the right work-life balance.

Yes, your life satisfaction is bound to depend – at least to some extent – on how much you earn. However, if you are currently sticking with an unenjoyable job just for a large paycheck, is that really the best trade-off?

This book takes readers through nine major steps to help them discern how to earn and spend in a manner that ensures the best life value.

📚 Topics covered:

- Tackling debt

- The ‘less is more’ approach to living well

- Saving money through eco-friendly means

- Investing savings

7. “The Psychology of Money” by Morgan Housel

Have you ever spent money on something and then wondered why? Maybe your head was turned by a flashy car or smartphone you turned out to not really need.

In this book, acclaimed author Morgan Housel strings together 19 short stories showing why our money decisions aren’t always entirely rational.

Each of the stories looks at a real-life instance of someone either making or losing money – and what psychological factors may have been at play.

Yes, many of us have access to figures and formulas indicating what we should buy and when. In practice, though, we tend to be swayed by other factors – like our personal history, pride, ego, and perception of the world.

If you are in your teens or 20s, you could be especially prone to ‘buyer’s remorse’. The trick, then, is to recognize when your subconscious biases are threatening to take you down the wrong spending path.

It helps that The Psychology of Money is a fun – rather than depressing – read, with its story format highlighting amusing oddities of human nature.

📚 Topics covered:

- How money is typically taught

- Why formulas aren’t the full story behind financial decisions

- How emotions interfere with our financial decision-making

8. “Financial Feminist” by Tori Dunlap

Are you a female millennial who has struggled to make financial headway? You might not have realized how many roadblocks in the professional sphere hinder women in particular.

The good news is that personal finance influencer Tori Dunlap knows how you can help yourself to level the playing field.

You might have already seen Tori sharing money tips on Instagram and TikTok. However, she goes into much more detail in the pages of Financial Feminist, making a copy a must-buy for any young woman with career ambitions.

Though Tori was always prudent with money even as a girl, she has found many other women’s knowledge of personal finance lacking.

Unlike boys, girls are rarely encouraged to take the kind of calculated risks necessary for them to grow their wealth. Meanwhile, adult women are unjustly stereotyped as frivolous spenders and tend to lose their jobs first when an economic crisis hits.

These hindrances aren’t easy to overcome, so it’s convenient that Financial Feminist isn’t merely a list of tips. It also includes exercises to help you not only reassess how you see money but also decide how you should tackle your financial troubles.

📚 Topics covered:

- Paying off debt

- Spending mindfully

- Saving and investing

- Easy-to-overlook threats, e.g. predatory credit card companies

9. “The Millionaire Next Door” by Thomas J. Stanley & William D. Danko

If you often struggle to make ends meet, it’s easy to feel despondent. Do you simply have to hold out hope for some sudden, unexpected windfall?

For this book, the two authors compiled more than two decades’ worth of research into America’s affluent. The results are heartwarming, as they dispel the myth that most of the United States millionaires inherited their wealth.

Instead, their monetary success is attributed to seven habits — including working hard, saving diligently and living frugally. Many millionaires pursuing extravagant lifestyles instead were also found to be lumbered with debt.

The book’s title is derived from the observation that many millionaires live ‘next door’ — i.e. in the suburbs — rather than the likes of Beverly Hills.

After reading The Millionaire Next Door, it could dawn on you that you already have all the skills you need to work towards millionaire status.

The book was last updated in 2010 when Stanley gave it a new foreword. However, the principles it puts forward remain relevant to this day. The million-dollar business ideas especially viable in the 2020s include podcasting and dropshipping.

📚 Topics covered:

- Fundamentals of personal finance

- Easy-to-follow instructions for financial good practice

- Quantitative data, including surveys

- Qualitative data, including interviews with millionaires

10. “When She Makes More” by Farnoosh Torabi

Are you an ambitious young woman? With a copy of the Tori Dunlap book Financial Feminist close at hand, you can look forward to increasing your earnings.

Now for another question — are you in a heterosexual relationship? It could become surprisingly fraught if your earnings begin to surpass your partner’s.

Farnoosh Torabi, the author of When She Makes More, has found herself in this exact situation. She knows how tricky it can be, as a male lover’s pride can rest heavily on his status as the household’s breadwinner.

At the same time, as more and more women smash the glass ceiling, their spouses will need to learn how to navigate the new reality.

In this book, Torabi details various tips and strategies you could follow to help alleviate tension resulting from income imbalances.

📚 Topics covered:

- Understanding how men think

- Communicating effectively

- Sharing responsibilities

- Avoiding power struggles

11. “The Total Money Makeover: Classic Edition” by Dave Ramsey

What financial challenges are you facing? It could feel like too many for you to list. Are you drowning in debt? Struggling to cobble together enough money for a rainy day? Desperate to get out of a mortgage? Trying to make sense of investing?

These are all riddles this Dave Ramsey book could immeasurably help you to solve. The title is wonderfully apt, as The Total Money Makeover covers a staggeringly wide range of personal finance subjects.

Ramsey is a highly respected finance coach, having made a name for himself as host of The Dave Ramsey Show. In The Total Money Makeover, he addresses common causes of financial strife, such as marriage conflict and college debt.

He also flags up the 10 money myths posing the greatest danger. However, even if your finances aren’t exactly in perilous shape, Ramsey can still show you how to improve them. You can never be certain when you might need that safety net!

📚 Topics covered:

- Budgeting

- Paying off debts

- Building a large nest egg for retirement

- Achieving financial freedom

12. “A Random Walk Down Wall Street: The Best Investment Guide That Money Can Buy” by Burton G. Malkiel

Have you seriously considered investing? It would be understandable if not, as the process can come across as dauntingly technical.

The complexity of supposedly wise investing strategies can sound like trying to solve a Rubik’s cube. Many experts (or so they are called) might advise you to build a portfolio from a range of assets selected by professionals.

However, inexperienced investors could too easily overlook other opportunities likely to prove more reliable in the long run.

In his repeatedly revised book A Random Walk Down Wall Street, successful investor Burton G. Malkiel draws attention to exchange-traded funds (ETFs). Given their market performance, these carry much lower fees than you might expect.

Now is an especially good time to buy this personal finance book, as its 13th edition was published in 2024.

📚 Topics covered:

- Why investors should avoid get-rich-quick schemes

- Why stock picking is overrated

- Recent investment trends, like factor investing and risk parity

- Why playing the long game is best for building wealth

13. “The Intelligent Investor” by Benjamin Graham

These days, many investors buy stocks as a matter of course. Back in the 1940s, though, they were deemed too risky for the typical investor.

The publication of The Intelligent Investor at the tail end of the decade changed how stock markets were viewed. Graham showed how investors could not only invest safely but also reap significant returns.

Nonetheless, the details have dated in some places, helping to explain why multiple new versions of The Intelligent Investor have been released over the decades.

For 2024, The Intelligent Investor has been given a ‘75th Anniversary Edition’ complete with an introduction and appendix by Warren Buffett.

The Berkshire Hathaway CEO, one of Graham’s most successful disciples, has hailed The Intelligent Investor as “the best book about investing ever written”.

The original text of the book’s chapters has not been edited for the 75th Anniversary Edition. However, each chapter now includes an up-to-date commentary by Wall Street Journal writer Jason Kweig.

By reading these annotations, you can absorb how Graham’s time-honored principles ought to be applied by investors in the 2020s.

📚 Topics covered:

- Value investing

- What rate of return to aim for

- How Graham’s philosophy has stood the test of time

14. “Beating the Street” by Peter Lynch

It would certainly bode well for you to heed the advice of someone who has “been there and done that”. You can have confidence in the quality of the advice they are sharing when you know they have achieved impressive results.

The legendary investor Peter Lynch falls into this category. He is renowned for the high returns he achieved as manager of a mutual fund, the Fidelity Magellan Fund, in the 1980s. Beating the Street was published in 1994.

This was the first time Lynch publicly explained how to devise a mutual fund strategy. There is a particularly strong focus on how to pick stocks. Lynch emphasizes how important it is for you to investigate the success of the company behind the stock.

All in all, you are given all the ingredients you need to build a long-term investment strategy. Along the way, you can garner valuable insights into what makes a company thrive. Who knows, you could even start your own business…

📚 Topics covered:

- Assembling a profitable investment portfolio

- Peter Lynch’s “invest in what you know” strategy

- Preparing a mutual fund strategy

- Handling a company’s finances

15. “The Woke Salaryman Crash Course on Capitalism & Money: Lessons from the World’s Most Expensive City” by The Woke Salaryman

If you are a young person, you could get a nasty shock when you enter the world of money for the first time. When it comes to freeing up enough money for major life goals, it can feel like the system is rigged against you.

Young adults can find themselves with precious few opportunities to make big money. Even if you forgo college in favor of the workplace, you could struggle to ascend the ranks all that quickly.

If only you had a fun comic to read to stave off your frustration. In fact, you might have already come across one by scrolling through your Facebook or Instagram feed.

You might follow The Woke Salaryman, which regularly posts morsels of webcomic genius on these social networks as well as its own personal finance blog.

The Singapore-based company has now brought out its first book. It’s a graphic novel titled Crash Course on Capitalism and Money: Lessons from the World’s Most Expensive City (Singapore, where The Woke Salaryman is based).

You certainly don’t need to reside in this Southeast Asian city-state to benefit from the personal finance advice on offer.

The riveting comics in this collection come with commentaries that further enlighten readers on how to thrive financially in the economically punishing modern world.

📚 Topics covered:

- Developing the right mindset for financial success

- The first steps worth taking after graduation

- How personal finance can serve your life goals

16. “The Automatic Millionaire” by David Bach

Many of us aspire to achieve what is often dubbed ‘financial freedom’. For some of us, this can simply mean being wealthy enough not to fret about money. For others, it can mean being able to contribute financially to charitable endeavors.

More money can also give you more options with regard to when and how you work. However, you don’t necessarily need to see a dramatic upswing in your salary straight away. For example, there are plenty of jobs for stay-at-home moms to consider.

Similarly, to get rich, you don’t have to set aside time just for work, work, work! In The Automatic Millionaire, David Bach introduces an ordinary couple who reached many lofty financial milestones despite never earning more than $55,000 a year altogether.

Those achievements included owning two homes debt-free, paying for two kids’ college tuition, and retiring with savings exceeding $1 million.

To key to such prosperity, Bach explains, is automating your finances. The book presents a one-step program you can complete from the comfort of your own home in one afternoon. You can then just leave your wealth to accumulate over time.

The Automatic Millionaire was first published in 2004 but has since been re-released with updated details on taxes, investments, and apps.

📚 Topics covered:

- Making the right spending decisions

- The importance of paying yourself first

- How to automate saving money and repaying debt

17. “The Richest Man in Babylon” by George S. Clason

Are you a history buff? If so, reading this collection of parables and short stories set in the ancient city of Babylon could be great for scratching that itch. Along the way, you can also learn a thing or two about the fundamental principles of personal finance.

These stories were written in the early 1920s and made it into pamphlets handed out to banking and insurance customers. The positive reaction to these literary pieces led them to be included in this compendium named after Clason’s best-known story.

Clason’s strategy of sharing financial wisdom through the mouthpieces of relatable characters clearly paid off. Though originally published in 1926, The Richest Man in Babylon is still regarded as one of the all-time classic personal finance books.

Thinking of picking up a copy? It could take a bit of time for you to get accustomed to the ancient language used for the sake of historical authenticity.

If you do struggle, you might want to look for financial educator Charles Conrad’s modern rewriting of the book. This version arrived in 2013 and uses simplified language easier for today’s readers to digest.

📚 Topics covered:

- How to preserve more of your earnings

- Getting out of debt

- Making your savings go further

- Choosing wise investments

18. “Retire Before Mom & Dad” by Rob Berger

If the concept of Financial Independence, Retire Early (FIRE) has piqued your interest, how can you put it into action? This book makes a useful primer.

Even if you see retiring early as a nice-to-have rather than a must-have, Retire Before Mom & Dad can accelerate your wealth creation efforts.

Its advice goes into the kind of forensic detail you won’t find in generic personal finance articles online. For example, this book can help you figure out what you need to do on a daily, weekly, and monthly basis to finally achieve FIRE.

Considering dipping your toes into investing? It’s easy to get confused by it all. Retire Before Mom & Dad shows how to assemble a simple but effective investment portfolio.

As you get to grips with these fundamentals, you could consider moving into other, more specialist forms of investing. While some have tended to fluctuate in fashionability, dividend investing has remained a consistently reliable moneymaker.

You might fear that saving ruthlessly for retirement could require you to make lifestyle changes in the here and now. Rob Berger explains why this doesn’t have to be the case — and why other financial avenues, like investing, are still open to you.

📚 Topics covered:

- Reducing debt in a way you can stick with

- How retirement accounts, e.g. 401(k) and 403(b) accounts, work

- How to choose the right retirement accounts for your needs

19. “The Latte Factor: Why You Don’t Have to Be Rich to Live Rich” by David Bach & John David Mann

You might not have realized how many superfluous little expenses you are incurring in your day-to-day life. Do you enjoy a daily latte? If so, skipping it could help you to free up much more wriggle room in your finances.

It’s admittedly slightly ironic, then, that one of the best personal finance books tells a parable about a young woman learning financial wisdom from a barista. The encounter significantly changes her life for the better.

The lead character — New York City resident Zoe — initially faces a raft of financial problems familiar to many other twenty-something professionals. She is weighed down by growing debts and struggles to make ends meet despite working long hours.

After chatting to elderly barista Henry at a Brooklyn coffee shop, she has an epiphany. She was already earning enough to be able to live comfortably. She just needs to make a few basic but clever changes to her daily routine…

By reading the book, you can find out what those changes are — and why you could benefit immensely from making them in your own life. The fiction format of The Latte Factor makes it fun to read in short, easily digestible chunks.

📚 Topics covered:

- Saving and investing wisely

- Singling out — and cutting out — unnecessary expenses

- Planning for the long-term

20. “Finance for the People: Getting a Grip on Your Finances” by Paco de Leon

One persistent problem with the subject of personal finance is how dryly it is often taught. Reading about it can feel too much like trying to make sense of a computer’s instruction manual, with obscure technical terms all over the place.

Former financial planner Paco de Leon is well aware of this. For this reason, she has written a book starting with the psychological factors behind the financial decisions we make.

Are your debts larger than your savings? Are you struggling to get your head around even supposedly ‘basic’ aspects of investing?

Some unhelpful beliefs about money could be festering in your mind without you consciously noticing. If you still need to pay off student loans, the pressure to do so could be worsening your mental health.

Meanwhile, you might have been considering making particular money moves only to be put off them by your parents’ (or society’s) expectations.

In situations like these, you need to take a step back and strive to observe matters objectively. Finance for the People can assist you with doing exactly that — not least as de Leon adopts the friendly, non-judgmental tone of a therapist.

📚 Topics covered:

- How to think more clearly about your financial troubles

- Assessing your relationship with money

- The importance of practicing mindfulness and gratitude

- Putting the debt cycle behind you

Expand what you know about personal finance

There’s a lot to like about personal finance books. You can buy them as print books, ebooks, or even audiobooks. Which of those formats you should personally go for will depend on your own preferences and situation.

Are you a busy entrepreneur? Imagine how convenient it would be to have a bookshelf or bookcase full of personal finance books. You could then easily retrieve one just by picking it up as and when you need to consult it.

An ebook can be similarly time-effective to read — you would be able to do so on your smartphone while waiting for the morning train. Need to wash some cutlery in the sink? Why not listen to an audiobook while you are at it?

As you deepen your personal finance knowledge, you could even consider selling your own ebooks on the subject. Whop makes it easy for you to open an online bookstore.

Nonetheless, relying entirely on books could leave blind spots in your personal finance knowledge. Once a book has been written, some time can pass before it hits retail shelves. So, by then, certain details in the book could be out of date.

Join personal finance communities online

Doing so can bring you into contact with personal finance experts capable of bringing you up-to-the-minute information. About what? Here are some examples…

📱 Apps: Some books even just a few years old may advocate software packages that no longer exist or have changed beyond recognition.

💰 Prices: Obviously, inflation can force suppliers to hike their prices. Also, some previously free apps could switch to a subscription or ‘freemium’ model.

🧾 Taxes: Even just getting started with tax compliance can be tricky, let alone keeping pace with changes brought about by successive administrations.

⚖️ The law: Some personal finance books could highlight legal loopholes that have actually been closed since the book’s publication.

Another option is to enroll in online courses teaching personal finance essentials. Either way, you can receive much more relevant advice personalized to your specific financial situation.

None of this is to say that you should ignore personal finance books altogether. On the contrary, they are ideal for beginners to the subject, as these books can dive into rich detail about its fundamentals.

However, once you have mastered those, joining communities and studying courses can aid you in keeping up with trends and other changes in personal finance.

Supercharge your personal finances with Whop

After soaking up knowledge from some of the best personal finance books, why not explore the personal finance communities and courses available here at Whop?

Many financial gurus have set up their own online hubs — ‘whops’ — on this platform. As you peruse Whop, you could come across many digital products — including ebooks, videos, and software — capable of alleviating your money woes.

Ready to pick up some nuggets of personal finance wisdom? You can find subject-matter experts right here on Whop, enabling you to directly ask them any questions you like about money issues. By joining a community, course, or both, you can quickly expand your personal finance knowledge.