Square is an all-in-one POS and payment processor that lets businesses take payments anywhere. Learn what it is, how it works, and when to choose one of the alternatives listed.

Key takeaways

- Square is an all-in-one payment processor ideal for small businesses needing simple in-person and online payments without separate merchant accounts.

- Square works best for local, physical-first businesses but lacks flexibility for digital products, subscriptions, or global expansion beyond nine countries.

- Square's flat-rate pricing has no monthly fees, but online transactions and instant transfers cost more than standard in-person payments.

Square is an all-in-one payment processor that lets businesses accept card, wallet, and online payments from almost anywhere.

Square was initially built for small, offline sellers, but I now see it serving a wide range of service providers and online businesses.

I think it’s a solid choice if you’re running a small team and need an easy way to collect payments, but its ecosystem is still built around local transactions with limited global reach.

This means digital-first brands, creators, and SaaS businesses growing beyond one region or platform can quickly feel restricted by Square.

In this guide, I’ll break down how Square payments work, who Square is best for, and when a more flexible processor might be a better option.

What is Square?

Square makes it easy for businesses to get paid, whether it’s online or face-to-face.

Instead of relying on external payment gateways or merchant accounts, Square handles everything: securely collecting card or wallet details, authorizing the charge, and depositing funds straight into your bank account.

It’s an end-to-end system managed entirely within Square’s ecosystem, connecting its POS app, payment hardware, and online checkout tools to one dashboard.

How does Square work for payments?

Square combines its hardware, software, and processing network to handle every step of a transaction inside one system.

When a customer pays by card or digital wallet, Square authorizes the transaction, captures the funds, and deposits them into your linked bank account (typically within one to two business days, or instantly for a small fee).

Here’s what that process looks like, step-by-step:

1. Checkout

A customer makes a payment either in person (using a Square Reader or terminal), online (through Square Online, a payment link, or checkout button), or by paying a digital invoice you send from your dashboard.

2. Authorization

Square encrypts the customer’s payment details and sends them through the card network (Visa, Mastercard, Amex, etc.) or digital wallet provider (Apple Pay, Google Pay, or Cash App Pay in the US) for approval.

3. Capture

Once the transaction is authorized, Square captures the funds and records the payment instantly in your Square Dashboard. You can view it in real time alongside any taxes, tips, or discounts applied.

4. Settlement

The approved funds are automatically transferred to your linked bank account, usually within one to two business days. You can also request an instant transfer for a small additional fee.

5. Reconciliation

Every payment, refund, and fee is automatically logged for reporting and accounting. Built-in fraud screening and dispute management tools help you track chargebacks and verify legitimate transactions.

Who can use Square?

I’ve found that Square is available to businesses and sole traders in a specific set of supported countries:

- United States

- Canada

- United Kingdom

- Ireland

- France

- Spain

- Australia

- Japan

- New Zealand

Each country has its own onboarding steps and payout schedules, but the setup process is basically the same everywhere.

Square eligibility requirements

To start taking payments with Square, your business needs to meet a few basic requirements:

- Registered location: Your business or sole proprietorship must be legally based in one of the above supported countries.

- Bank account: You’ll need a local checking account in your payout currency that can accept electronic transfers. For example, US sellers need a USD account with a US-based bank that supports ACH deposits.

- Verification: During setup, Square will ask for key details like your business name, tax ID (EIN or SSN in the US), address, and bank information. These are used to verify your identity and meet anti-money-laundering requirements.

- Business type: Square is built for legitimate small to mid-sized businesses, freelancers, and service providers. It’s not suited for digital creators selling memberships, downloads, or subscriptions, as recurring billing and multi-platform integration are limited.

Once your account is verified, you can start taking payments right away by sending checkout links, invoices or setting up an online store through Square Online.

Square mainly serves small to mid-sized businesses like retail shops, cafés, and service providers, but it’s also used by freelancers and independent creators who want a quick way to collect payments.

That said, I’ve noticed a few limits: Square’s payment tools are built around physical POS sales, so digital products, memberships, and subscription-style models are harder to manage.

You can send invoices or sell through Square Online, but there’s little flexibility to customise checkout, automate recurring payments, or sell through multiple platforms.

Square also doesn’t support modern payment options like crypto or region-specific methods used outside its core markets, which makes scaling globally more difficult.

Square's top features

Once you activate Square, you get access to an all-in-one ecosystem that covers payment processing, reporting, and optional business tools, all synced through the Square Dashboard.

1. Seamless checkout and fast payouts

Square connects checkout, POS, and payments under one roof (something I see as a major convenience for small teams). Customers can pay in person, online, or via invoice - without leaving your sales flow.

Transactions are authorized, captured, and settled directly through Square, with payouts typically hitting your linked bank account within 1–2 business days. Instant transfers are available for a 1.75 % fee.

Whop Payments offers the same simplicity but with faster settlement options (including crypto or local bank payouts in 241+ territories) and no need for extra instant-transfer fees.

2. Multi-channel selling

Square works across in-person, online, and mobile channels. You can:

- Take payments with Square Readers or POS hardware

- Sell online through a Square Online store or checkout links

- Send invoices or recurring bills directly from your dashboard

All activity syncs in real time, giving you one view of orders, taxes, and refunds.

Fan of a multi-channel approach? Whop takes it further, letting you sell products, memberships, livestream access, or downloads from a single storefront without separate hardware or POS integrations.

3. Management and reporting

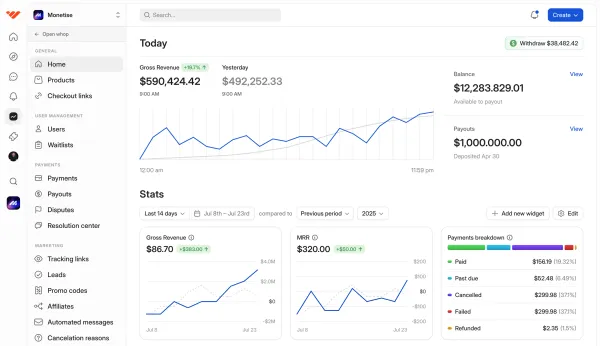

The Square Dashboard is where you find everything you’ll need to manage payments: tracking live sales, customer details, and payout history.

You can process refunds, adjust tax or tip settings, and monitor transactions across channels in real time.

Square also includes basic fraud detection and dispute management, flagging risky transactions automatically and helping you submit evidence if a chargeback occurs.

Whop Payments goes beyond basic reporting, offering real-time analytics on payment conversions, failed charge retries through orchestration, and custom automation triggers that sync with your entire business stack.

4. Buy Now, Pay Later with Afterpay

Square’s BNPL option, powered by Afterpay, lets customers split purchases into four interest-free instalments while you still get paid in full upfront.

- Availability: US, Canada, Australia, and New Zealand

- Payouts: Merchants receive full payment at checkout

- Fees: Afterpay transactions carry a separate 6 % + 30¢ processing fee

- Disputes: Managed through the Square Dashboard like any other payment

Whop supports multiple BNPL providers globally (not just Afterpay) and routes them automatically for better conversion, while keeping fees at the same flat rate as standard transactions.

5. Add-ons and integrations

Beyond payment processing, Square offers optional tools for appointments, email marketing, loyalty programs, payroll, and staff management.

Integrations through the Square App Marketplace let you extend functionality with ecommerce, accounting, and CRM platforms, though some add-ons incur extra monthly fees.

Whop includes over 150 add-ons and tools natively via the Whop App Store, from email automation to affiliate management – no need for paid third-party apps or separate subscriptions.

How to set up Square Payments

Getting set up with Square is quick. In my experience, you can start taking payments within minutes of signing up.

Here’s the play-by-play to set it up:

1. Create your Square account

Head to Square’s website and sign up with your business or personal email. You’ll be asked for your name, business category, country, and estimated transaction volume.

2. Verify your business details

Square will prompt you to complete identity verification.

Provide your legal business name, EIN or SSN (for US sellers), physical address, and date of birth.

Verification is required under Know Your Customer (KYC) and anti-money-laundering rules before you can process live payments.

3. Link your bank account

Add a checking account that can accept ACH transfers in your payout currency (USD for US sellers).

Square deposits a small test transfer (usually within a business day) to confirm your account.

Once verified, payouts will start arriving automatically within 1–2 business days after each transaction.

4. Choose how you’ll take payments

You can:

- Accept in-person payments: Using a Square Reader, Stand, or Terminal (available online or in major retailers).

- Take online payments: Through a Square Online store, payment link, or checkout button.

- Send invoices: Directly from your dashboard or mobile app.

You can also store cards on file for repeat customers or set up recurring subscriptions.

5. Enable digital wallets and BNPL

Square supports Apple Pay, Google Pay, and all major debit and credit cards (Visa, Mastercard, Amex, Discover).

If you’re eligible, you can also enable Afterpay (Square’s built-in Buy Now, Pay Later option) directly from your dashboard.

6. Download the Square app and start selling

Download the Square POS app (iOS or Android) to accept payments, issue refunds, and track sales on the go.

Once everything’s set up, you can start accepting payments immediately.

Funds flow straight into your connected bank account on your chosen schedule, and Square handles all card processing, wallet transactions, and basic fraud checks in the background.

What is Square’s pricing?

I’d describe Square’s pricing model as straightforward — but not necessarily the cheapest.

There are no setup or monthly subscription fees (win), and you only pay when you make a sale (also good).

But while setup feels straightforward, the cost of convenience and limited flexibility can add up. Card-not-present transactions (like online checkouts or invoices) carry higher rates, and instant transfers incur a small extra fee.

Square also has no orchestration layer to reroute failed transactions between multiple processors (unlike Whop Payments - but more on that later). Buy Now, Pay Later is available through Afterpay – but only in select countries.

Here’s how Square’s standard rates break down for US merchants:

| Payment type | Fee | Notes |

|---|---|---|

| In-person payments | 2.6% + 10¢ | Tap, dip, or swipe transactions through Square Reader or POS. |

| Online payments | 2.9% + 30¢ | For ecommerce checkouts, payment links, and Square Online. |

| Invoices | 3.3% + 30¢ | Applies to card payments made through Square Invoices. |

| Keyed-in / virtual terminal | 3.5% + 15¢ | For manually entered or phone transactions. |

Square fees worth knowing:

- Dispute fees: Square doesn’t charge an upfront fee for chargebacks, but if you lose the dispute, you’re liable for the full transaction amount. Funds are held during the investigation period (typically 60-90 days).

- Refunds: Processing fees are not refunded when you issue a customer refund; you’ll still eat the 2.6-3.5 % + fixed fee portion of the original sale. Ouch.

- Instant transfer fees: Payouts to your bank are free on the standard 1-2 business-day schedule. If you use Instant Transfer to access funds immediately, there’s an extra 1.75 % fee per payout.

- Afterpay (BNPL) fees: Sellers using Afterpay (Square’s BNPL option) pay 6 % + 30¢ per transaction, a lot higher than standard credit-card rates.

- Cross-border and currency conversion: Square automatically converts foreign-issued cards to your account currency (USD for US sellers). A small foreign-exchange margin (around 1-2 %) may apply, depending on your customer’s bank and card network.

- Card-on-file storage: Storing cards for recurring payments or invoices is free, but failed charges still incur the full processing fee once approved on retry.

- Chargeback protection: Square offers limited protection through its Chargeback Protection program (up to $250 USD per month in eligible chargebacks automatically covered). Beyond that, you bear the cost of disputes.

Is Square worth it? Pros and cons

Square is one of the easiest ways to start taking payments online or in person, especially for small or hybrid businesses.

But its simplicity comes with trade-offs in flexibility, pricing, and global reach.

| Pros | Cons |

|---|---|

| All-in-one system combining POS, invoicing, and online checkout | Limited availability outside North America, Europe, and a few Asia-Pacific regions |

| Fast onboarding, can start accepting payments within minutes | No orchestration or smart routing for failed payments |

| No setup or monthly fees; transparent flat-rate pricing | Higher processing fees for online and BNPL (Afterpay) transactions |

| Built-in tools for appointments, payroll, and loyalty programs | Basic analytics and limited automation compared to newer platforms |

| Supports major cards, wallets, and Afterpay for BNPL | Not optimised for digital-first or multi-platform businesses |

| Unified dashboard for sales, payouts, and customer data | Few global currencies and no multi-currency settlement |

Square’s ecosystem makes sense if you’re running a local or service-based business that wants a quick, reliable way to take payments without coding or third-party setup.

But for digital-first brands, creators, and SaaS operators scaling across borders?

Its limited payment routing, higher online rates, and regional restrictions make it a tougher long-term fit.

Luckily, I’ve found there are alternatives that offer the features Square lacks.

Top alternatives to Square for payments

If your business lives on the internet (not just in one location), these alternatives offer more flexibility, reach, and advanced infrastructure when it comes to accepting payments.

1. Whop

Whop isn’t a payment processor - it’s the platform you run your entire business on. Inside it, Whop Payments powers the money movement behind everything you sell.

Whop Payments now handles billions in transactions across 27,000+ businesses, from coaching programs and SaaS startups to digital marketplaces and creator-led brands.

Whop Payments has evolved into a comprehensive payment infrastructure, handling KYC, pay-ins, and payouts internally.

Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.

- Hunter Dickinson, Head of Partnerships at Whop

TL;DR? That means faster onboarding, broader coverage, and lower fees.

Whop Payments supports 195+ countries, 135+ currencies, and over 100 payment methods (including credit/debit cards, wallets, BNPL, and crypto). Each checkout routes dynamically across multiple providers to maximise approval rates, boosting successful payments by up to 11 percent.

The key reason I decided to move over to Whop was because they had access to great BNPL options, which I couldn't secure on my previous platform.

I started getting payments that I ordinarily couldn't make, because customers couldn't afford my fee up front. It's been a game-changer.

- Whop coach Carl Parnell

You can sell digital products, subscriptions, memberships, or event access from a single storefront. Or, embed a Whop checkout directly into your existing site.

Payouts are just as flexible, arriving via bank transfer, Venmo, or crypto.

- Features: Global orchestration, built-in BNPL and crypto, embedded checkout links, affiliate tools, store builder, 24/7 live human support.

- Pricing: Free to start; 2.7 % + $0.30 per successful charge (enterprise discounts above $50K/month).

- Best for: Digital-first businesses that want global reach, instant payouts, and one platform for payments, products, and growth.

2. Stripe

Stripe is one of the most established payment platforms in the world, powering brands like Amazon, Instacart, and Shopify’s early payment stack. It’s ideal for businesses with developer resources or complex payment flows.

Its API-first design lets you build highly customised checkout experiences, manage recurring billing, issue invoices, or even open business bank accounts through Stripe Treasury.

Tools like Radar (fraud detection) and Billing (subscription management) make it a full-stack financial engine – but these require a bit of technical know-how to navigate, which is hard for solo or small business operators.

Stripe also supports hundreds of payment methods, including Apple Pay, Google Pay, Alipay, and Klarna, though setup and verification can take time.

- Features: Developer-friendly APIs, invoicing and billing, financial products, global acquiring, and Radar fraud suite.

- Pricing: 2.9 % + $0.30 per US transaction, +1 % for international cards or currency conversion.

- Best for: Startups and tech teams building custom checkout or recurring-revenue products that need global coverage and full API control.

- Caveats: Requires manual KYC and ongoing technical maintenance; limited crypto or BNPL options out of the box.

3. PayPal

PayPal is probably the world’s most recognised online payment brand. It’s trusted by 430 million+ users and supported by nearly every ecommerce platform. That consumer familiarity alone often lifts checkout conversion rates.

Merchants can accept credit/debit cards, PayPal Credit, and Pay in 4 BNPL, and send invoices directly. Plus, payouts are quick, and integrations with WooCommerce, Wix, and Shopify are plug-and-play.

But a huge drawback? PayPal’s fees are steep (especially on cross-border payments), and its dispute process tends to favour buyers. Businesses also report occasional fund holds for risk review.

- Features: One-touch checkout, wallet and BNPL options, invoicing, multi-currency support, and decent buyer protection.

- Pricing: 3.49 % + $0.49 per commercial transaction (US).

- Best for: Sellers targeting international consumers who value PayPal’s trust and protection.

- Caveats: High cross-border and dispute costs; limited transparency; slower growth path for high-volume merchants.

4. Adyen

Adyen is another global payment processor powering big brands: think Spotify, Uber, and H&M.

It’s built for enterprises managing large, multi-channel volumes, with a unified commerce framework that lets companies process payments across web, app, and in-store under one account.

Adyen also optimises routing for better approval rates and offers advanced fraud tools and real-time reporting. It also supports multi-currency settlement in major global markets.

That said, it can be overkill for most small or digital-first businesses.

Setup requires dedicated developer resources, onboarding can take weeks, and pricing isn’t flat – you’ll pay interchange + scheme + processing fees, which vary by market.

- Features: Global acquiring, advanced risk management, unified commerce, detailed analytics, 250+ methods

- Pricing: Interchange + 0.6 %, plus network and processing fees.

- Best for: Large merchants or enterprises needing robust international infrastructure and in-depth control.

- Caveats: High setup complexity, minimum invoice thresholds, and enterprise-level pricing make it excessive for small teams.

5. Shopify Payments

If you’re already selling on Shopify, its native payment gateway may be the most frictionless option. It integrates checkout, payouts, and dispute management directly into your store, eliminating third-party logins.

Shopify Payments supports major cards, wallets (Apple Pay, Google Pay, Shop Pay), and Shop Pay Installments via Affirm. Everything syncs automatically with your orders and analytics.

However, it’s exclusive to Shopify, so you can’t use it on other platforms, and it’s only available in select countries.

- Features: Built-in checkout, BNPL via Affirm, unified orders and payouts, fraud tools.

- Pricing: 2.9 % + $0.30 per online transaction (varies by plan and region).

- Best for: Shopify-only stores that want a plug-and-play checkout without extra gateways.

- Caveats: Shopify-exclusive, regional restrictions, limited flexibility for hybrid or non-Shopify businesses.

Is Square right for my payments?

Square is a good option for local or service-based businesses that need a simple way to start accepting card and wallet payments fast.

Its built-in POS system, free online store, and transparent flat-rate fees make Square payments especially appealing for cafés, salons, gyms, and small retailers. You can sell online, in person, or through invoices without third-party integrations, and everything syncs automatically in your Square Dashboard.

But like I said, limits exist: Square only settles payouts in supported regions, lacks multi-currency options, and doesn’t offer global orchestration to boost failed payment success rates.

And the biggest negative? Online transactions also carry higher fees than in-person sales.

To me, those trade-offs make Square less ideal for digital-first or international businesses that want flexible payments, faster global payouts, or alternative methods like crypto.

If your business is starting to scale online or beyond one region, Whop Payments combines global orchestration, BNPL, and crypto support in one unified system.

Process payments online, everywhere, with Whop

Processing payments shouldn’t limit your growth. Whatever you’re selling online, you need a system built for the internet, and not just one location.

Whop makes it easy to accept cards, wallets, BNPL, and crypto in 195+ countries with one unified system (and some of the lowest fees going).

Every transaction routes intelligently across multiple providers to maximise successful charges, and payouts land fast – to your bank, Venmo, or even in stablecoins.

No plugins, no extra fees, no regional barriers. Just faster payments, global coverage, and complete control from a single dashboard.

Earn without limits. Use Whop Payments and see how easy it is to sell, scale, and get paid online.

Square FAQs

What is Square Payments?

Square Payments is the payment processing system built by Square that lets businesses accept card, wallet, and online payments. It can handle everything from authorizing transactions to depositing funds into your bank account.

How does Square payment processing work?

Square acts as both a payment gateway and processor – when a customer pays by card or wallet, Square authorizes, captures, and settles the funds directly to your linked bank account.

What are Square’s fees (in the US)?

Square charges a flat rate for each transaction: 2.6% + 10c for in-person payments and 2.9% + 30c for online payments. Invoices and manually entered payments cost slightly more. Square doesn’t charge setup or monthly fees, but instant transfers add a 1.75% fee.

Is Square a good option for online businesses?

Yes, Square can provide a simple and beginner-friendly payment processing system for online businesses, offering checkout links, online stores, and invoicing.

However, it’s less suited for global or digital-first brands and businesses that need multi-currency and crypto options, or advanced payment routing.

Does Square offer Buy Now, Pay Later (BNPL)?

Yes, Square offers BNPL through Afterpay, letting customers split purchases into four interest-free instalments while you receive full payment upfront. However, it’s only available in select regions: The US, Canada, Australia, and New Zealand.

In which countries is Square available?

Square is available in the United States, Canada, the United Kingdom, Ireland, Australia, Japan, France, and Spain – with limited support in other European markets.

What are the best alternatives to Square?

The best Square alternatives include Whop Payments, Stripe, PayPal, and Ayden. Whop offers the most flexibility, though: global coverage, multiple BNPL options, crypto support, and smart routing to boost successful charges (by 11%).

How is Whop Payments different from Square?

Whop Payments is designed for online-first entrepreneurs, sellers, creators, and businesses that need to accept payments anywhere and everywhere, not just in local markets.

Fees are as low as 2.7%, with no monthly or setup fees. Enterprise discounts apply for sellers earning over $50K monthly.