The best payment processing companies for ecommerce in 2026 include Stripe, PayPal, and Apple Pay. Learn how to choose the right processor based on your business model, transaction volume, and global reach.

Key takeaways

- Choosing the right payment processor directly impacts your fees, conversion rates, and global reach for ecommerce success.

- Multi-PSP orchestration routes transactions through multiple processors to increase successful charges by up to 11%.

- BNPL options like Klarna reduce cart abandonment while ensuring merchants receive payment upfront.

The best payment processing companies for ecommerce in 2026 are Stripe, PayPal, and Apple Pay, each offering unique features for different business models, transaction volumes, and global reach.

Choosing the right processor ensures faster payments, lower fees, and smooth transactions, keeping your ecommerce business running efficiently.

In this guide, we break down the top processors, their strengths, and what to consider when picking the right solution for your store.

12 best payment processing companies for ecommerce

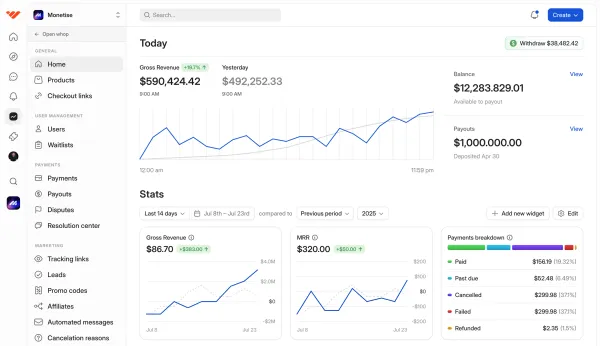

1. Whop

We’ve evolved into a fully independent payment platform — no longer just a gateway on top of Stripe.

“When we started, Whop was essentially a Stripe Connect wrapper. Now we’ve built our own infrastructure, from KYC to pay-ins and payouts."

- Hunter Dickinson, Head of Partnerships at Whop

We now power payments for over 27,000 businesses worldwide, routing billions in transactions and increasing successful charges by up to 11%. (Yeah, we're pretty proud of that too.)

But that's not all: We support 195+ countries, 135+ currencies and 100+ payment methods – including BNPL, crypto, and region-specific options.

"I mean, you can now get paid out in Bitcoin or Stablecoin and basically every single country in the world, which are things that Stripe doesn't really support."

- Steven Schwartz, Whop CEO

All while keeping fees among the lowest at 2.7% + 30¢ per transaction.

Payouts? Yeah, they're just as flexible, with over 241+ methods from bank transfers to Venmo and crypto.

All of this is backed by 24/7 human support (sub-3-minute response time, not to brag), and dedicated account management for higher-volume businesses.

Whop at a glance:

- Price: Free to use, 2.7% + 30¢ per successful charge (enterprise rates for $50K+ monthly)

- Pros: Global reach, lowest fees, crypto support, orchestration for higher acceptance rates, physical & digital sales support, world-class support

- Cons: Best suited for digital-first businesses; less focused on large-scale physical inventory fulfillment

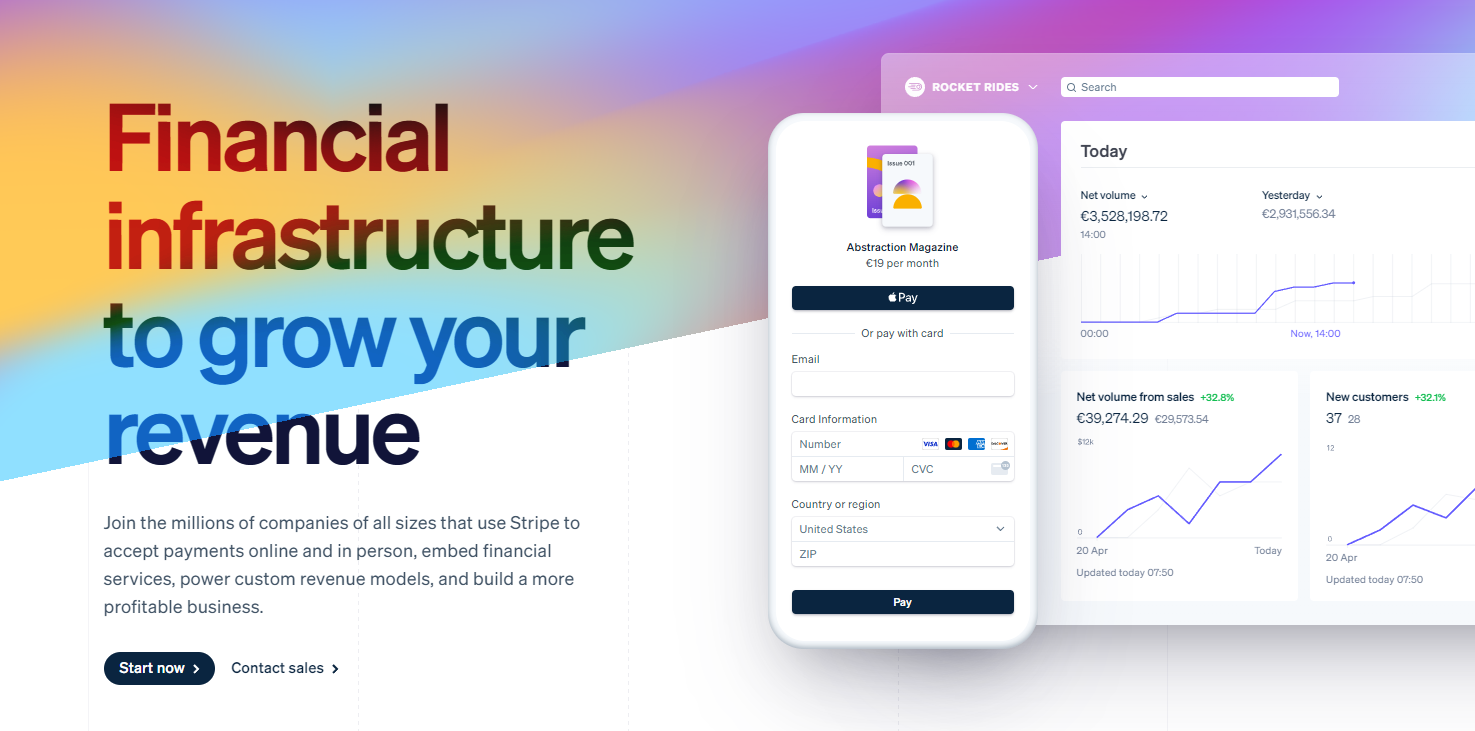

2. Stripe

Stripe is one of the top payment processing companies out there today, well-known for having the most solid payment infrastructure possible. That reputation has been well-earned across a number of years, and today Stripe offers more than just a great payment gateway.

One of the biggest advantages of Stripe is the ability to use it as a merchant account, with companies all around the world using it to accept payments both online and in person. It provides a fully integrated suite of financial and payment products so that you can use it as a one-stop shop irrespective of what sort of ecommerce business you’re running.

Stripe at a glance:

- Price: 2.9% transaction fee plus flat $0.30 charge for US domestic cards

- Pros: Very easy to use and integrate, and starting businesses can make full use of Stripe’s no-code products such as invoices and payment links

- Cons: Doesn’t support as many currencies and payment methods as Whop

3. PayPal

PayPal remains one of the most widely used payment options globally, trusted by millions of buyers and integrated by nearly every major ecommerce platform.

It’s fast, secure, and comes with added features like PayPal Credit and deferred payment options.

However, it ranks third here because of ongoing merchant concerns. PayPal’s history of chargeback abuse and account holds has made it less reliable for some businesses, even with stricter controls now in place.

PayPal at a glance:

- Price: Most commercial transactions, including PayPal Checkout and Venmo, are priced at 3.49% + $0.49.

- Pros: Extremely convenient and beloved by consumers for the different payment options and protections available to them

- Cons: Instances of chargeback abuse and fraud as well as a record of putting disproportionate holds on merchant accounts

4. Apple Pay

Apple Pay is an option if your customers primarily shop on iPhones or other Apple devices. It offers a fast, secure, one-tap checkout experience that reduces friction and cart abandonment.

Its popularity keeps climbing: in 2026, Apple Pay ranks among the top payment services in the U.S. thanks to millions of users locked into the Apple eco-system, seamless integration, and built-in security through Face ID and tokenization.

With millions of active users worldwide, adding Apple Pay to your stack can significantly boost conversions among Apple’s loyal customer base.

Apple Pay at a glance:

- Price: 2.9% + $0.30 per transaction for domestic payments, with an additional 1% for cross-border transactions

- Pros: Quick, convenient means of payment for consumers with Apple devices

- Cons: Restricted to Apple devices, meaning that you can’t rely solely on it and definitely need to add other payment companies unless you’re running some sort of Apple-exclusive business

5. Google Pay

Google Pay is a direct competitor to Apple Pay and is the corresponding option for users who prefer Chrome over iOS, with the added advantage that you can use Google Pay on an iPhone, though only for online payments.

It’s just as convenient as Apple Pay, if slightly different in how it works, given that transaction authentication works with either a PIN, biometrics, or a chosen passcode.

Google Pay is gaining a lot of traction among ecommerce vendors and consumers alike, although it hasn’t quite reached the popularity level that Apple Pay has.

Google Pay at a glance:

- Price: 2.9% + $0.30 per transaction for domestic payments, with an additional 1% for cross-border transactions

- Pros: Can be used on all devices for online payments, and contactless on all devices except for Apple ones

- Cons: Isn’t used by as many people as some of the higher-ranked entries on this list

6. Amazon Pay

Amazon Pay lets customers use their existing Amazon accounts to complete purchases on your site – no new logins or payment details required.

It delivers the same trusted checkout experience shoppers know from Amazon, helping to reduce friction and boost conversions.

It supports recurring payments, subscriptions, and split payments, and Amazon’s A-to-Z Guarantee covers purchases for added buyer confidence.

Amazon Pay at a glance:

- Price: 2.9% + $0.30 per transaction for domestic payments, with an additional 1% for cross-border transactions

- Pros: Familiar checkout experience and the ability to split payments or handle recurring charges

- Cons: Limited adoption in the marketplace compared to previous entries on this list

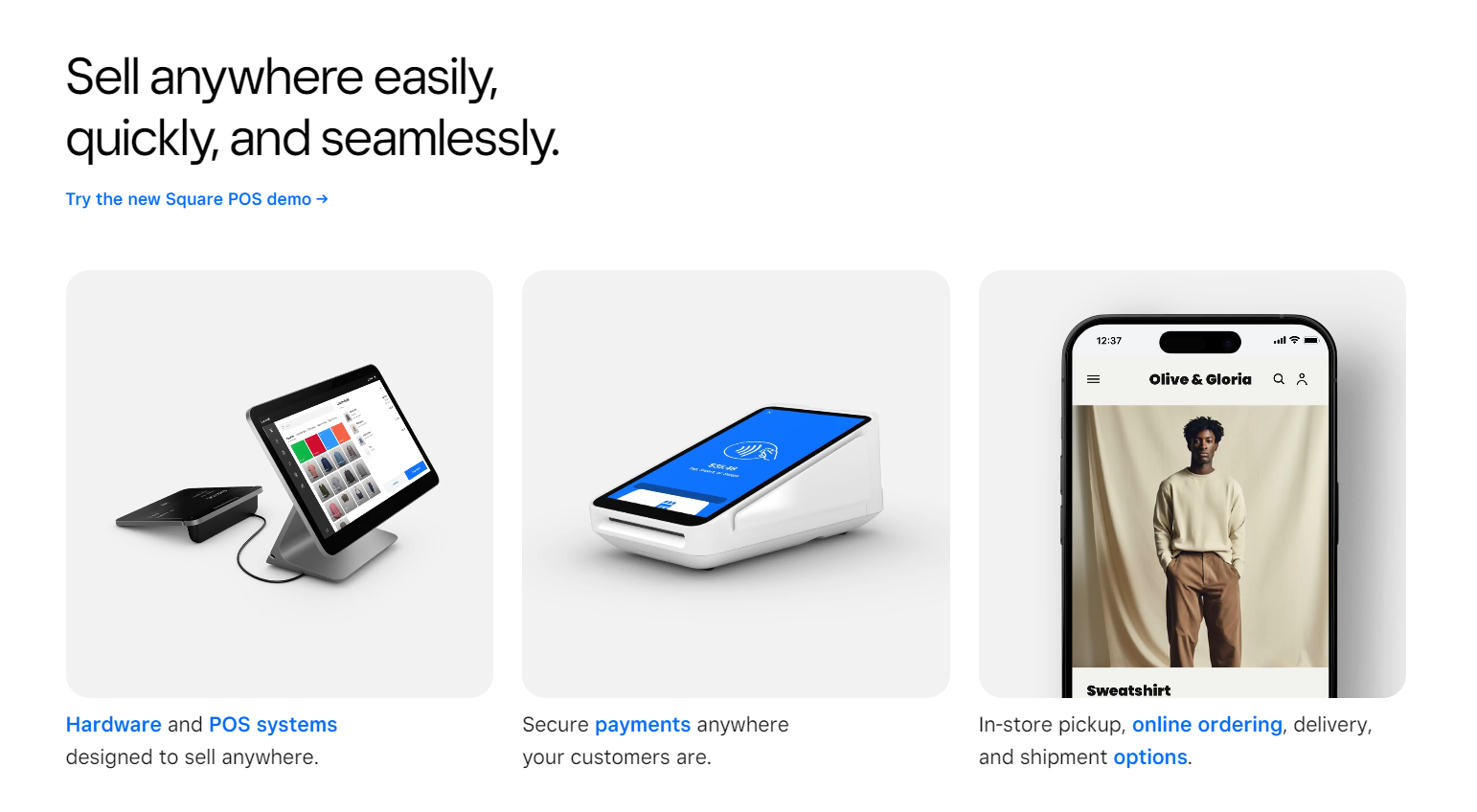

7. Square

Square is best known for its in-person POS hardware, making it a strong choice for ecommerce businesses with a physical footprint (particularly in retail, restaurants, and beauty).

Online, Square’s API makes it easy to integrate payments into your own website or ecommerce platform.

While it’s not a standalone payment processor, pairing it with other gateways lets you access extra tools like Square Online Store, BNPL options, invoicing, and email marketing.

Square at a glance:

- Price: There’s a free plan, but you get more features if you upgrade to Plus at $29 per month

- Pros: Trusted name in the world of commerce and gives you plenty of back-end and front-end advantages if you integrate it

- Cons: Not a standalone ecommerce payment processor

8. Klarna

Klarna is one of the most recognized Buy Now, Pay Later (BNPL) providers, letting customers split purchases into flexible installments while merchants get paid upfront.

It integrates easily with major ecommerce platforms and offers shoppers multiple options: pay later, pay in four, or finance larger purchases. This helps reduce cart abandonment and boost average order value.

Klarna at a glance:

- Price: Variable

- Pros: Extremely well-designed user interface and experience, and they give customers the ability to vary the time and terms of payment

- Cons: Klarna are slightly opaque about pricing, and what the fee is will depend on the market and what sort of contract you sign

Our list of the best payment processors for side hustles

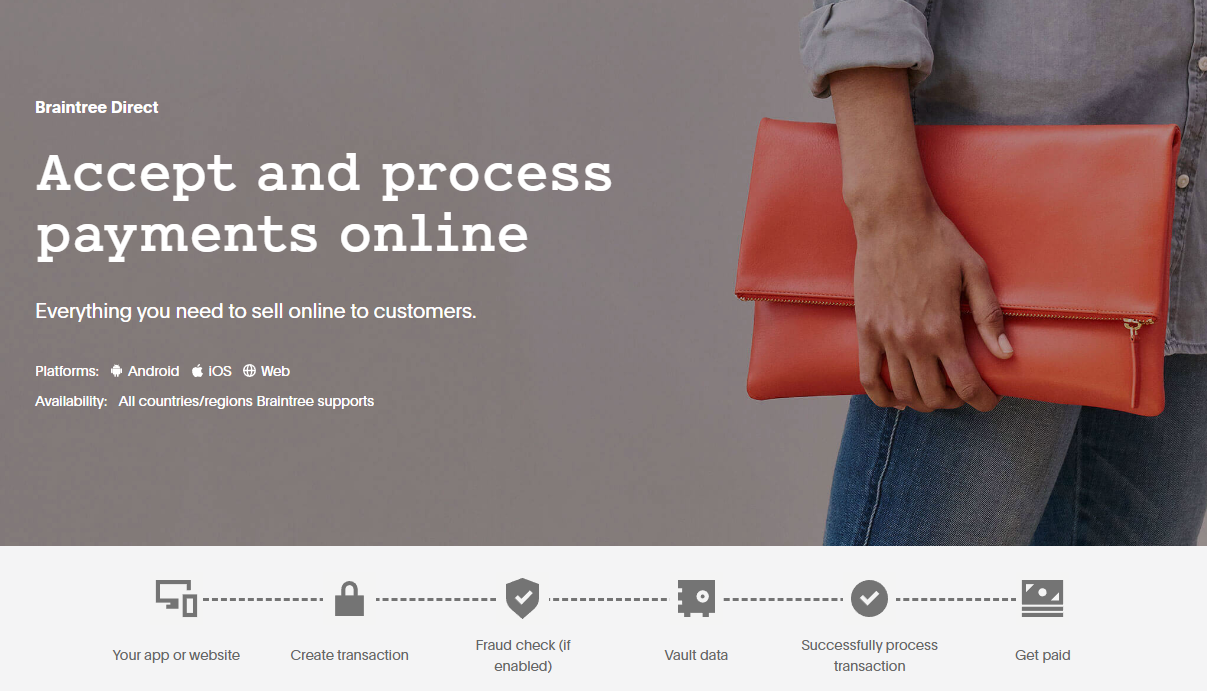

9. Braintree

Braintree, owned by PayPal, powers payments for PayPal, Venmo, and Apple Pay, making it one of the most technically robust processors available.

It’s a full-stack solution that supports cards, digital wallets, and BNPL through a single integration.

While it benefits from PayPal’s global network, it also inherits some of its drawbacks, including occasional account holds and complex fee structures. Still, its lower transaction fees and native wallet integrations make it a strong Stripe alternative.

Braintree at a glance:

- Price: 2.59% plus $0.49 per transaction

- Pros: Integration with multiple other payment methods and buy-now-pay-later

- Cons: Not as recognizable as a brand, and may be pulled fully into PayPal before too long

10. Payment Depot

Payment Depot serves all sorts of businesses, big or small, and as well known as they are for their physical payment terminals, they’re also a powerhouse in the area of virtual payment terminals and ecommerce.

Mobile payments are a big part of their product too, and they offer a pricing model that actually separates and itemizes the cost elements involved, letting you see exactly what you’re paying for.

Payment Depot at a glance:

- Price: Variable depending on your business model, ranging from 0.2% to 1.95%

- Pros: Extremely economical to use even at the higher end of their fee structure, and they are transparent about pricing revolving around payment processing

- Cons: Part of the Stax family but not yet a recognizable brand name for consumers like some of the others on this list

11. Adyen

Adyen is a global, enterprise-focused payment processor known for its flexibility and advanced infrastructure. It supports a wide range of payment methods, from cards and digital wallets to local payment options, making it a top choice for businesses with an international customer base.

Adyen also provides fraud prevention tools, recurring billing support, and a single platform for both online and in-person payments, giving ecommerce merchants complete control over their payment flows.

Adyen at a glance:

- Price: Custom pricing (depends on card type, transaction volume, and region)

- Pros: Enterprise-grade, global reach, supports multiple currencies and payment channels, excellent analytics

- Cons: Can be overkill for small businesses due to complexity and custom pricing

12. BlueSnap

BlueSnap offers a unified payment platform designed for global ecommerce businesses. It supports subscriptions, one-time payments, and alternative payment methods like PayPal, Apple Pay, and Google Pay.

BlueSnap is especially useful for businesses looking to scale internationally without juggling multiple payment providers.

BlueSnap at a glance:

- Price: Custom pricing (starting rates around 2.9% + $0.30 for U.S. merchants; international rates vary)

- Pros: Global payments, subscription and recurring billing support, robust reporting, multiple payment options

- Cons: Pricing can be tricky to understand and may be higher for smaller merchants

More processors, more approvals, one simple platform - Whop

Whop isn’t a payment processor you “pick” — it’s a fully independent payment infrastructure that gives you access to many processors through multi-PSP orchestration. Instead of choosing one provider, Whop routes your payments through the processor most likely to approve each transaction.

When we started, Whop was essentially a Stripe Connect wrapper. Now we’ve built our own infrastructure, from KYC to pay-ins and payouts.

- Hunter Dickinson, Head of Partnerships at Whop

We now power payments for over 27,000 businesses worldwide, routing billions in transactions and increasing successful charges by up to 11%. (Yeah, we're pretty proud of that too.)

But that's not all: We support 195+ countries, 135+ currencies and 100+ payment methods – including BNPL, crypto, and region-specific options.

I mean, you can now get paid out in Bitcoin or Stablecoin and basically every single country in the world, which are things that Stripe doesn't really support."

- Steven Schwartz, Whop CEO

All while keeping fees among the lowest at 2.7% + 30¢ per transaction.

Payouts? Yeah, they're just as flexible, with over 241+ methods from bank transfers to Venmo and crypto.

All of this is backed by 24/7 human support (sub-3-minute response time, not to brag), and dedicated account management for higher-volume businesses.

How to choose a payment processing company for your ecommerce business

Picking a payment processor comes down to your goals, margins, and customer base. Here’s what matters most:

Price

Choose a processor with pricing that matches your scale. Flat rates suit fast-growing stores, while percentage-based fees work well for smaller merchants. Many leading providers will customise rates once you hit higher volume.

Security

Only work with PCI-compliant processors that use tokenization and strong encryption. Anything less puts your business and customers at risk.

Trust

Consumers don’t think about backend security; they think about brand trust. Familiar names like PayPal, Stripe, or Apple Pay reassure customers that their money is safe.

Payment methods

Offer options. Cards, wallets, BNPL, and even crypto if your audience demands it. The more ways to pay, the fewer abandoned carts you’ll see.

Considering these options? Whop Payments meets every criteria, allowing you ultimate flexibility for the lowest fees.

What a good ecommerce payment processing company can do for you

The right payment partner doesn’t just move money — it drives growth.

- Higher conversions: When checkout is smooth, trusted, and offers multiple payment methods, customers are far more likely to complete their purchase. Reliable processors reduce friction, boost trust, and cut cart abandonment.

- Happier customers: Fast, secure, and familiar payment options make for a better buying experience. Satisfied customers are more likely to come back — and recommend your brand to others.

"Crossed my first six figures on Whop! Been a pleasure getting to know the platform and the people behind it.

I came from Kajabi, where they lost their way with how they treat their users. This is how it’s done!"

- Carl Parnell, Whop seller and educator

Process your ecommerce payments with Whop

The right payment processor makes running your business easier and way more profitable. Customers are more likely to complete checkout when payments are safe, seamless and trusted.

At Whop, we’ve built an independent payment stack that combines low fees, global reach, modern payment methods, and built-in growth tools. From hosting your offers and running affiliates to accepting crypto and routing payments through multiple processors for higher approval rates, we’ve got you covered.

Go with a platform built for the future of online sales. Sign up for Whop to run your business and process payments in one seamless place.

Payment processor FAQs

What is the difference between a payment processor and a payment gateway?

A payment gateway handles the front-end of payments, like the checkout form and security measures, while a payment processor manages the back-end, moving money between banks and completing transactions. Some platforms, like Whop or Stripe, combine both features.

How do ecommerce payment processors handle international payments?

Processors like Adyen, and BlueSnap support multiple currencies and local payment methods. They automatically convert funds, handle cross-border fees, and ensure compliance with regional regulations, making global sales seamless.

What are interchange fees and how do they affect my ecommerce business?

Interchange fees are the percentage (and sometimes flat fee) charged by card networks for processing transactions. They’re typically passed on to merchants but can be factored into pricing.

Can I accept buy-now-pay-later (BNPL) options on my ecommerce site?

Yes. Services like Klarna and Whop enable BNPL payments, letting customers pay in installments while you receive full payment upfront. This can boost conversions, especially for higher-priced items, but may involve slightly higher processing fees.

How do refunds and chargebacks work with online payment processors?

Most processors allow you to initiate full or partial refunds directly through their dashboard. Chargebacks occur when a customer disputes a transaction, and the processor investigates. Platforms like Whop, Stripe, and PayPal provide tools and fraud prevention features to reduce disputes and protect merchants.

Which payment processors are best for high-volume or enterprise ecommerce businesses?

Whop, Adyen, and BlueSnap excel for high-volume merchants due to scalable infrastructure, flexible pricing, multi-currency support, and robust analytics. They help reduce failed transactions, manage complex workflows, and integrate easily with enterprise software.

Can I integrate multiple payment methods on a single ecommerce platform?

Yes. Most modern processors allow integration with cards, digital wallets (Apple Pay, Google Pay), BNPL, and even crypto. Using multiple processors can improve acceptance rates, offer flexibility to customers, and optimize conversions.