A payment processor is a service that handles transactions between customers, businesses, and banks, securely moving money from buyer to seller. Learn how payment processors work and why they are essential for any business.

Key takeaways

- Payment processors securely move money between customers, banks, and merchants while providing analytics to optimize business decisions.

- Multi-PSP orchestration routes payments through optimal providers, boosting successful transaction rates by up to 11%.

- Merchant of Record services handle compliance, taxes, and chargebacks, letting you focus on growing your business.

Payment processors are key to running your own online business without headaches.

The last thing you want is to waste hours on stuff that doesn’t actually grow your business, like messy payments.

So knowing how payment processing works isn’t optional; it’s key to how you make your business run smoothly.

Let’s break down what you need to know, how it works, and which options are worth your time.

What is a payment processor?

A payment processor moves money between your customer’s bank, your bank, and the networks in between, so you get paid instantly.

Think of it like a middleman between you, your customer, and their cash.

“You need payments, you need to accept payments, and you need to pay out payments. And if you can't do that, you can't run a business.”

- Hunter Dickinson, Head of Partnerships at Whop

How do payment processors work?

Payment processors handle the flow of money between your customer, your bank, and the card networks.

They check that the buyer has enough funds or credit, protect sensitive info, and even help spot fraud before it becomes your problem.

The best payment processors don’t just move money: they also give you the data you need to level up your biz. From sales reports to trend insights, the analytics they provide can help you track performance and make better business decisions.

Let’s break down a typical transaction step by step:

1. Customer buys something

The process kicks off when a customer checks out: online, in an app, or at a POS.

They enter their card info and other transaction details, like the amount and their merchant account.

2. Data is encrypted

All that info is encrypted to keep it safe from hackers or fraudsters.

3. Info gets sent out

Encrypted data moves from your store to the payment processor through a payment gateway. From there, it goes to your acquiring bank (sometimes the processor is the bank too).

4. Transaction starts rolling

The acquiring bank forwards the details to the issuing bank (your customer’s bank) via the card network – Visa, Mastercard, AMEX, or the bank’s network for debit.

5. Issuer checks it out

The customer’s bank verifies the payment method, confirms the buyer’s identity, and checks that there’s enough money or credit. Some online transactions may require the customer to authorize manually.

6. Authorized (or declined)

If everything checks out, the bank sends an authorization code. If there’s a problem, it sends a decline code instead.

7. Processor confirms the transaction

The payment processor finalizes the transaction on your end. The gateway or POS tells you instantly whether it went through or failed. If it failed, customers can try a different card or payment method.

8. Transaction is done

From your perspective, the sale is complete, and you can ship the product or start fulfillment. But the actual funds haven’t moved yet.

9. Capture and settlement

At the end of the day, the processor batches all approved transactions and sends them to the acquiring bank. The banks then move the money from the customer’s account to yours, a process called “capture.” It can take a few business days to settle fully.

How to choose a payment processor

Choosing the right payment processor means taking your personal circumstances, as well as business size, selling platform, and customer base, into account.

Here’s what to look for:

1. Payment methods

Give your customers flexibility. Credit and debit cards are basic, but BNPL, installments, digital wallets (Apple Pay, Google Pay), and crypto can make higher-priced products more accessible.

More payment options = more potential sales.

2. International support and currencies

If you’re selling online, think global. Your processor should handle multiple currencies and countries. Digital fulfilment removes shipping barriers, so the right processor makes international sales seamless.

3. Pricing structure

Check the fees. Flat fees, percentages, or tiered pricing can all work – but pick what best fits your business model.

Small-ticket items? Flat fees can eat your profits. High-value items? Percentage-based fees might make more sense.

4. Security

Don’t gamble with customer data. Ensure compliance with industry standards, strong encryption, and chargeback fraud detection. Look for processors that actively monitor suspicious activity.

5. Integrations

Your processor should fit into your current setup. Whether it’s an ecommerce platform, POS, or mobile app, smooth APIs, plugins, or SDKs make life easier and avoid painful migrations later.

6. Analytics and reporting

Data is your best friend. Top processors provide dashboards, reports, and insights so you can track sales, spot trends, and make smarter business decisions.

7. Scalability

Your business will grow, so pick a processor that scales with you with pricing, transaction volume, or new features like crypto payments or subscription billing.

8. Contract terms

Read the fine print.

Look for hidden fees, minimums, termination clauses, or other red flags. Transparency is key.

9. Customer support

When something breaks, streamlined support help is a non-negotiable. Check reviews, test response times, and make sure they offer help via the channels you prefer.

Top 5 payment processors & platforms

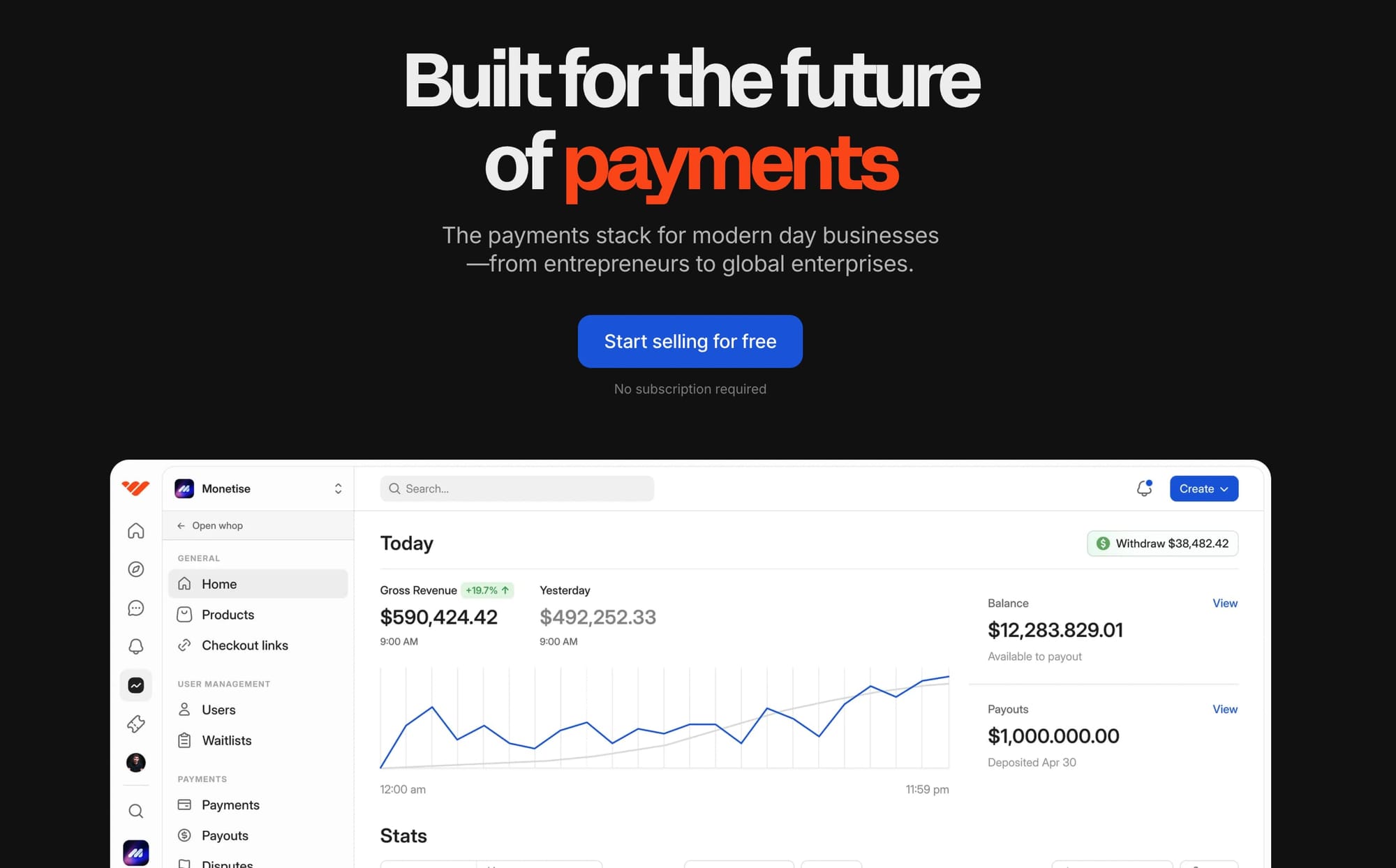

1. Whop

Whop isn’t just a marketplace; we're also a next-gen payments platform built for modern online sellers. We're now fully independent from Stripe, meaning sellers now get faster payouts, lower fees, and more control over how they accept payments globally.

Accept all payment forms, from credit and debit cards to crypto, stablecoins, digital wallets, and even Buy Now, Pay Later.

Multi-PSP orchestration automatically routes each payment through the provider most likely to approve it, boosting successful charges by up to 11%.

“Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.”

- Hunter Dickinson, Head of Partnerships at Whop

Whether you want to embed a checkout on your site, send a simple checkout link, or use Whop’s own store builder, the platform meets you wherever you sell.

On top of that, Whop comes with built-in tools like automatic dispute handling, affiliate programs, free trials, and even the ability to host products with chat, courses, or livestreams.

"The reason I went for Whop is because there's actually a human on the other side ready to help whenever there's an issue. And I can't risk my SAAS being disrupted due to payment holds."

- Redditor u/Financial_Bug2389

We also give you analytics dashboards and integrations with most business tools, so you can track sales, spot trends, and scale without switching platforms.

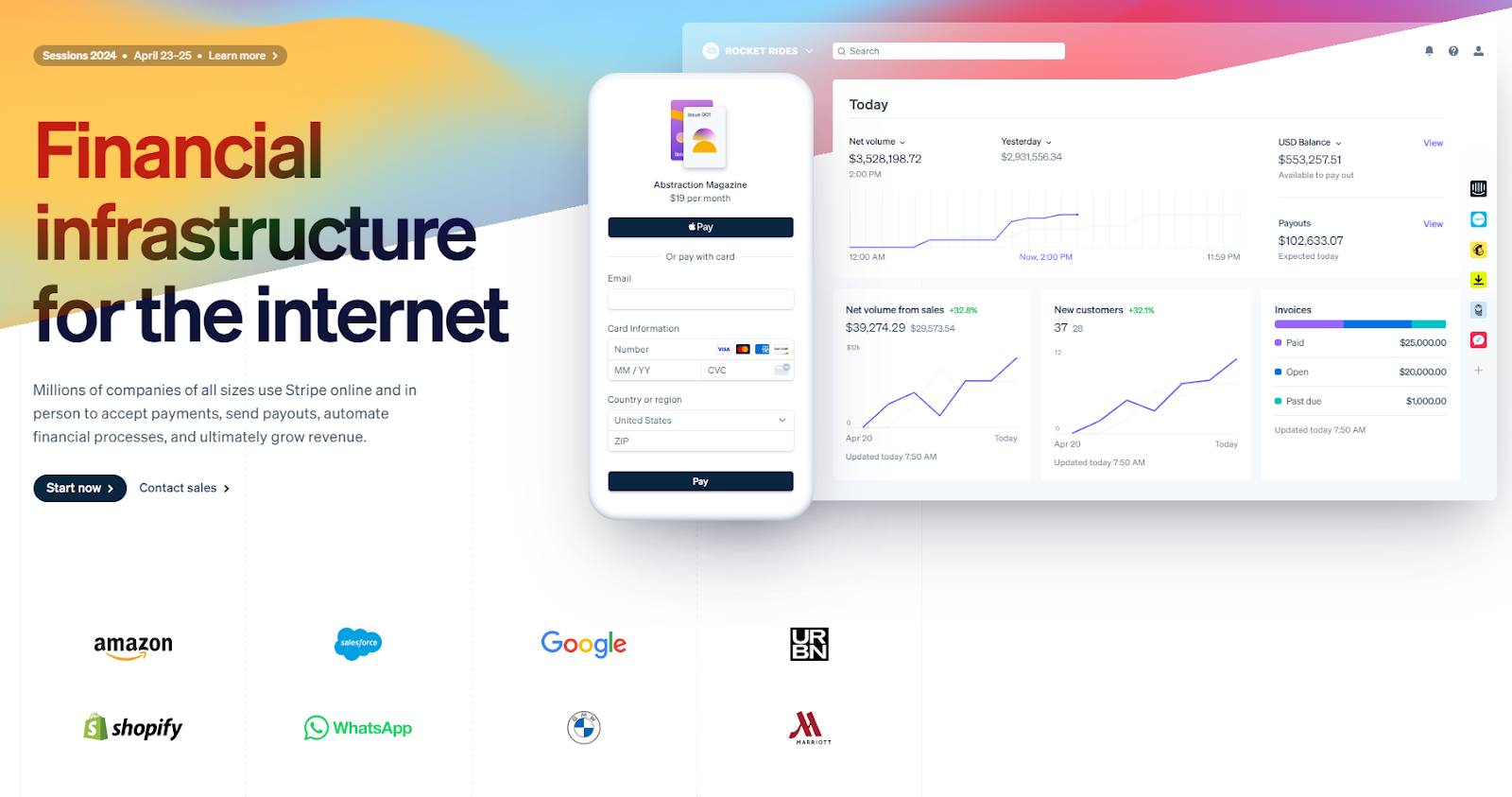

2. Stripe

Stripe is one of the more popular processors for digital stores, mainly because it removes the headache of setting up a merchant account.

It works for online payments and even in-person sales through Stripe Terminal, and it can act as a Merchant of Record if you need it to.

Its API makes it easy to plug into your existing tech stack, whether that’s a website, app, or backend system. Security is top-notch, too: Stripe is a PCI Level 1 certified provider, with heavy encryption and separate servers for storing sensitive data.

Of course, this comes at a price. Standard domestic payments are charged at 2.9% + $0.30 per successful transaction, though businesses with high volume can reach out for custom pricing.

3. PayPal

PayPal is built around making money transfers easy, and that extends perfectly to ecommerce.

Customers can pay you instantly with cards, PayPal balances, QR codes, or even in installments, giving you plenty of ways to close the sale.

Plus, PayPal works with everything from enterprise software to popular ecommerce platforms, and it comes with solid reporting tools so you can track sales and performance. Best of all, there’s no monthly or startup fee.

Pricing can be a bit tricky, though: online card payments are 2.59% + $0.49 per transaction, with optional 0.4–0.6% chargeback protection.

POS transactions via PayPal Zettle are cheaper at 2.29% + $0.09, and QR code payments are priced the same. PayPal’s own native digital payment system runs at 3.49% + $0.49.

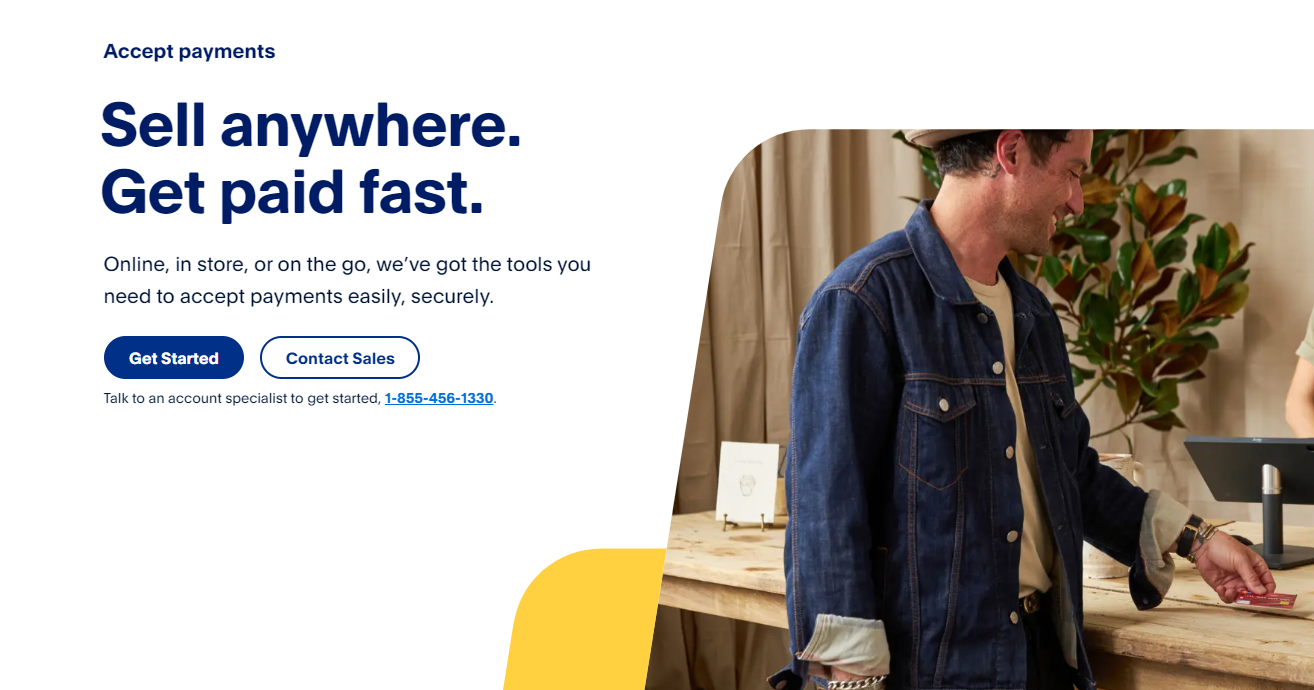

4. Square

Square is sleek, modern, and built for a wide range of businesses, though it’s especially popular with restaurants, retail, and beauty brands.

It’s good for growing businesses thanks to its robust analytics and tools that help you track sales, add new revenue streams, and scale smartly.

Square works with your existing tech stack and offers flexible features as your business evolves.

Pricing is equally adaptable: the basic plan only charges processing fees, while more advanced options are available for retailers, appointment-based companies, or custom enterprise setups.

Transaction fees vary depending on how you accept payments. In-person tap or swipe transactions cost 2.6% + $0.10. Using a card on file or manual entry is slightly higher at 3.5% + $0.15 for added fraud protection. Online purchases are 2.9% + $0.30, and invoices come in at 3.3% + $0.30.

5. Payment Depot

Payment Depot gives businesses flexible merchant services. They focus on transparency and simplicity, letting you know what you’re paying for without hidden markups.

Pricing is volume-based, so transaction fees typically range from 0.2% to 1.95%, and you’ll pay a monthly subscription fee (around $79) to access the platform and its full suite of tools.

There are no setup or cancellation fees, and you get complete access to their software, making it easy to manage payments across multiple channels.

Skip choosing a single processor altogether with Whop

Whop is where the internet does business. With Whop you can run your entire business on the platform – or, you can simply use Whop Payments for your existing business.

Instead of picking one processor from the list above, Whop gives you access to multiple payment processors behind the scenes through multi-PSP orchestration.

Payments are routed through the provider most likely to approve them — boosting successful charges by up to 11%.

Accept all payment forms, from credit and debit cards to crypto, stablecoins, digital wallets, and even Buy Now, Pay Later.

“Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.”

- Hunter Dickinson, Head of Partnerships at Whop

Whether you want to embed a checkout on your site, send a simple checkout link, or use Whop’s own store builder, the platform meets you wherever you sell. We also give you analytics dashboards and integrations with most business tools, so you can track sales, spot trends, and scale without switching platforms.

What’s the difference between a payment processor and a merchant of record?

Payment processors are the tech that makes transactions happen, i.e, they move money from your customer to your account and keep things secure. But that’s about it.

A Merchant of Record (or MoR) goes further – they actually take on the legal and financial responsibility for the transactions, handling things like compliance, taxes, chargebacks, and refunds on your behalf.

Basically, a MoR lets you focus on your business and your customers, while they manage the messy, behind-the-scenes stuff. Partnering with a processor that also acts as your MoR saves you time, reduces risk, and makes global selling much easier.

Process your payments with Whop

Selling on Whop unlocks Whop Payments at zero cost, giving you access to full Merchant of Record services, a super easy-to-use API, and a platform built on the security and reliability that powered Stripe.

We've built our own payments infrastructure that allows us so much more flexibility on everything, from what payment methods we accept, to which countries we can pay out, to which ways we can pay out.

- Steven Schwartz, Whop CEO

Plus, Whop opens up new ways for your business to make money, from recurring subscriptions to clever marketing tactics like UGC, clipping and affiliate campaigns.

Payments are just one part of the stack. When you are trying to set up a business, of course, you have to have payments. But after that, what else do you need? It doesn't stop there.

- Steven Schwartz, Whop CEO

Sell with Whop and make experience payments, scaling, and support on another level.

Payment processor FAQs

Can I use multiple payment processors for my online business?

Yes. Using multiple payment processors can reduce declined transactions, increase sales, and provide redundancy. Platforms like Whop Payments use smart orchestration to automatically route payments through the processor most likely to approve them.

How long does it take for payment processors to transfer money to my bank account?

Settlement times vary by provider and region. Most processors batch transactions daily, with funds typically reaching your bank in 1–3 business days, though international transfers may take longer.

Are there transaction limits with payment processors?

Yes. Many processors set daily, monthly, or per-transaction limits. High-value transactions or rapid growth may require custom arrangements or enterprise-level solutions.

How do payment processors prevent fraud and manage chargebacks?

Payment processors use encryption, tokenization, and fraud detection algorithms. Merchant-of-Record (MoR) services handle chargebacks and disputes automatically to protect your revenue.

Can I integrate a payment processor with my website, app, or accounting tools?

Absolutely. Most modern processors provide APIs, SDKs, and plugins that integrate seamlessly with ecommerce platforms, CRMs, accounting software, and mobile apps, enabling automated workflows and real-time analytics.