Paddle is a complete billing and payments platform for SaaS and digital businesses that handles subscriptions, taxes, and compliance. Learn how Paddle works, what it costs, and how it compares to other subscription billing solutions.

Key takeaways

- Paddle acts as Merchant of Record, handling payments, taxes, and compliance so SaaS businesses can focus on building products.

- Paddle's 5% fee is higher than Stripe's 2.9%, but eliminates the burden of managing global tax compliance yourself.

- Best suited for SaaS companies selling internationally who want all billing complexity handled in one platform.

Paddle is a Merchant of Record (MoR) platform that handles billing, processing payments, and tax compliance for SaaS and digital product businesses.

It lets companies sell globally without managing multiple payment gateways, dealing with VAT or sales tax, or worrying about compliance across regions.

In this review we’ll break down how Paddle works, what it costs, and who it’s best suited for, plus how it compares to competitors like Chargebee and Whop Payments to help you decide if it’s the right billing solution for your business.

Paddle: quick overview

In a hurry? Here's a quick snapshot of Paddle:

| What it is | Merchant of Record for SaaS billing and payments |

|---|---|

| Best for | Software companies selling products or subscriptions internationally |

| Pricing | 5% + $0.50 per transaction (or custom pricing for high-volume businesses) |

| Key features | Subscription billing, tax compliance in 100+ jurisdictions, fraud protection, multi-currency checkouts |

| Main benefit | Handles all payment complexity, taxes, and compliance so you can focus on your product |

Keep reading for the whole rundown.

What is Paddle.com?

Paddle.com is a Merchant of Record (MoR) that provides payment infrastructure for thousands of companies worldwide.

When a customer buys a product or subscription through a business using Paddle, the payment goes directly to Paddle.

Paddle then manages everything behind the scenes (currency conversion, tax compliance, fraud protection, and payouts), before sending the proceeds to the business.

Who is Paddle for?

Paddle is designed for software and SaaS companies that sell products or subscriptions online.

By acting as a Merchant of Record, Paddle removes the complexity of global payments, handling compliance and cross-border regulations on your behalf.

It also manages the back-end operations of billing, invoicing, and payment infrastructure, so developers and founders can focus on building and improving their software instead of managing admin or legal hurdles.

Working with a MoR simplifies the many technical, legal and regulatory challenges of operating in a global marketplace.

In addition, Paddle handles the back-office tasks associated with payment processing and provides the technical infrastructure for it, freeing the developer to focus on the thing they do best – providing great software.

Paddle features: what does Paddle billing do?

Paddle provides a comprehensive range of billing services and payment gateway features for SaaS merchants, including:

- Subscription billing and recurring payments: Paddle can handle both one-time payments and recurring subscriptions. Developers can automate the process of sending monthly invoices or taking recurring payments for their SaaS products.

- Automated invoicing: SaaS developers can use Paddle's payment API to automate their invoicing processes, reconcile payments, and provide product access based on successful payments.

- Multi-currency checkouts: Localized checkouts are available in more than 17 different languages and 29 currencies. Use regional pricing to unlock new markets and maximize profits. Show users the most popular payment options based on their region.

- Tax compliance and regulatory management: Paddle handles sales taxes and local regulatory requirements for more than 100 jurisdictions. They automatically collect, file and remit taxes for you.

- Fraud protection and chargeback prevention: As part of the payment MoR, each transaction is carefully analyzed and evaluated based on multiple variables to detect potential fraud while reducing the likelihood of false positives. This helps protect you from chargebacks or penalties from your payment network and protects your reputation among your customers.

The complex regulatory environment is one of the biggest challenges faced by SaaS developers.

Paddle is compliant with SOC 1 & SOC 2, PCI-DSS, GDPR, CCPA and several other data protection regulations, making it a secure and legitimate billing platform.

All of these features are made available by an easy-to-use Paddle API for seamless integration.

Paddle pricing: how much does Paddle cost?

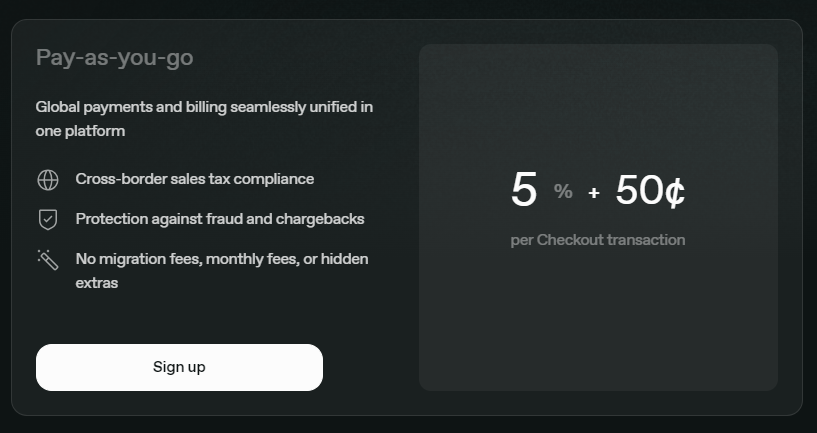

Paddle offers two pricing models for its billing platform: Pay-as-you-go and Custom Enterprise pricing. Both include full access to Paddle’s billing, payment, tax, and compliance features with no monthly fees or hidden costs.

Here's a closer look:

Pay-as-you-go pricing

The standard plan costs 5% + $0.50 per checkout transaction. It includes global payments, tax handling, fraud protection, chargeback coverage, and customer billing support.

This tier is designed for SaaS and digital product businesses selling items priced at $10 or more.

Custom enterprise pricing

For companies processing high volume, selling lower-priced products, or needing invoicing and migration support, Paddle offers custom pricing tailored to your business model.

Enterprise plans come with access to optional premium services like success management, bespoke implementation, and advisory support.

Paddle reviews: what do customers say about Paddle?

Overall, Paddle receives strong feedback from SaaS developers and digital product companies that use it to manage global billing.

It’s widely praised for simplifying compliance, automating tax management, and reducing chargebacks — three of the biggest pain points for software businesses selling internationally.

Master English Ltd reduced chargebacks by 55% in the US and 54% globally after switching to Paddle’s fraud detection system.

Similarly, Kaleido, the company behind remove.bg, reported a 20% month-on-month increase in customer growth and a 38% reduction in churn after integrating Paddle.

Paddle alternatives

Paddle is best suited to companies that sell globally and want an all-in-one Merchant of Record (MoR) solution.

If you only need basic payment processing or prefer lower fees, other tools may fit better:

Paddle vs Stripe

Stripe is primarily a payment processor, not a Merchant of Record.

It focuses on handling card payments, digital wallets, and payouts – but compliance, tax filing, and chargeback liability remain your responsibility.

Stripe’s pricing varies by country, but standard rates start at around 2.9% + $0.30 per transaction. While cheaper than Paddle’s 5% + $0.50 fee, Stripe is a developer-heavy platform that requires more setup and maintenance.

It’s a good fit for businesses with dedicated engineering teams or those that only sell domestically.

- Choose Stripe if: you want a flexible API and already have systems for tax, invoicing, and fraud protection.

- Choose Paddle if: you want an MoR that automates all of that for you and handles compliance in 100+ jurisdictions.

Paddle vs Chargebee

Chargebee is a subscription management platform designed for SaaS companies that need advanced recurring billing features.

It automates subscriptions, invoicing, and dunning workflows, and integrates with payment gateways like Stripe and PayPal.

Chargebee offers three pricing tiers:

- Starter plan: Free until you reach $250,000 in total billing, after which a 0.75% overage fee applies

- Performance plan: Costs $599 per month (billed annually) and supports up to $100,000 in monthly recurring revenue, with a 0.75% fee on revenue above that

- Enterprise plan: Provides custom pricing and advanced implementation support

While Chargebee is great for complex billing logic and analytics, it doesn’t act as a Merchant of Record – meaning tax, compliance, and fraud liability remain your responsibility.

- Choose Chargebee if: you want flexible subscription control and already use your own payment gateways.

- Choose Paddle if: you want an all-in-one platform that manages payments, billing, and tax compliance globally.

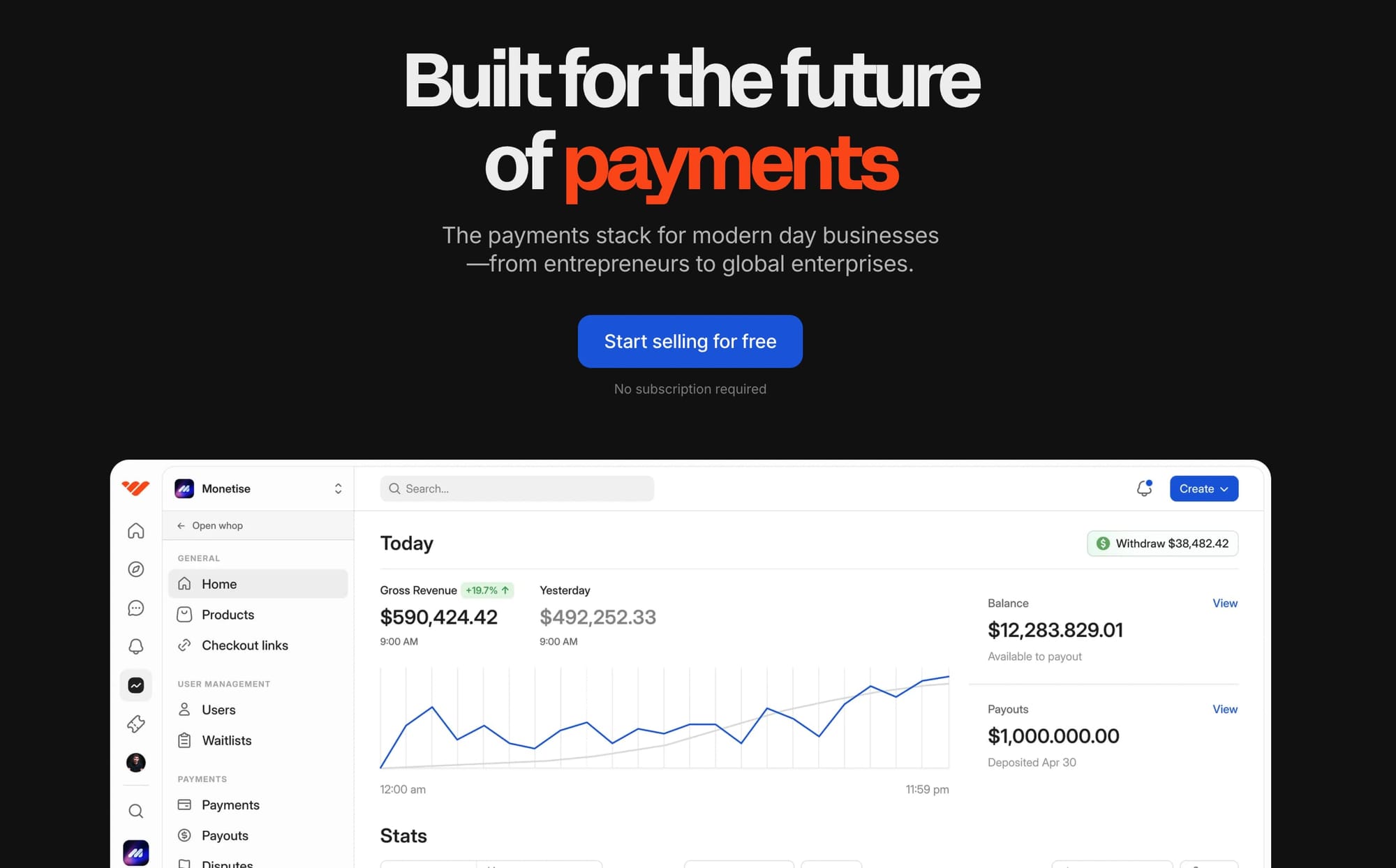

Paddle vs Whop Payments

Whop Payments is a modern Merchant of Record (MoR) platform built for creators, SaaS founders, and digital businesses.

It handles payments, global tax compliance, and fraud protection, while also providing tools to host, market, and scale your digital products in one place.

While Paddle is designed primarily for established SaaS companies, Whop caters to a wider audience of creators and digital entrepreneurs who want the same compliance and infrastructure benefits at a lower cost.

- Choose Whop Payments if: you want a low-fee, all-in-one MoR platform with built-in tools for payments, subscriptions, BNPL, and digital storefronts.

Whop Payments: the #1 one choice for SaaS billing

Paddle remains a strong choice for established SaaS companies that want a reliable Merchant of Record to manage subscriptions, taxes, and compliance.

But for modern SaaS founders, creators, and digital businesses that need the same billing infrastructure without high fees or rigid setup? Whop Payments offers a faster, more flexible alternative.

With built-in orchestration, BNPL options, crypto support, and instant global payouts, Whop turns what’s usually the hardest part of running a SaaS business (payments) into your simplest.

If you’re ready to grow globally without borders, complexity, or steep costs, start selling with Whop today.

Frequently asked questions

Is Paddle a Payment Processor?

Paddle serves as a Merchant of Record, meaning it handles all payments and also takes on the liability related to the transaction, such as tax payments, regulatory compliance, and refunds or chargebacks.

Is Paddle safe and legitimate?

Yes, Paddle is a legitimate and secure billing platform. The company is compliant with SOC 1, SOC 2, PCI-DSS, GDPR, and CCPA regulations. Paddle has been processing payments for thousands of software companies worldwide since 2012 and maintains strict security standards to protect both merchants and customers.

What is Paddle Charge on my credit card?

If you see "Paddle.com" or "Paddle" on your credit card statement, it means you purchased a product or subscription from a software company that uses Paddle as their Merchant of Record.

Paddle processes payments on behalf of their clients, which is why their name appears instead of the actual company you purchased from. Check your email for receipts to identify which service or product you purchased.

How does Paddle work for developers?

Paddle works by acting as the seller of record for your software products. You integrate Paddle's API into your application or website, and Paddle handles the entire payment flow—from checkout to payment processing, tax calculation, compliance, and payouts to your account.

This means Paddle takes on all the legal and financial liability while you focus on building your product.

Does Paddle handle VAT and sales tax?

Yes, Paddle automatically handles VAT, sales tax, and GST compliance in over 100 jurisdictions worldwide. The platform calculates, collects, files, and remits taxes on your behalf, so you don't need to register for tax in multiple countries or manage complex international tax compliance yourself.

What payment methods does Paddle support?

Paddle supports major credit and debit cards (Visa, Mastercard, American Express), PayPal, Apple Pay, Google Pay, and various local payment methods depending on the customer's location. The platform automatically shows the most relevant payment options based on the buyer's region.

How long does Paddle take to pay out?

Paddle typically processes payouts on a monthly basis, though payout schedules can vary based on your specific agreement and account setup. High-volume merchants on custom enterprise plans may be able to negotiate more frequent payout schedules.

Can I use Paddle for mobile apps?

Yes, Paddle can be used for mobile applications, web apps, desktop software, and SaaS products. The platform provides APIs and SDKs that integrate with various platforms, making it suitable for any software product that requires payment processing and subscription management.

Paddle vs Stripe: which is better?

The choice depends on your needs. Paddle is better if you want a complete Merchant of Record solution that handles taxes, compliance, and fraud protection—ideal for international SaaS companies.

Stripe is better if you want lower fees and more control over the payment process, but you'll need to handle tax compliance yourself. Paddle charges 5% + $0.50 per transaction, while Stripe charges around 2.9% + $0.30 but doesn't include MoR services.

Can you use Whop for SaaS subscriptions?

Whop is more than just a social commerce platform, it also offers Merchant of Record (MOR) services through Whop Payments. SaaS developers can use Whop Payments to handle subscriptions, invoicing, multi-currency transactions, taxes and more.