Chargebee is a subscription billing and revenue management platform that helps businesses automate recurring payments, invoicing, and revenue operations. Our review breaks down its features, pricing, and best use cases for growing subscription-based businesses.

Key takeaways

- Chargebee automates subscription billing, invoicing, and dunning but requires external payment processors like Stripe or PayPal.

- The platform suits enterprise-level SaaS companies with complex billing needs better than small businesses or creators.

- Alternatives like Whop Payments offer simpler, all-in-one solutions with built-in payment processing and lower barriers to entry.

Chargebee is a subscription billing and revenue management platform that automates recurring payments, invoicing, dunning, proration, trials, coupons, tax, and reporting.

It’s built for teams that need granular billing logic, multiple payment gateways, and audit-friendly finance workflows. Still, it relies on external payment processors like Stripe or PayPal to handle the actual transactions.

In this review, we'll cover how Chargebee works, its key features, pricing structure, and its pros and cons.

We'll also see how it stacks up against alternatives like Whop Payments, so you can decide if it’s the right tool for your subscription stack.

What is Chargebee?

Chargebee is a subscription management platform designed to automate billing, invoicing, revenue recognition, and customer lifecycle tasks for recurring businesses.

It connects with popular payment gateways like Stripe, PayPal, and Adyen, letting you manage everything from trials and upgrades to failed payments and taxes in one place.

While Chargebee can technically serve startups and small businesses, it’s built with enterprise complexity in mind (with brands like Calendly, Toyota, and Linktree using the platform).

This makes it better suited for SaaS companies or teams that need fine-grained billing logic and finance-grade reporting.

What can you use Chargebee for?

Chargebee is used to manage every stage of the subscription lifecycle, from signup to renewal to churn.

It automates billing, invoicing, dunning, and revenue tracking, while giving you control over pricing models, trials, coupons, and customer communication.

Here’s a breakdown of its main features:

Subscription management

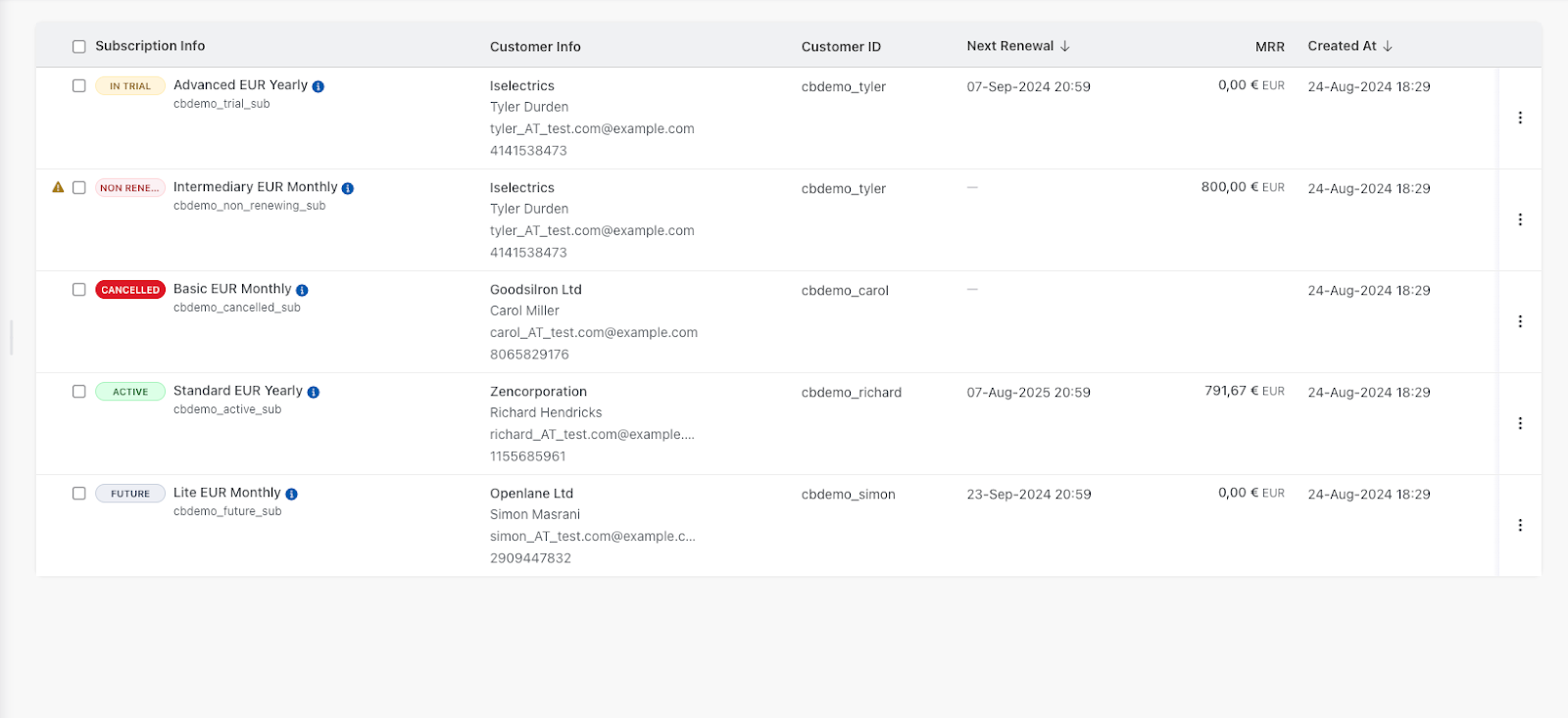

The first and most important feature in Chargebee is Subscription Management.

Once you sign up and configure your account, the Subscriptions tab is front and center.

You can view every active customer subscription in detail: what product they bought, their billing cycle, start date, coupons, payment status, and more.

You can also edit subscriptions manually, pause or delete them, and apply changes like discounts or trial extensions.

The Customers page gives you a clear picture of each customer: their contact info, invoices, payment methods, tax details, and any past or active subscriptions.

It’s not the most intuitive dashboard, but everything you need is there in a straightforward layout. Since this is Chargebee’s core feature, it makes sense that it’s built to handle a lot of complexity once you get used to it.

Automated invoicing

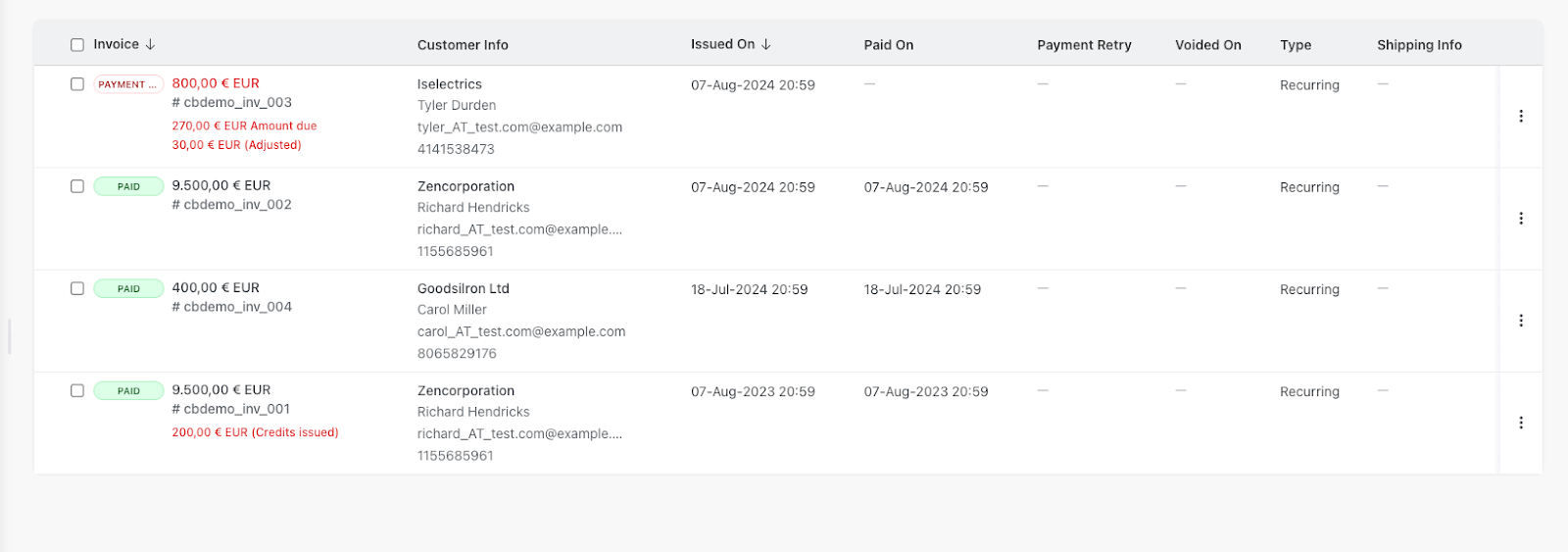

Right under Subscriptions, you’ll find the Invoices tab.

Chargebee automates the entire invoicing process, generating and sending invoices automatically whenever a customer signs up, renews, or changes a plan.

If you issue refunds or pricing changes, Chargebee can also apply credit notes or adjustments automatically.

For recurring subscriptions, invoices are sent on the set billing date, so you never have to trigger them manually.

The tab gives you all the data you need at a glance: when invoices were sent, whether they’ve been paid, and which are overdue.

You can also click into each invoice for details or send reminders manually.

It’s well-organized and does what you’d expect from a platform built for recurring billing, though it could live under the same tab as Subscriptions for a cleaner experience.

Data analytics and revenue reporting

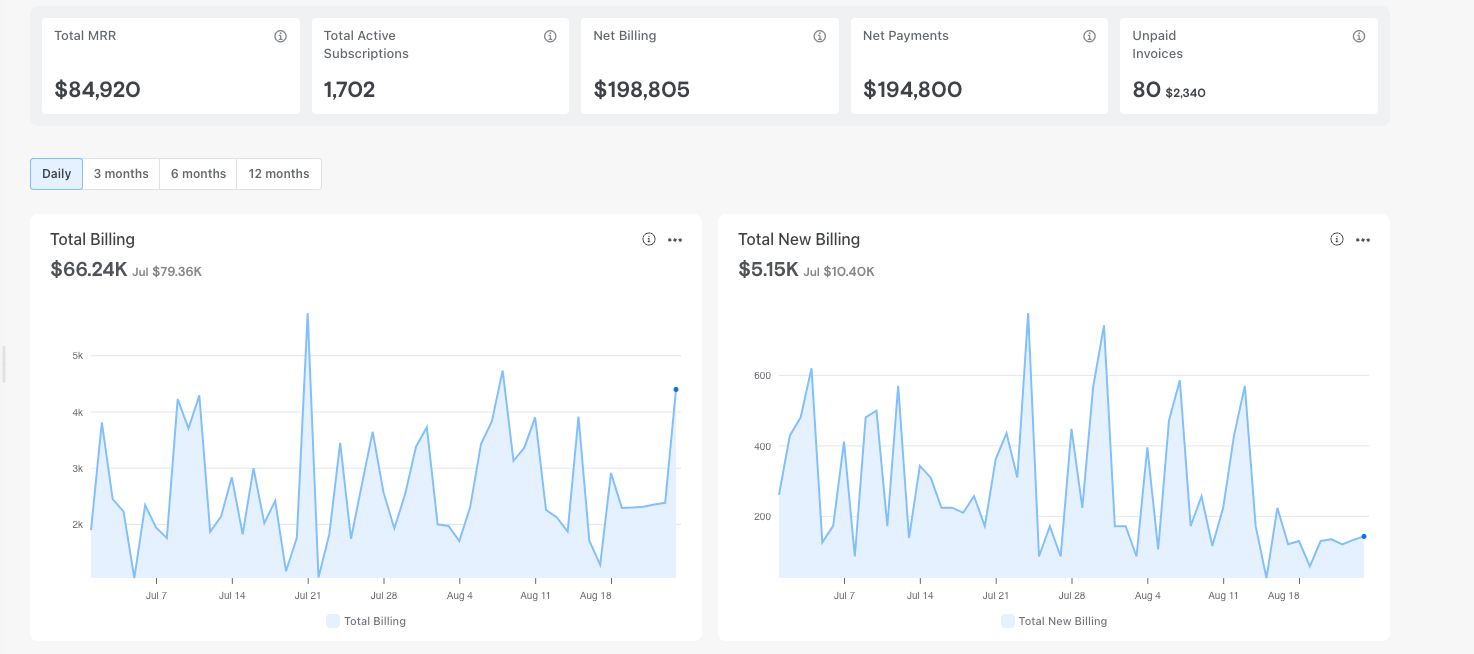

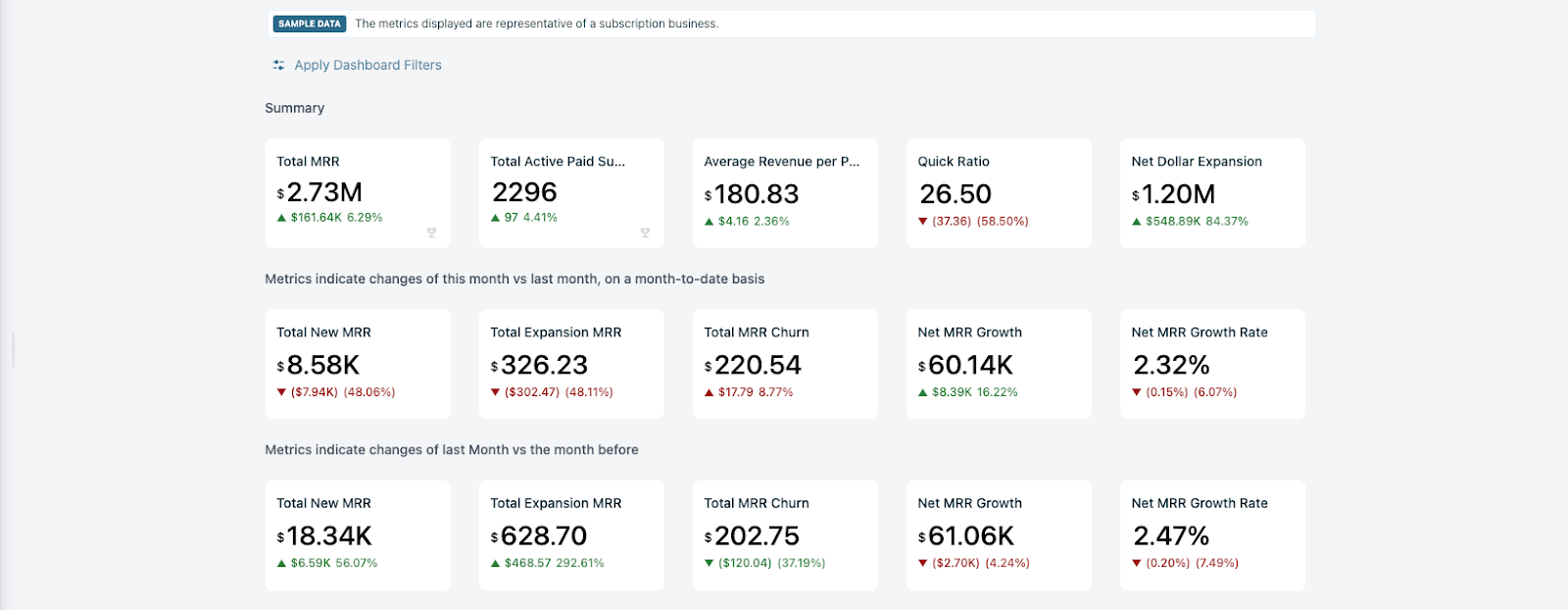

Chargebee’s reporting system, called RevenueStory, is one of its key features.

It tracks metrics like monthly recurring revenue (MRR), churn, active customers, unpaid invoices, and more – all displayed on your dashboard.

You can filter data by day, quarter, half-year, or year, and compare performance over time.

RevenueStory includes more than 100 built-in reports covering everything from accounting and customer insights to growth analytics. You can even set revenue goals and alerts to track progress.

Note: It can feel overwhelming at first, especially if you’re new to analytics-heavy platforms.

All of this is also configurable for daily, quarterly, 6-month, and yearly periods, with notes on the previous month's data or annual averages.

AI-powered features

In 2025, Chargebee introduced several AI-powered capabilities to help streamline subscriptions.

The platform now includes Chargebee Copilot, an AI assistant that helps you navigate the dashboard and find information quickly.

There's also AI-powered search functionality that makes it easier to locate specific customers, subscriptions, or reports without digging through multiple tabs.

These AI features are designed to reduce the learning curve for new users and help experienced users work more efficiently.

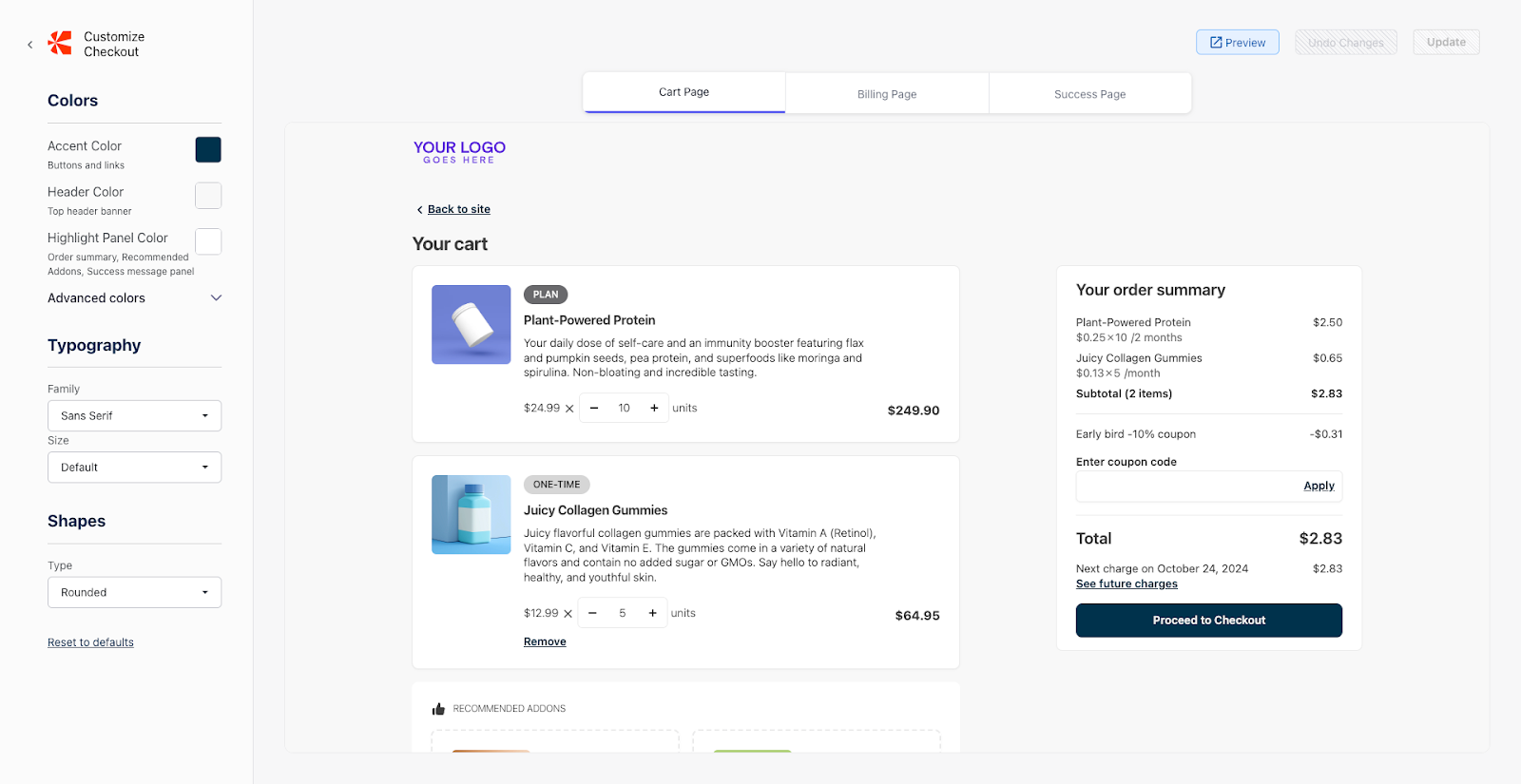

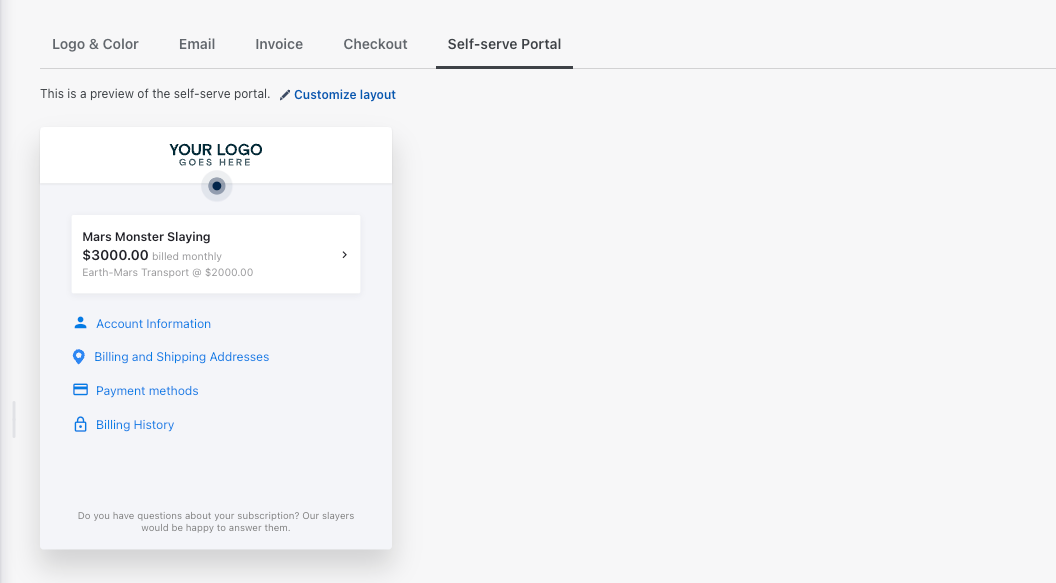

Custom checkout pages and self-serve portal

Chargebee includes tools for building custom checkout pages and a self-serve customer portal.

The checkout editor offers ready-made templates that you can customize with your own branding (fonts, colors, and layout tweaks) without any coding.

It’s basic, but effective if you want to stay on-brand and get customers through checkout quickly.

The self-serve portal ties in seamlessly, letting customers log in to update billing information, add or remove payment methods, change their subscription, or download invoices.

Both features help reduce support requests and give users more control over their accounts.

Dunning and payment gateways

Chargebee’s dunning process (a fancy term for payment recovery) lets you automate reminders for failed or overdue payments.

You can define how many reminders to send, how often, and what happens after the final attempt (such as pausing or cancelling the subscription).

On the payments side, Chargebee integrates with over 30 payment gateways, including Stripe, PayPal, and Authorize.Net.

This means Chargebee doesn’t process payments itself; it connects to whichever gateway you already use to handle transactions. The sandbox version includes a built-in test gateway for setup and testing purposes.

How much does Chargebee cost?

Chargebee has three main pricing tiers: Starter, Performance, and Enterprise.

- Starter: Free until you hit your first $250,000 in cumulative billing. After that, you’ll pay 0.75% of whatever you process each month. This plan includes the essentials, making it a solid entry point for early-stage businesses.

- Performance: Starts at $7,188 per year (billed annually, about $599 per month) and supports up to $100,000 in billing each month. Beyond that limit, you’ll also pay an additional 0.75% on any extra revenue processed. This tier unlocks more advanced features like multi-currency support, revenue recognition, and deeper analytics.

- Enterprise: Quote-based and built for large-scale, multi-entity businesses. Pricing depends on volume, setup complexity, and support needs.

Chargebee’s pricing scales with your revenue: the Starter plan works for smaller teams, but once you’re processing meaningful volume, it quickly moves into mid- to enterprise-level territory.

How easy is it to use Chargebee?

Chargebee is generally considered an easy platform to use. Most users say they can find everything they need without digging through the entire dashboard.

That said, there are some users who say that it can be pretty complex for newcomers.

The dashboard is clean, but it’s packed with options that reflect its enterprise roots.

Basic setup (sign-up, adding products, and creating your first plan) is simple enough. You can start in a sandbox environment to test everything before going live, which is a big plus.

Where things get tricky is configuration: setting up custom checkout pages, integrating payment gateways, or adjusting tax and dunning rules takes time.

There’s solid documentation and AI-powered guidance now (via Chargebee Copilot), but you’ll still need to dig into menus and settings to get everything running perfectly.

Is Chargebee worth it?

Chargebee may be worth it for established businesses with high recurring revenue and complex billing needs. If you’re managing multiple pricing models, currencies, or customer segments, the platform’s automation and reporting tools can easily justify the cost.

For smaller teams or creators, though, it’s probably overkill.

The setup time, layered fees, and enterprise-focused design make it less appealing if you only want to sell subscriptions quickly or manage a lean digital business.

That's why I've listed three alternatives below.

3 Chargebee alternatives

If you like what Chargebee does but not its limits or pricing, there are plenty of alternatives that cover the same ground.

Here are three strong alternatives worth checking out:

Whop Payments

Whop Payments is a modern, all-in-one payment stack for creators and online businesses.

It replaces multiple tools for billing, checkout, and payouts: handling everything from collection to global disbursement in one platform.

Fees are as low as 2.7% + $0.30 per transaction, with no subscriptions or hidden costs. You can sell courses, memberships, digital products, or communities, and Whop automatically manages renewals, access, and taxes.

Unlike Chargebee, we include built-in payment processing and act as your Merchant of Record, so you don’t need external gateways or compliance add-ons.

Oh, and our payment orchestration system automatically retries failed charges with other providers, boosting success rates by 6–11%:

“My first month on Whop, I made $12.5k all from X organic traffic – with 0 failed payments. Thanks Whop!” - Whop seller @0xroas

Whop supports 100+ payment methods worldwide (including cards, wallets, BNPL, and crypto) and pays out to 190+ countries via ACH, crypto, Venmo, Cash App, and more.

"You can now get paid out in Bitcoin or Stablecoin and basically every single country in the world – things competitors don't really support."

- Steven Schwartz, Whop CEO

You can embed checkout on your site, send checkout links, or use Whop’s no-code store builder and Marketplace to reach new buyers.

With 99.9% uptime, 24/7 human support, and built-in analytics for MRR, churn, and conversions, Whop Payments helps you sell and scale without limits.

Recurly

Recurly is one of Chargebee’s closest competitors, offering a full suite of subscription management, billing, and analytics tools aimed at SaaS companies and digital businesses.

The platforms share similarities: automated invoicing, dunning, revenue recognition, and deep reporting, but Recurly stands out in a few key areas.

It integrates natively with more than 20 payment gateways, giving you the flexibility to choose your preferred processor and keep redundancy across providers.

Recurly’s reporting tools are comparable to Chargebee’s, too. You’ll get insights into MRR, churn, lifetime value, and customer behavior, though the interface feels slightly more straightforward for everyday use.

Pricing is where Recurly edges out for smaller businesses: the Core plan starts at $249 per month and covers up to $40,000 in monthly billing.

Anything above that is charged at 0.9% of overage revenue. While not cheap, it’s more accessible than Chargebee.

Stripe

Stripe is one of the most popular choices for online payments and subscription billing. It combines a robust payment gateway with invoicing, recurring billing, and revenue reporting in one platform.

You also get access to rich transaction data, fraud protection tools, and global payment support without paying beyond standard card processing fees.

Stripe can also operate as a Merchant of Record, making it easier to handle recurring payments, manage invoices, and stay compliant across regions.

The trade-off is complexity: to unlock Stripe’s potential, you’ll need some technical knowledge or developer support.

Manage your subscriptions with Whop

Chargebee might be a solid choice for enterprise-level billing. But for creators, startups, and modern digital brands, it’s often more complex and expensive than it needs to be.

Whop Payments gives you everything you need to sell and scale subscriptions without setup fees, monthly costs, or confusing revenue limits.

You can launch instantly, accept 100+ global payment methods (including BNPL and crypto), and get paid in over 190 countries.

Every transaction runs through our smart orchestration system, which boosts your revenue by automatically routing payments for the highest approval rate.

Selling memberships, access to SaaS, community access, apps, or info, Whop handles the billing, access, and payouts so you can focus on growth, not admin.

Start using Whop Payments today and turn your subscriptions into a frictionless, global revenue engine.

Chargebee FAQs

Which accounting software can Chargebee integrate with?

Chargebee integrates with popular accounting platforms, including QuickBooks Online, Xero, NetSuite, and Sage Intacct. These integrations allow you to automatically sync invoices, payments, and revenue data, reducing manual bookkeeping errors.

How does Chargebee handle failed payments?

Chargebee uses an automated dunning management system to handle failed or overdue payments. You can configure the number of retry attempts, timing, and follow-up actions such as pausing or canceling subscriptions.

Does Chargebee process payments directly?

No, Chargebee does not process payments itself. It connects to external payment gateways like Stripe, PayPal, Adyen, and Authorize.Net to handle transactions. Chargebee manages billing logic, invoicing, and subscription lifecycle, but relies on gateways for actual payment collection.

Can customers manage their subscriptions themselves?

Yes, Chargebee offers a self-serve customer portal. Customers can update payment methods, view or download invoices, change plans, and manage their subscriptions directly, reducing support workload and improving customer satisfaction.

What payment methods does Chargebee support?

Chargebee supports all payment methods available through connected gateways, including credit/debit cards, ACH, SEPA, digital wallets, and Buy Now, Pay Later options. The exact methods depend on the gateway you choose.