Top payment processors for 2026 include Stripe, PayPal, Adyen, Square, and more. Compare fees, multi-currency support, and features to find the best fit for side-hustles, agencies, and global platforms.

Key takeaways

- Choosing a payment processor that matches your business type and risk profile directly determines your ability to scale globally.

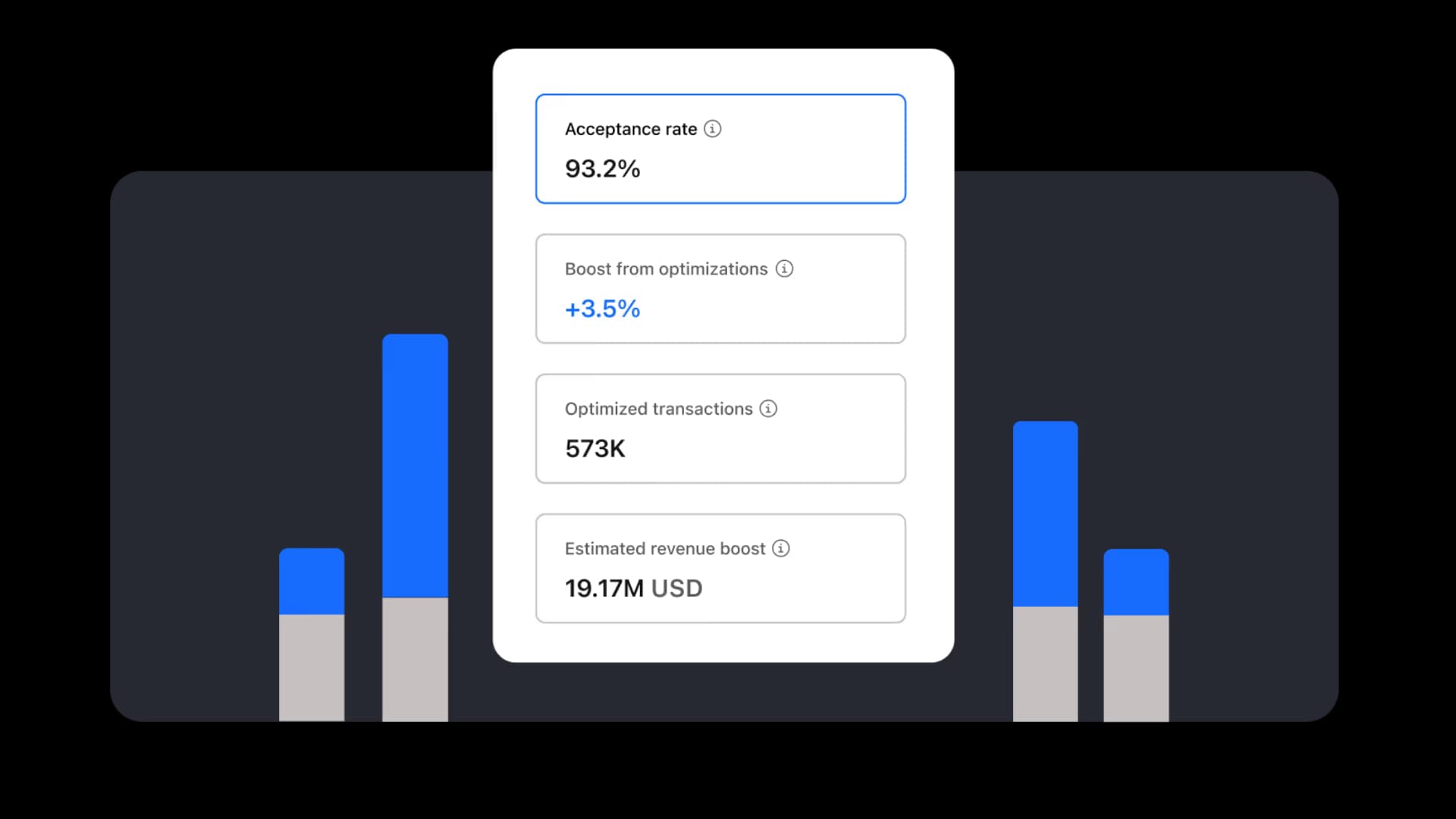

- Multi-PSP orchestration and smart payment routing can significantly boost transaction approval rates and reduce failed charges.

- Modern businesses need processors offering multi-currency support, flexible payout options, and diverse payment methods beyond traditional cards.

Reality check: How you choose to process payments can affect your business in more ways than one. Where the right payments stack leads to increased order values, payment acceptance, and customer acquisition; the wrong one leaves you scrambling.

93% of consumers want pricing in their local currency, and 70% will abandon their cart when it's not offered.

So it makes sense that the best payment system for your business depends on who you sell to, what their expectations are, and how fast you need to get paid.

This guide covers 23 of the top options for 2026 - with fees, features, and honest assessments for every business type, from side-hustles to global platforms.

Top payment processors for every business type

Here's a list of 25 of the best ways to accept payments, built for everyone from side-hustles to 7-figure businesses.

Keep in mind that fees listed are indicative and can vary by region, account type, and payment method.

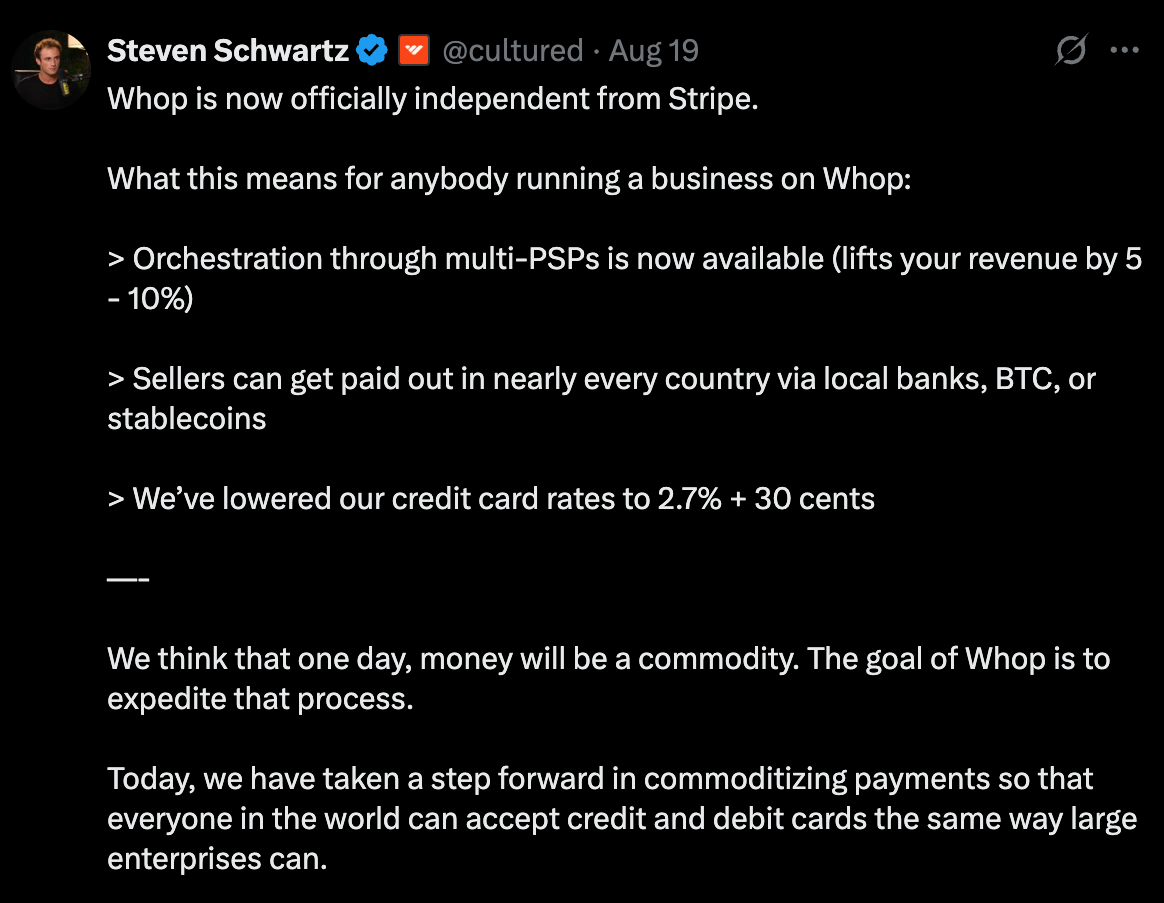

1. Whop: a platform powered by leading payment processors

Best for: 7‑figure businesses, agencies, platforms, side‑hustles

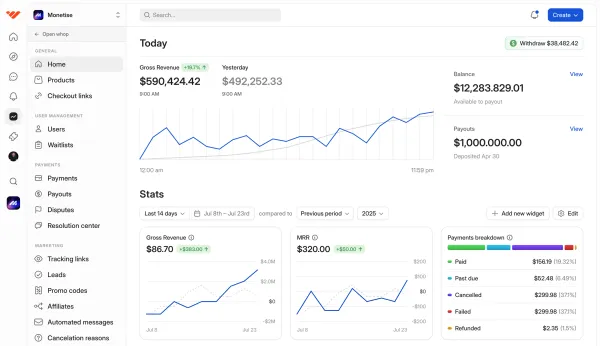

Whop is a technology platform built for creators, side-hustlers, marketplaces, agencies, SaaS, and platforms - with faster payouts, lower fees, and more control over how you accept payments globally.

Whilst Whop itself is not a payment processor, it is powered by leading payment processors. Whop Payments lets you accept credit & debit cards, crypto, digital wallets, and even Buy Now, Pay Later.

Our Multi-PSP orchestration automatically routes each payment through the provider most likely to approve it, boosting successful charges by up to 11%.

Through thousands of conversations, we've learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.

– Hunter Dickinson, Head of Partnerships at Whop

Create embedded and linked checkouts or use Whop's own store builder and marketplace to list. We meet you wherever you sell.

Add built-in tools like automatic dispute handling, affiliate programs, free trials, and products with chat, courses, or livestreams, and you've got everything a modern seller needs.

Fees:

- Domestic card payments: 2.7% + $0.30

- International card payments: +1.5%

- Conversion: +1%

- ACH: 1.5% (max $5)

- Setup/monthly fees: None

Whop is trusted by more than 27,000 businesses.

2. Stripe

Best for: Online stores, SaaS, subscription businesses

Stripe is a payment processor trusted by businesses worldwide, from small online stores to fast-growing SaaS platforms. Founded by Patrick and John Collison, it was built to make online payments simple, secure, and developer-friendly.

You can use Stripe for subscriptions, marketplace payouts (Stripe Connect), multi-currency transactions, and international payments, all through a flexible API that supports fully customizable checkout experiences.

It also provides tools for fraud prevention, analytics, and recurring billing, making it a solid choice for businesses that want both power and control.

Fees:

- Card payments: 2.9% + $0.30 USD

- International cards: +1.5%

- Currency conversion: +1%

- Instant Payouts: +1.5% (min 50¢)

3. PayPal

Best for: Small businesses, international ecommerce, buyer‑trusted checkout

PayPal's been around forever, and for good reason - it's one of the most trusted ways to send and receive money online.

Launched officially in 1999, it's now a global payments platform used by millions of merchants, with tools for online stores, mobile apps, and even peer-to-peer payments like Venmo.

You can accept payments from domestic and international cards, digital wallets, and more, making it simple to sell anywhere in the world. Its checkout is widely recognized by buyers, which helps reduce friction at payment time.

Fees:

- PayPal Checkout / Guest Checkout: 3.49% + $0.49 USD

- Standard Credit and Debit Card Payments: 2.99% + $0.49 USD

- International transactions: +1.50%

- Currency conversion: 3.00% - 4.00%

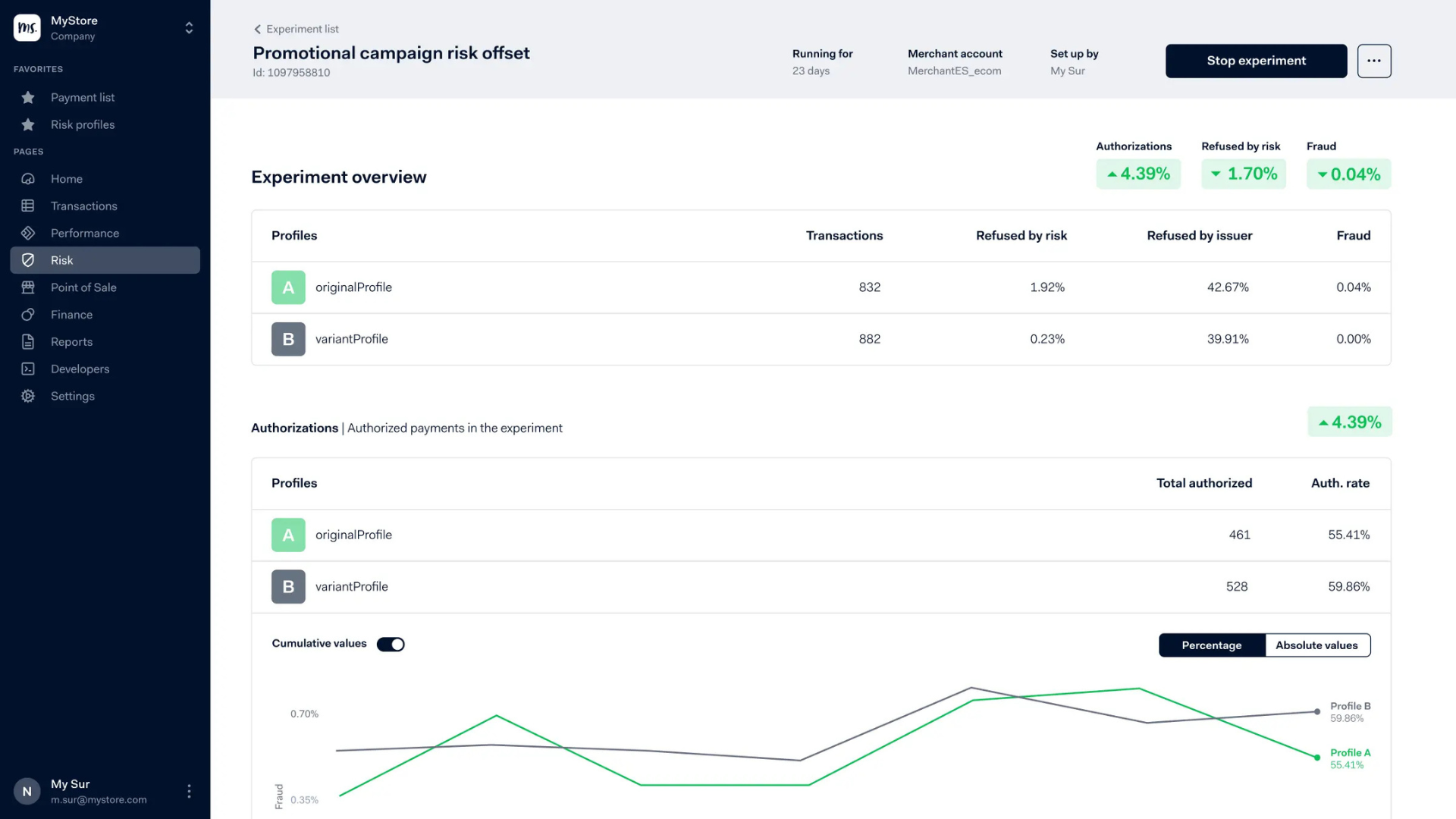

4. Adyen

Best for: Enterprise marketplaces and global platforms

Adyen is a global payments powerhouse that supports businesses of all sizes, from online merchants to multi‑channel retailers. The company offers a unified platform for online, mobile and in‑store payments.

Adyen uses Interchange++ model, which means you'll pay three separate fees: the card's network fee, the card scheme fee (Visa/Mastercard), and Adyen's markup.

You'll typically see a fixed processing fee (e.g., ~£0.11 in the UK) plus a variable payment‑method fee (often ~0.60% or more) depending on card type and region.

There are no setup fees or monthly minimums for many accounts, but outbound fees and currency conversions can add up.

Fees:

- Fixed processing fee (UK): ~£0.11 per transaction

- Variable fee: ~0.60% + interchange & scheme fees (cards)

- Setup/monthly fees: None listed for standard accounts

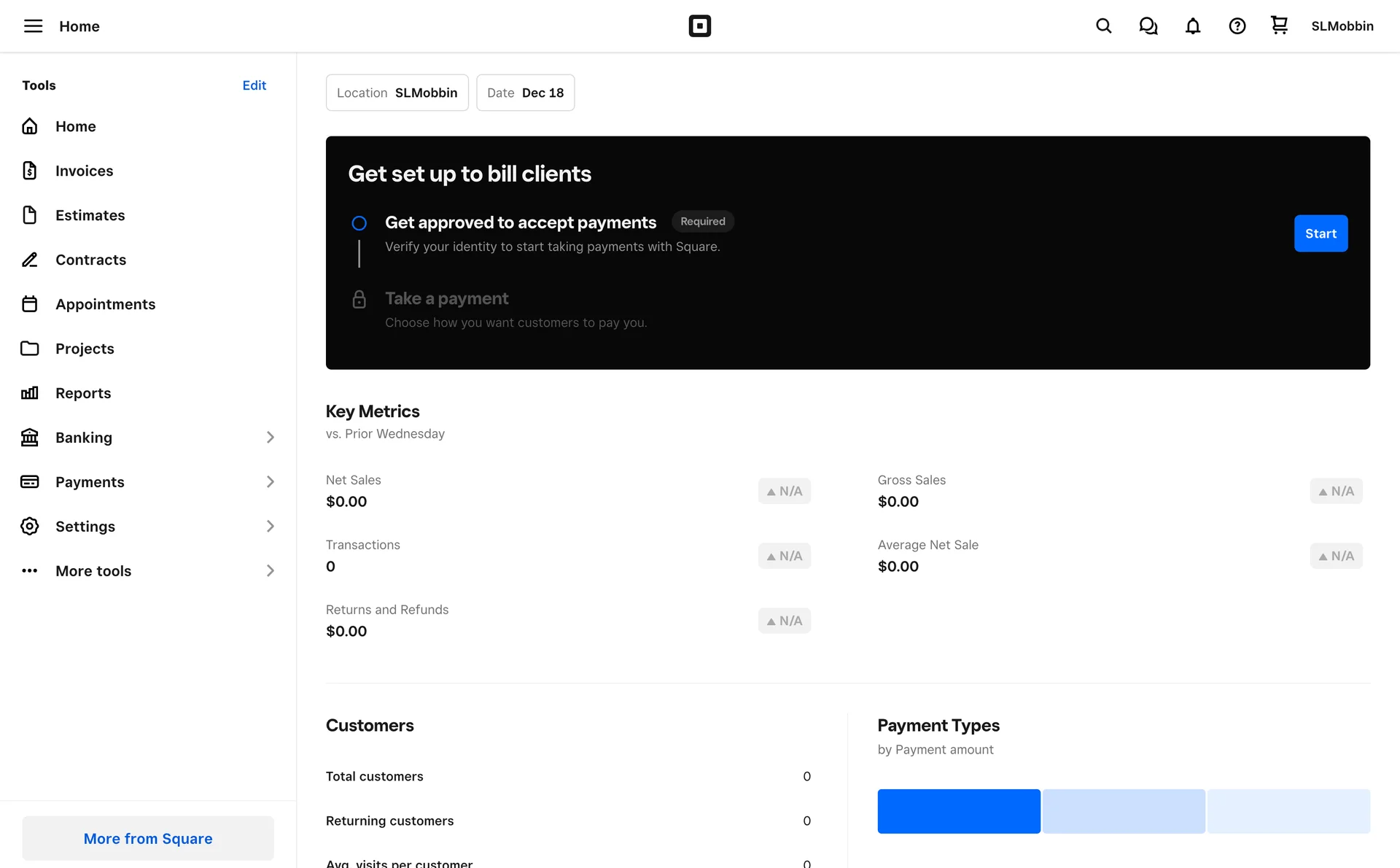

5. Square

Best for: Omnichannel retail, small‑to‑medium ecommerce, POS + online

Square, owned by parent-company Block, started with a simple idea: let anyone accept card payments without a traditional merchant account. Now, it's grown into a full financial ecosystem for small-to-medium businesses.

With Square, you can accept in-person, online, and mobile payments, manage inventory, run loyalty programs, and even handle payroll. It's especially popular with retail and food businesses that need omnichannel solutions in one platform.

Fees:

- Card payments (in-person, swipe/dip/tap): 2.6% + $0.15 USD (Free plan), lower rates on paid plans

- Online transactions: 3.3% + $0.30 USD (Free plan) or 2.9% + $0.30 USD (Plus/Premium plans)

- ACH / bank transfers: 1% per transaction ($1 min)

6. Checkout.com

Best for: Digital‑native enterprises, global online merchants

Checkout.com is built for global online sellers who need speed, flexibility, and multi-currency support. It handles payments across 150+ currencies and dozens of local payment methods, making it a solid choice for merchants selling across borders.

Its platform includes real-time analytics, fraud protection, and customizable payment flows, which is why fast-growing ecommerce brands and marketplaces rely on it to manage complex global payments.

Fees:

- Standard card payments: 2.3%–2.9% + $0.30 USD

- FX / currency conversion: variable, depends on contract

- No flat monthly or setup fees; pricing is usually customized per merchant

7. Worldline

Best for: European enterprises, merchant infrastructure, large‑scale terminal networks

If you're operating in multiple European markets and need a payments partner with serious scale and legacy credibility, Worldline checks that box.

Worldline excels in merchant acquiring, terminal networks, multichannel payments, and cross‑border flows, including support for local European payment methods, A2A (account-to-account) solutions, and complex enterprise integrations. Its fee structures tend to lean enterprise‑grade, often using Interchange + ++ models and requiring tailored contracts.

For example, its UK "Full Service Online Payments" model lists a monthly fee (£29) plus translated domestic/ regional rate details.

If you're scaling across Europe, handling multiple currencies, or require enterprise‑grade merchant services with local presence, Worldline is a valid contender. Just expect a more complex pricing model and potentially longer contracts than smaller‑scale processors.

Fees:

- Online gateway model (UK example): £29/month + first 300 transactions free; then £0.10 per transaction + ~1.00% domestic and ~2.50% regional fee.

- European merchant schedule: Interchange + Scheme model with complex variables; public "Indicative Card Scheme Fee Rates" show base scheme fees (e.g., 0.0009 € per transaction, up to 0.0200% for some card types) for EEA domestic.

8. PaymentCloud

Best for: High‑risk merchants, underserved verticals

PaymentCloud is built for businesses that get told "no" by most payment processors. This includes CBD shops, travel sites, adult businesses, and other high-risk verticals.

PaymentCloud specializes in custom merchant accounts, chargeback mitigation, and flexible underwriting, so you can start accepting payments quickly without jumping through endless hoops.

It's all about giving high-risk sellers a path to scale safely, with support for card payments, ACH, and international options where possible. Their team knows these industries inside and out, which makes onboarding faster and less stressful than with mainstream providers.

Fees:

- Card processing: typically 2.99%–4.99% + $0.25–$0.30 USD per transaction, depending on risk level and industry

- ACH / bank transfers: around 1% per transaction

- Monthly fees / setup fees vary per merchant account and industry

9. PayKings

Best for: High‑risk merchants requiring fast onboarding and tailored support

PayKings thrives where standard payment processors hesitate. If your business falls into a high‑risk category (CBD, adult, vape, firearms, travel, or online gaming), PayKings has built the framework to keep you moving.

With over 15 years of experience and more than 10,000 merchants served, PayKings offers tailored underwriting, advanced fraud protection, and flexible gateway options designed for complex industries.

Expect a processing model that adapts to your risk profile: you'll often see higher rates but with the trade‑off of approval when others won't. Inventory support for crypto, ACH, mobile payments and virtual terminals adds to its flexibility.

Fees:

- Rates often start around 2.49%+ for accepted merchants, but can vary widely depending on vertical and volume.

- Set‑up fee: typically $0 for many merchants.

- Contract term: could run 2‑3 years depending on the acquiring bank.

10. Durango Merchant Services

Best for: High‑risk merchants needing custom processing, gateway integration and high‑risk underwriting

Durango Merchant Services is another payment processor built specifically for high-risk businesses that standard processors might reject. From adult content and CBD to travel and gaming, Durango offers tailored merchant accounts, gateways, and underwriting solutions that standard processors often won't touch.

Their platform supports credit/debit cards, ACH, and virtual terminals, with options for multi-currency processing and international payouts. They also provide dedicated support for onboarding, chargeback management, and compliance, making it a reliable option for high-risk verticals that need hands-on guidance.

Fees:

- Card processing: 2.99%–4.99% + $0.25–$0.30 USD depending on risk and industry

- ACH / bank transfers: typically 1% per transaction

- Setup / monthly fees: vary by account and vertical

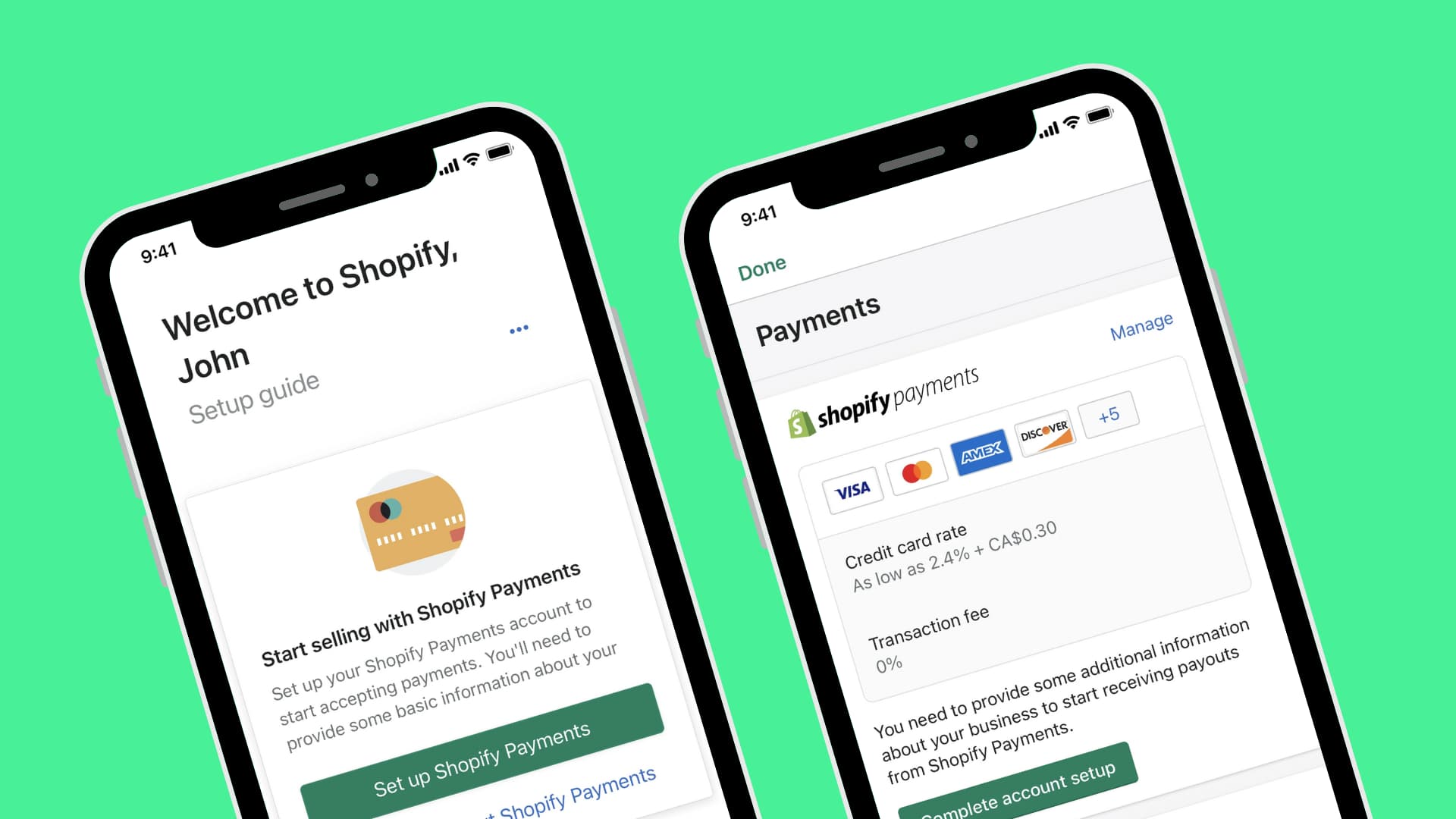

11. Shopify Payments

Best for: Shopify merchants who want a way to process payments without extra fees (only works within Shopify's ecosystem)

Shopify Payments is Shopify's own processor, allowing Shopify merchants to accept payments through their online store.

It's handy because it lets you start accepting and processing payments without having to set up third party tools or services, but it only works through the Shopify network (so you can't use it to process payments on another platform or marketplace).

Still, sellers can use Shopify Payments and avoid extra costs that come from running payments through a third-party, making it a good option for small-scale sellers only operating on Shopify.

Fees (for Basic, see other Shopify Payments pricing tiers here):

- Card processing: 2.9% + 30¢

- In-person payments (POS): 2.6% + 10¢

- Setup/monthly fees: None on top of your existing Shopify account fees

12. WooPayments

Best for: WooCommerce store owners who want fully integrated payment processing without leaving their WooCommerce dashboard

WooPayments is the official built-in payment processor for WooCommerce. It lets WooCommerce merchants accept payments, manage transactions, handle disputes, and track payouts directly from their WooCommerce dashboard, without needing to log into a separate payment processor.

It supports major credit and debit cards, Apple Pay, Google Pay, and local payment methods including iDEAL, Bancontact, and P24. You can also accept in-person payments for orders placed online using WooPayments and a card reader. WooPayments supports payments in 135+ currencies and is available to merchants in 30+ countries.

The biggest caveat: WooPayments only works within the WooCommerce ecosystem. If you sell on multiple platforms or want to move away from WooCommerce, you'll need a different processor.

Fees (US):

- Card processing: 2.9% + $0.30 (+1.50% for international payments)

- In-person fees: 2.7% + $0.10 (+1.00% for international payments), plus $5.00 per active device per month

- Instant payouts: +1.5% of payout amount

- Setup/monthly fees: None

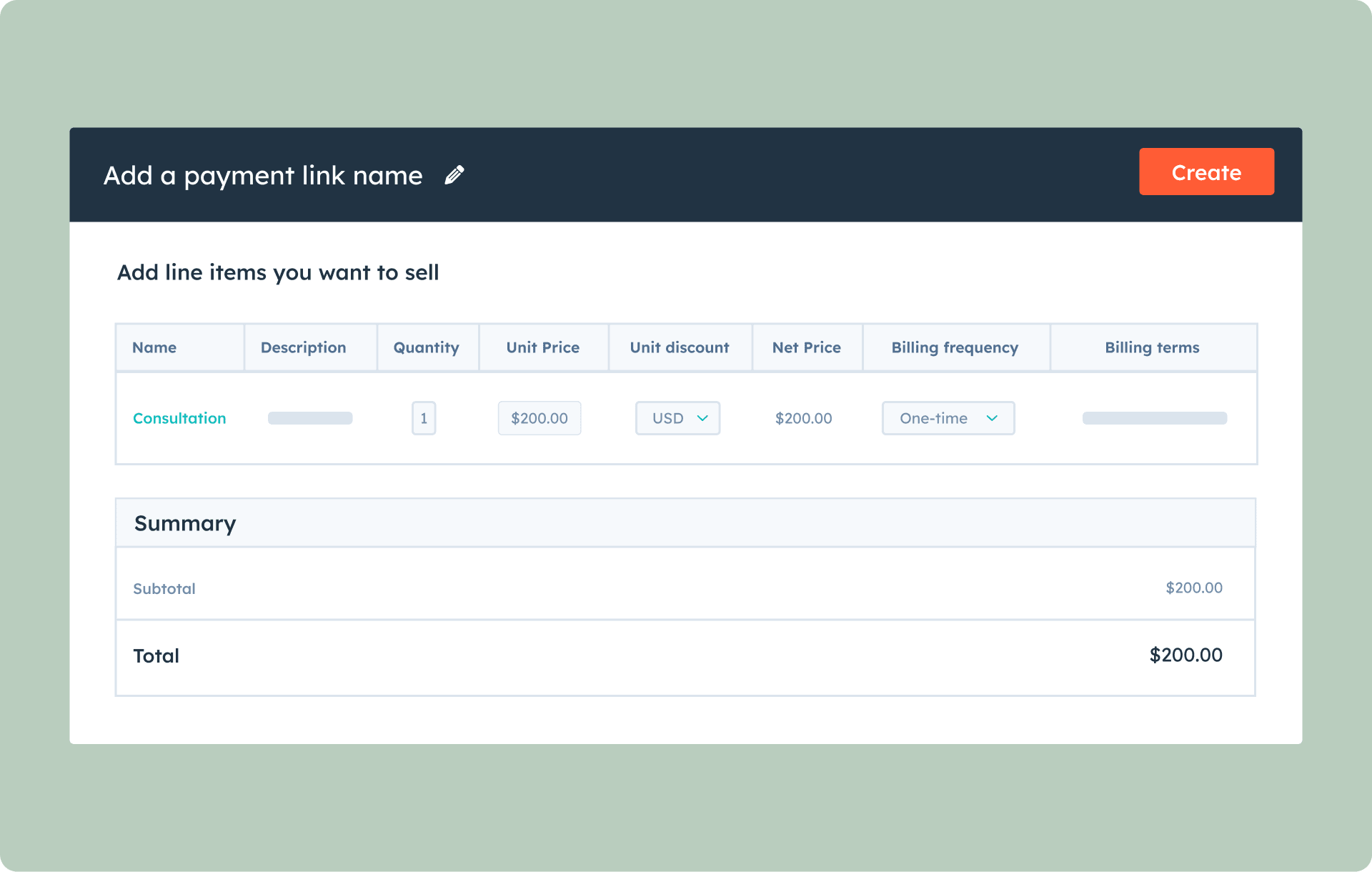

13. HubSpot Payments

Best for: Service-based, CRM-heavy businesses that already live and operate within HubSpot.

HubSpot Payments is another built-in payment processing system (powered by Stripe), that lets you collect both one-time and recurring payments through invoices, payment links, and quotes.

If you already use HubSpot for CRM, sales, invoices, quotes, etc., this lets you charge customers directly from there instead of sending them somewhere else.

You can accept payments via credit/debit cards, Apple Pay, Google Pay, and various bank debit methods.

HubSpot Payments is available to users in the United States, United Kingdom, and Canada and is included with several HubSpot subscriptions such as Marketing, Sales, Service, Data, Content, and Commerce Hubs; and at various tiers.

Fees (US):

- Card processing: 2.9% per transaction

- International direct debit fee: 1.5%

- ACH/bank transactions: 0.8%, capped at $10 per transaction

- Currency conversion: Additional 1% transaction fee

14. Helcim

Best for: Small and growing businesses based in North America that need both in-person and online payment processing.

Helcim is a payment processor that lets businesses accept payments online, in person, and through invoices from one account.

You can accept payments via credit and debit cards, contactless and chip payments in person, online checkout, virtual terminals, invoicing, and ACH/EFT bank transfers (so you've got options).

Helcim uses interchange-plus pricing (meaning you pay the underlying card network cost plus a transparent markup) but they don't charge monthly fees, setup fees, PCI fees, or cancellation fees.

The biggest caveat is that Helcim is currently only available to businesses based in the United States and Canada.

Fees (US, based on transaction size of $300):

- Online card processing: 2.27% + 25¢, higher for American Express

- ACH/bank transactions: 0.5% + 25¢, capped at $6 for transactions below $25k and +0.05% for transactions above

- In-person: 1.83% + 8¢, higher for American Express

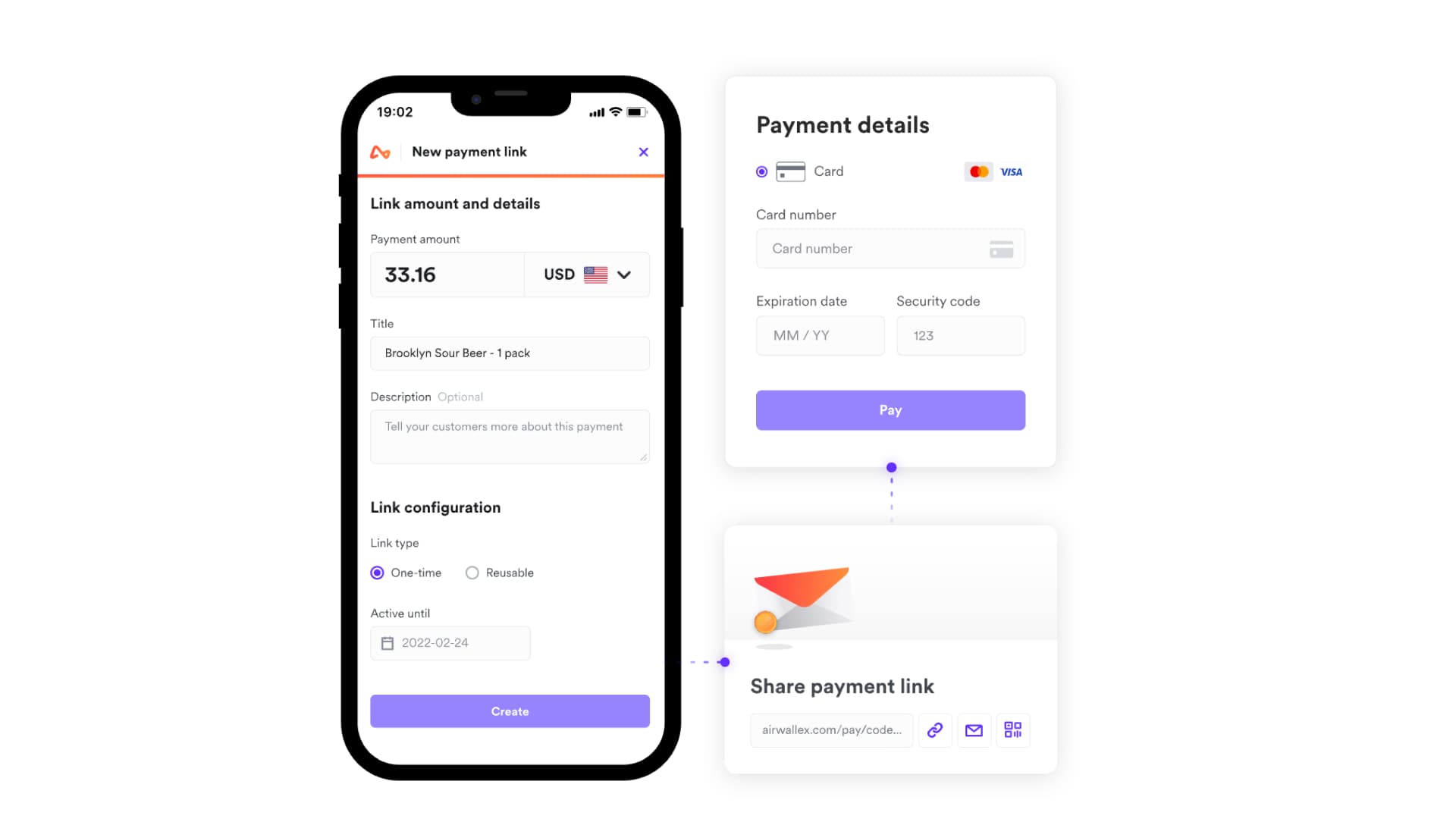

15. Airwallex

Best for: Larger-scale businesses that need to process cross-border payments in multiple currencies.

Airwallex is a global payments and financial services platform.

It helps businesses manage international payments, foreign exchange, spending, and payment acceptance from one place.

If you're selling across borders (or deal with multiple currencies), Airwallex lets you open multi-currency accounts, hold funds in different currencies, send transfers to 120+ countries, and convert currencies without using a traditional bank.

Airwallex supports domestic and international credit/debit cards, Apple Pay, Google Pay, and 160+ local payment methods. It also supports recurring billing, subscription management, payment links, and custom checkout integrations.

The fees, though? They're pretty steep (and the below costs are on the cheapest plan).

Fees (US, Explore plan):

- Domestic card processing: 2.8% + $0.30¢

- International cards: 4.30% + $0.30¢

- Local payment methods: $0.30 + payment method fees

- Subscriptions: 0.50% per successful card transaction

16. Stax

Best for: US and Canadian-based businesses processing high volume and need access to wholesale interchange rates.

Stax is a US-based payment processor that's a little different: it uses a subscription pricing model instead of charging a percentage markup on transactions.

Businesses pay a monthly fee (starting at $99 a month, based on annual processing), and in return get access to direct-cost interchange pricing with no markup.

You still pay the actual card network interchange fee, plus a flat per-transaction fee, though.

Stax also offers add-ons like ACH payments, chargeback protection, POS terminals, and terminal protection plans. All plans include invoicing, recurring billing, payment links, analytics, and compliance tools.

Fees:

- Card processing: $0.08 in-person and $0.15 online

- ACH/bank transfer (additional add-on to plan): $0.60 per transaction

- Setup/monthly fees: Starts at $99/month (based on annual processing volume)

17. Finix

Best for: North American, high-volume businesses chasing full control over underwriting, fees, and payouts.

Finix is a payments infrastructure provider that lets businesses (and platforms) build their own payment stack.

Finix focuses on payments ownership, giving companies control over merchant onboarding, underwriting, compliance, reporting, and fees. For 'direct merchants' (businesses processing their own payments), Finix offers card acceptance online and in-store, ACH, subscription billing, fraud tools, and in-person POS terminals.

Platforms and marketplaces get embedded payments, merchant management tools, split payouts, and white-label onboarding. It's best suited to platform-level and high-volume businesses needing (and who have the resources to manage) full operational control.

Fees (direct merchants):

- Card processing: 0% markup on interchange + $0.08 (in-person) or $0.15 (online) per transaction

- ACH/bank transfer: $0.50 per transaction

- Setup/monthly fees: Start at $250/month (based on processing volume)

Fees (platforms):

- Card processing: 2.75% + $0.30 (US cards), international cards + 1.5%

- ACH/bank transfer: 0.75% ($0.25 min, $5 max)

- Setup/monthly fees: Custom (contact sales)

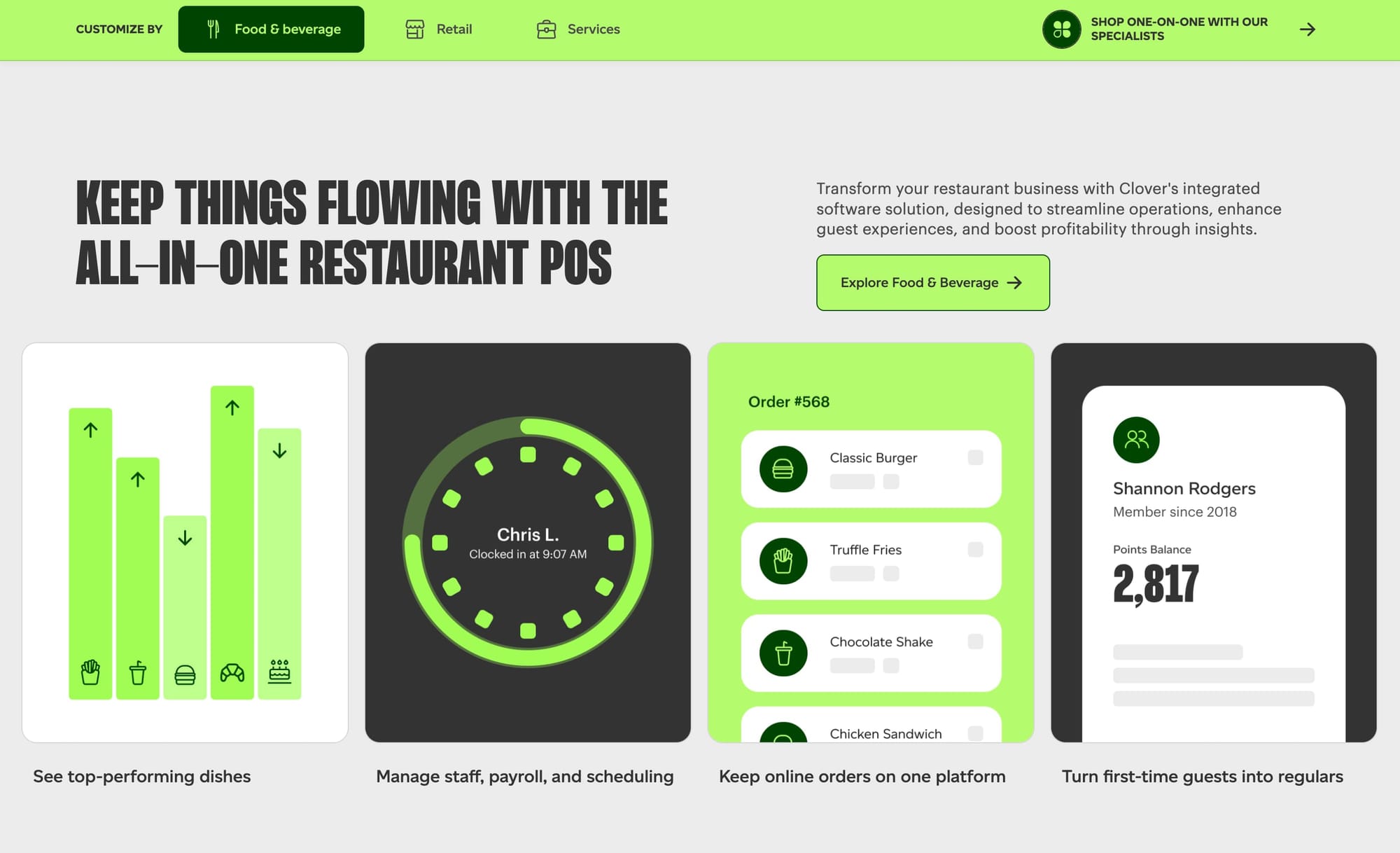

18. Clover

Best for: Restaurants, retail stores, and service-based businesses that want an all-in-one POS with built in processing.

Clover is a point-of-sale system combining hardware and software into a single platform (kind of like Square when it started). It mainly supports food, beverage, and hospitality merchants; but also caters to retail and service businesses.

Clover offers in-person POS terminals, online ordering, invoicing, a virtual terminal, reporting tools, and employee management software; as well as hundreds of integrations through its App Market.

Unlike other payment processors, Clover is hardware-first – meaning you typically buy (or finance) a POS system, and pair that with a monthly software plan. Payment processing is bundled in, and rates are fixed rather than interchange plus.

Fees (restaurant pricing example):

- Card processing: 2.3% + $0.10 (in-person), 3.5% + $0.10c (keyed/typed)

- ACH/bank transfer: Varies by merchant account

- Setup/monthly fees: $89.95-$129.85/month (plus device cost/financing)

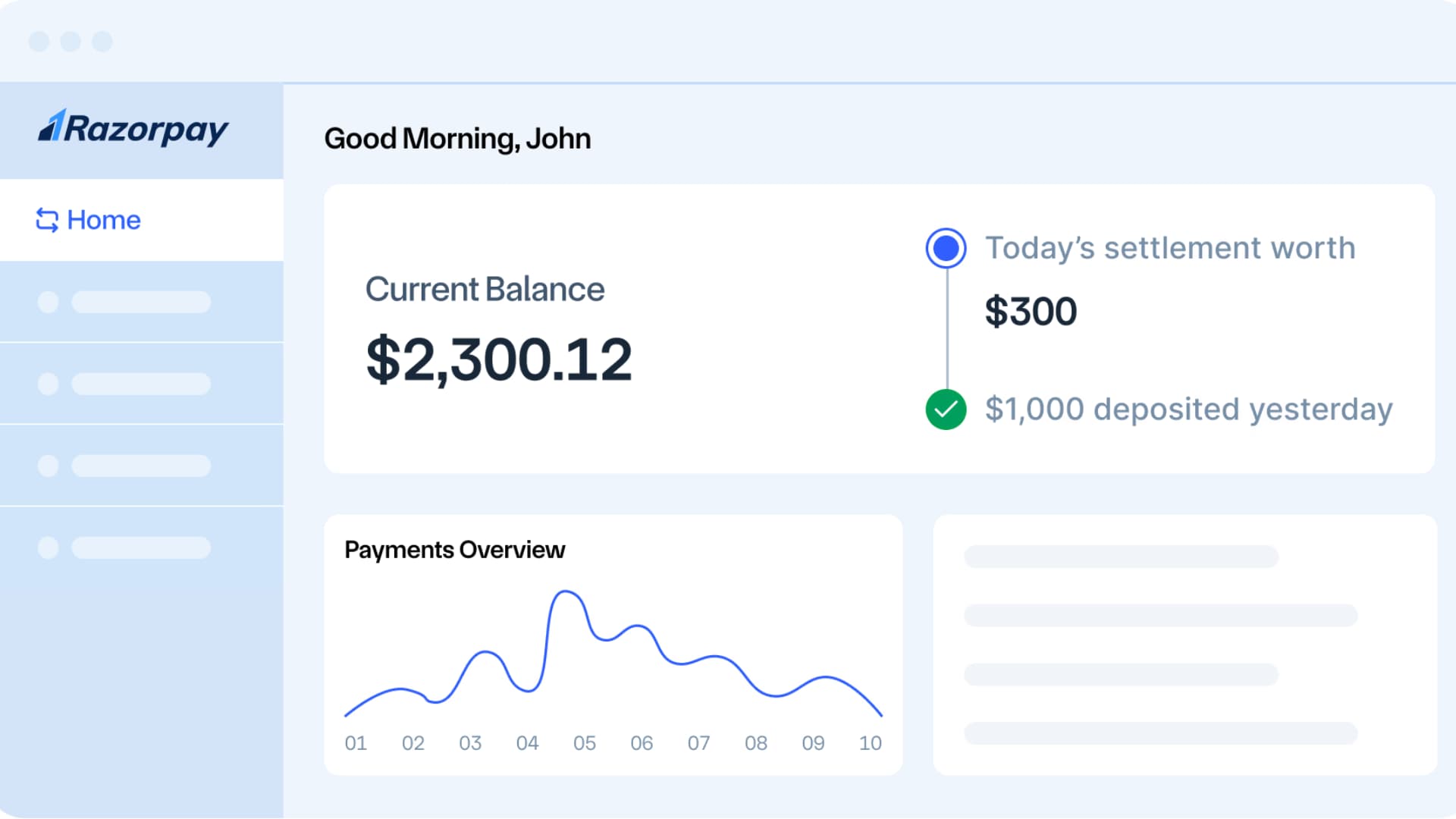

19. Razorpay

Best for: Online, US-based businesses and companies looking for a payment gateway with lower headline pricing and dev tools.

Razorpay is a payments platform that lets businesses accept payments, run subscriptions, and offer payment links.

Globally, it operates in India, Singapore, Malaysia, and the United States; focused on digital businesses chasing fast onboarding, API automation, and customizable checkouts.

Razorpay's U.S product offers hosted checkout, no-code payment links, recurring billing, and reporting. ACH is available as a cheaper alternative to card payments for businesses processing in USD.

Fees (U.S):

- Card processing: 2.49% + $0.30

- ACH: 0.5% (capped at $5 per transaction)

- International processing: +1.5%

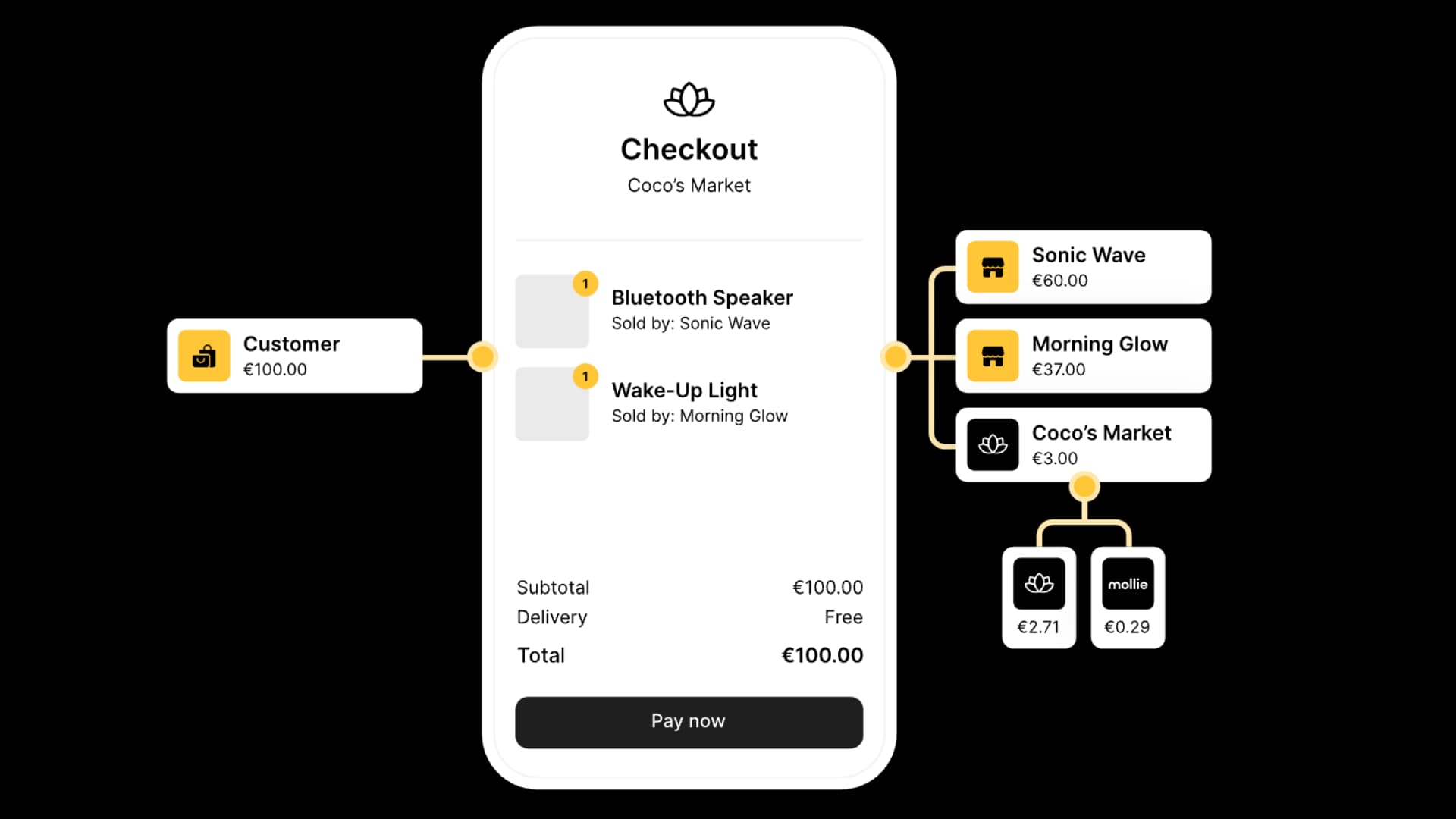

20. Mollie

Best for: European businesses wanting wide local payment method coverage and multi-currency payouts without contracts.

Mollie is a European payment processor available in the European Economic Area (EEA), United Kingdom, and Switzerland, that supports 40+ local and global payment methods.

It's particularly popular among ecom brands in the EU, and processes payments via card, SEPA, iDEAL, Bancontact, Klarna, Apple Pay, and other local methods.

Mollie also supports multi-currency payments and payouts: you can add up to 11 payout currencies. If you receive a payment in a currency you haven't chosen to enable, it's automatically converted to your primary currency before being paid out.

Fees (online payments):

- EEA consumer cards: 1.80% + €0.25

- Non-EEA cards: 3.25% + €0.25

- American Express: 2.90% + €0.25

- SEPA Direct Debit: €0.35

- SEPA Bank Transfer: €0.25

- Currency conversion: 1%

21. Worldpay

Best for: Mid-market and enterprise-level businesses processing high volumes globally.

Worldpay is an enterprise-level global payment processor, offering omnichannel payment solutions across 170+ countries and 135+ currencies.

It provides access to a wide range of card networks and local payment methods, alongside multi-currency pricing so customers can pay in their own currency. It's built for high transaction volume and offers smart routing, fraud prevention, and dispute management.

Integrations range from developer APIs to low-code and hosted solutions. Worldpay also supports subscriptions, payment links, and embedded checkouts for platforms.

Fees:

- Worldpay uses custom pricing negotiated per merchant - there's no public rate card. A $35 monthly minimum fee applies from January 2026. Contact their sales team for a quote based on your volume and business type.

22. Authorize.net

Best for: North American businesses looking for a traditional payment gateway with fraud tools included.

Authorize.net is a well-known, US-based payment gateway owned by Visa that lets businesses accept online, invoiced, and recurring payments.

It supports credit cards, digital wallets, and ACH; sellers can use it as an all-in-one solution or as a gateway connected to an existing processor.

Authorize.net is available to businesses in the United States and Canada, so it's more regionally focussed than global-first options like Whop, Stripe, or Adyen.

Fees (All-in-one plan):

- Cards and digital wallets (domestic and international): 2.9% + $0.30

- ACH (eCheck): 0.75%

- Monthly fee: $25

- Batch fee: $0.10

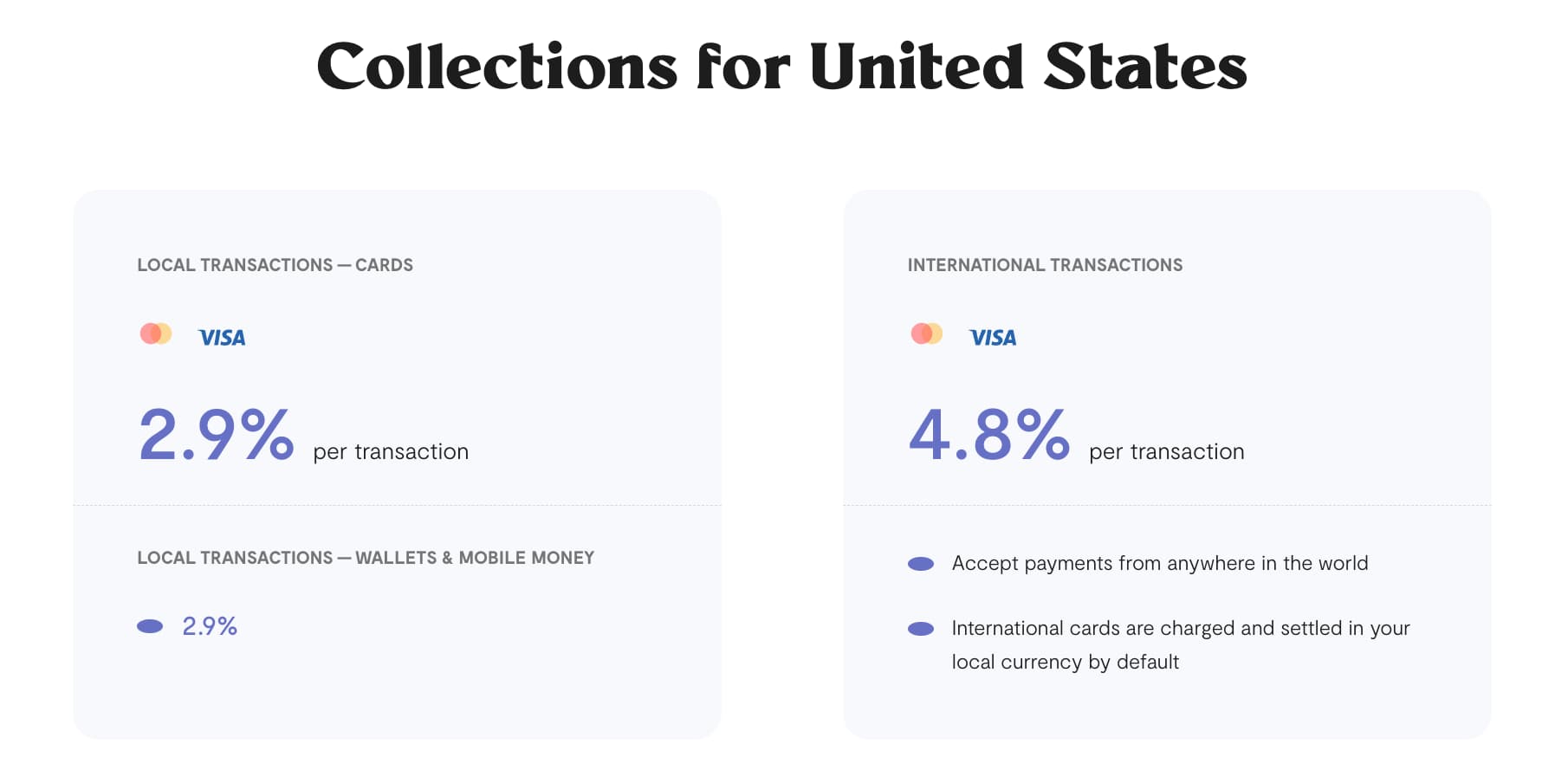

23. Flutterwave

Best for: Businesses in Africa, the U.K, the U.S, and Europe that need strong local payment rails plus global card acceptance.

Flutterwave is a payments platform with a strong presence in Africa and Europe, enabling businesses to accept payments via card, mobile money, POS payments, wallets, and local rails (though available methods are dependent on the merchant's region).

Flutterwave's main focus in the US is via card payments and digital wallets, and it supports online checkout, payment links, subscriptions, and API customization.

Fees (U.S.):

- Cards and digital wallets (domestic): 2.9%

- International cards: 4.8%

- Monthly fees: None

24. Nuvei

Best for: Large enterprises that need global acquiring, not an all-in-one selling platform.

Nuvei is an enterprise-grade payment processor with a big focus on global acquiring and alternative payment methods.

It’s great for companies that already have mature tech stacks and internal payments teams; but less ideal startup platforms or fast-moving digital businesses that want to launch quickly.

Nuvei supports cards, wallets, local payment methods, and crypto across many regions, with tools for authorization, fraud management, and chargeback handling.

That makes it a solid infrastructure layer for high-volume businesses, but it comes with complexity, contracts, and custom pricing.

Fees:

- Pricing is custom and contract-based. Fees vary by region, volume, payment method, and business model, and are typically negotiated at enterprise scale.

25. Elavon

Best for: Brick-and-mortar businesses, franchises, hospitality, and enterprises that want traditional bank-backed processing.

Elavon is a well-known payment processor owned by U.S. Bank. It’s designed for businesses seeking tools like POS terminals, online checkout, hosted gateways, and standard bank settlement (rather than a modern, platform-first stack).

In-person, online, mobile, mail and phone payments are all supported by Elavon, with tools for reporting, fraud prevention, PCI compliance, and chargeback handling.

It also offers value-added services like business funding, industry-specific POS integrations, and 24/7 phone support, which makes it popular with retailers, restaurants, service businesses, and larger enterprises.

What Elavon does lack, however, is flexibility. Pricing and onboarding follow a traditional model, with contracts and negotiated rates. That can feel kinda heavy for fast-scaling platforms and businesses.

Fees (US):

- Elavon advertises starting rates for standard plans (~2.6% + $0.10 for in-person and ~2.9% + $0.30 for online transactions). However, final pricing is negotiated per merchant and varies depending on many factors.

How to choose the right payment processor for your business

We've run you through options to suit every business, from brick-and-mortar stores to fast-scaling online platforms. But with so many providers offering so many different tools, integrations, and fee structures, things can get confusing.

Our best advice is to focus on finding a solution that can offer you fast payouts, supports your business type, and scales with you.

Know your business type

Are you a side-hustle, a 7-figure agency, or a platform? Some processors are built for high-risk verticals, others for global marketplaces. Pick a processor that can scale with you, not hold you back.

Check payout speed

Faster payouts = better cash flow. If you want to get paid today instead of waiting days, look for processors with instant or same-day payouts.

Multi-currency support

Selling internationally? Make sure your processor supports the currencies your customers use and handles FX smoothly.

Payment method flexibility

Credit cards, digital wallets, stablecoins, BNPL… the more you accept, the fewer sales you leave on the table.

You need payments, you need to accept payments, and you need to pay out payments. And if you can't do that, you can't run a business.

- Hunter Dickinson, Head of Partnerships at Whop

Fees and transparency

Always remember: listed fees are indicative, not concrete. Dig into hidden charges, FX markups, and extra costs for cross-border payments. A slightly higher fee can be worth it if it means fewer declines and faster payouts.

Ease of integration

You don’t want to spend weeks coding just to start accepting payments. Check if the processor works with your website, store, or platform out of the box.

Support and reliability

When something breaks, you need fast, competent help. Look at uptime stats, support channels, and real-world reviews.

Don't rely on one payment processor. Get multi-PSP orchestration with Whop

Instead of choosing just one payment processor, you can use Whop Payments to tap into many.

If you’re looking for a solution built for creators, side-hustlers, agencies, and platforms, Whop was made for you. We have fast payouts, low fees, and more control over how you accept payments globally - with card fees typically around 2.7% + $0.30 USD (varies by region/currency) and no setup or monthly fees at all.

Get paid faster, smarter, and on your terms with Whop

Choosing the right processor isn’t just about fees. It’s also about speed, flexibility, and reliability. You want your money moving when it should, your customers’ checkout to be smooth, and a platform that grows with you.

But with Whop, you don't have to choose just one. Whop Payments - backed by best-in-class processing partners - powers 27,000+ businesses, including Shelby Sapp’s She Sells, Iman Gadzhi, and Bad Marketing.

Accept cards, crypto, stablecoins, wallets, and BNPL - all with multi-PSP routing for faster, more reliable payouts.

Get paid smarter. Get paid faster. Get Whop.

Payment processor FAQs

What makes a payment processor “top-rated”?

Top-rated processors combine speed, reliability, multi-currency support, flexible payment options, and solid customer support. Basically, they keep your money moving and your business running smoothly.

Can I use Whop if I sell globally?

Absolutely. Whop supports over 241 territories, multiple currencies, and a huge range of payment methods, from cards to crypto and digital wallets.

Are the fees listed for each processor fixed?

No, all fees are indicative. They vary by region, account type, payment method, and volume. Always double-check before committing.

Which processor is best for high-risk businesses?

Processors like PaymentCloud, PayKings, and Durango Merchant Services specialize in high-risk industries such as CBD, adult content, travel, or gaming. They provide custom underwriting and flexible merchant accounts.