We’ve rounded up six top SaaS payment gateways that make checkout seamless, secure, and scalable for your online business.

Key takeaways

- Whop offers the lowest fees (2.7% + $0.30) with no monthly charges, ideal for creators and startups.

- Payment orchestration can boost revenue by 6-11% by automatically routing transactions for higher success rates.

- Choose your gateway based on business stage: free tiers for startups, enterprise plans ($295-$599/month) for complex billing needs.

We’ve rounded up six of the best SaaS payment gateways for 2025, from lightweight tools for startups to full-scale billing systems for enterprise teams.

Whether you’re selling subscriptions, memberships, or digital products, these platforms make it easy to get paid (and stay compliant).

Getting customers interested in your product is only half the battle — the real test comes when they’re ready to pay. A reliable SaaS gateway keeps checkout smooth, protects sensitive data, and ensures every transaction clears without friction.

“You need payments, you need to accept payments, and you need to pay out payments. And if you can't do that, you can't run a business.”

- Hunter Dickinson, Head of Partnerships at Whop

Let’s look at the top options and find the one that fits your business best.

TL;DR: 6 best SaaS payment gateways

| Gateway | Best for | Pricing* |

|---|---|---|

| Whop | Creators & marketplaces | 2.7% + $0.30 per sale, no monthly fees |

| Braintree | PayPal & Venmo integration | 2.9% + $0.30 per transaction |

| Stripe | Developers & startups | 2.9% + $0.30 per transaction |

| Recurly | Subscription management | Custom pricing, free startup plan + transaction fees |

| Chargebee | Complex SaaS billing | From $599 / month + transaction fees |

| Stax Bill | Enterprise automation | From $295 / month + transaction fees |

*Pricing accurate as of 2025; may vary by region and volume.

Keep on reading for the full run-down.

What is a SaaS payment gateway?

A SaaS payment gateway allows businesses to accept debit and credit card payments online.

Its core job is to securely authorize and process payments, moving money from customer to business without friction.

A gateway acts as the customer-facing layer of checkout — collecting payment details, encrypting sensitive data, and passing it through secure protocols for approval.

In practice, that can look like shopping carts, order forms, or hosted checkout pages.

Below, we'll go into the top 6 gateways in more detail so you can see which one fits your business best.

Six SaaS payment gateways for your business

1. Whop

Whop is more than a payment gateway — it’s a marketplace and infrastructure platform designed for creators and founders.

You can sell memberships, communities, SaaS products, eBooks, courses, and more, with options for one-time, recurring, or free offers.

Sellers can embed Whop checkouts into existing websites or rely on Whop’s marketplace, which has millions of buyers browsing daily.

“My first month selling on Whop, I made $12.5k with 0 failed payments. Thanks Whop!”

- Whop seller @0xroas

Fees

- Pricing is only 2.7% + $0.30 per transaction, with no setup fees or monthly charges.

Pros

- Free to get started — no setup fees or monthly charges.

- Flexible pricing models: free trials, usage-based, lifetime access, or subscriptions.

- Advanced controls: stock limits, waitlists, and renewal automation.

- Built-in discoverability via the Whop marketplace.

- Supports multiple payment methods including PayPal, credit/debit, crypto, and international currencies.

2. Braintree

Braintree is PayPal’s full-stack payment gateway, designed for businesses that want to accept credit cards, digital wallets, and PayPal/Venmo transactions. It’s a favorite for developers because of its clean APIs and global support.

Fees

- U.S. standard cards and digital wallets: 2.9% + $0.30 per transaction.

- International cards: +1%.

- Currency conversion: +1%.

- Venmo: same as standard card transactions.

- No setup or monthly fees.

Pros

- Seamless PayPal and Venmo integration.

- Works in 45+ countries with multi-currency support.

- Advanced fraud protection and recurring billing tools available.

- Developer-friendly with extensive documentation.

Cons

- Better suited for one-off purchases than complex subscription communities.

- Reporting tools are fairly limited — most businesses use third-party analytics.

3. Stripe

Stripe is one of the most popular payment processors in the world. It started as a simple payment gateway but now offers subscription billing (Stripe Billing), fraud protection, and even financing. It’s especially popular with startups because of its ease of use and huge integration ecosystem.

Fees

- U.S. card transactions: 2.9% + $0.30.

- International cards: +1%.

- Currency conversion: +1%.

- Additional features (Radar, Billing, Connect) may carry separate charges.

Pros

- Global coverage and support for 135+ currencies.

- Extensive integrations with platforms like WordPress, Squarespace, Shopify, and SaaS tools.

- Advanced APIs give developers total flexibility.

- Transparent pay-as-you-go structure makes it accessible for small businesses.

Cons

- Pricing complexity grows as you scale and add features.

- Limited built-in analytics — often requires external tools.

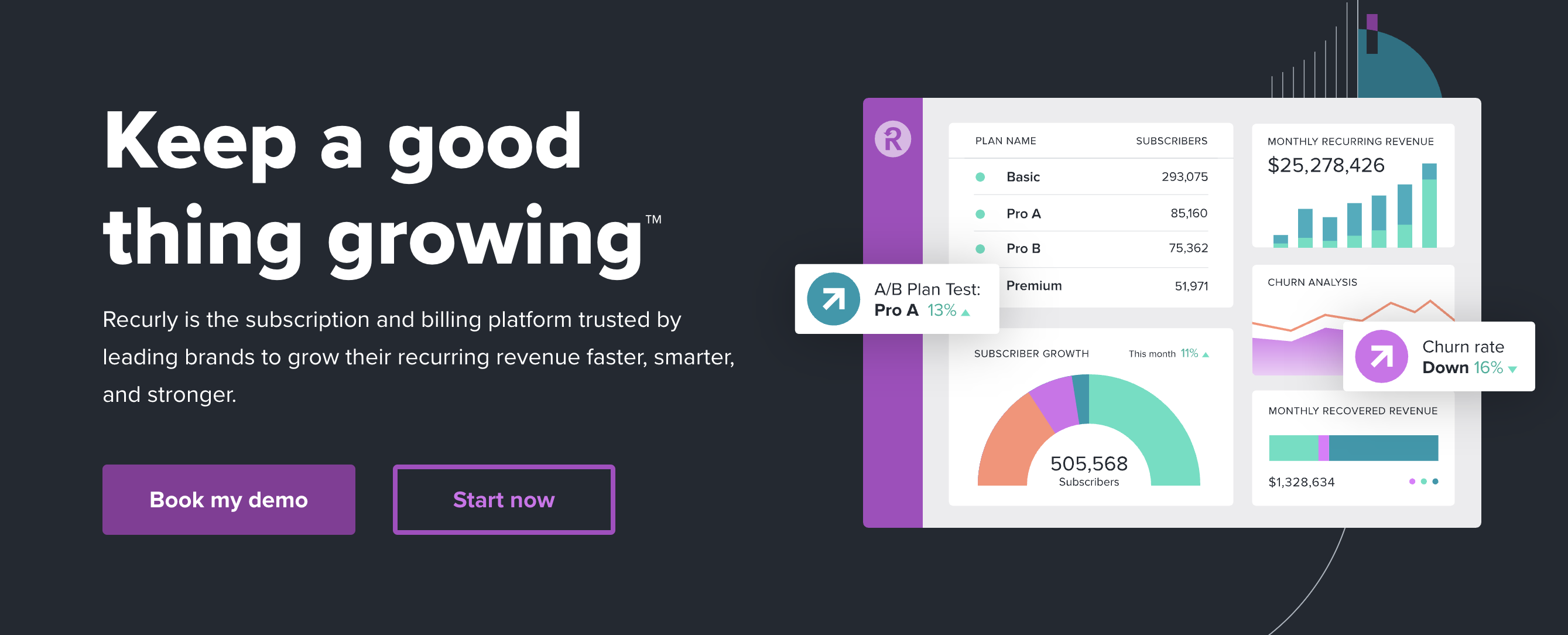

4. Recurly

Recurly specializes in subscription management and is a great fit if your business revolves around memberships, recurring SaaS, or digital subscriptions. It integrates with gateways like Braintree, PayPal, and Stripe but does not handle payment processing itself.

Fees

- Startup plan: free, with revenue and feature caps.

- Growth and Enterprise plans: custom pricing based on volume and requirements.

- The old $149/month flat plan is no longer offered.

Pros

- Highly flexible subscription setups (tiered, usage-based, hybrid).

- Built-in features like coupon codes, dunning management, and automated retries for failed payments.

- Integrates with popular gateways to combine billing with payment processing.

Cons

- No built-in gateway — you’ll need a processor alongside it.

- Pricing is opaque beyond the startup tier.

- Reporting tools are functional but not as advanced as competitors.

5. Chargebee

Chargebee is a subscription billing platform built for SaaS companies. It doesn’t process payments directly but integrates with processors like Stripe, PayPal, and Braintree. It’s known for offering advanced features and customization at the enterprise level.

Fees

- Launch plan: free for early-stage startups (capped revenue).

- Performance plan: $599/month + 0.75% overage fee.

- Enterprise plan: custom pricing.

Pros

- 480+ pre-built recurring billing templates for quick setup.

- Handles complex billing models: metered usage, multi-tier pricing, coupons, discounts, and trials.

- Excellent scalability for SaaS startups that are ready to grow.

- Works with dozens of gateways for flexibility.

Cons

- Expensive for beginners or side hustlers.

- User interface and setup can feel complex if you’re not tech-savvy.

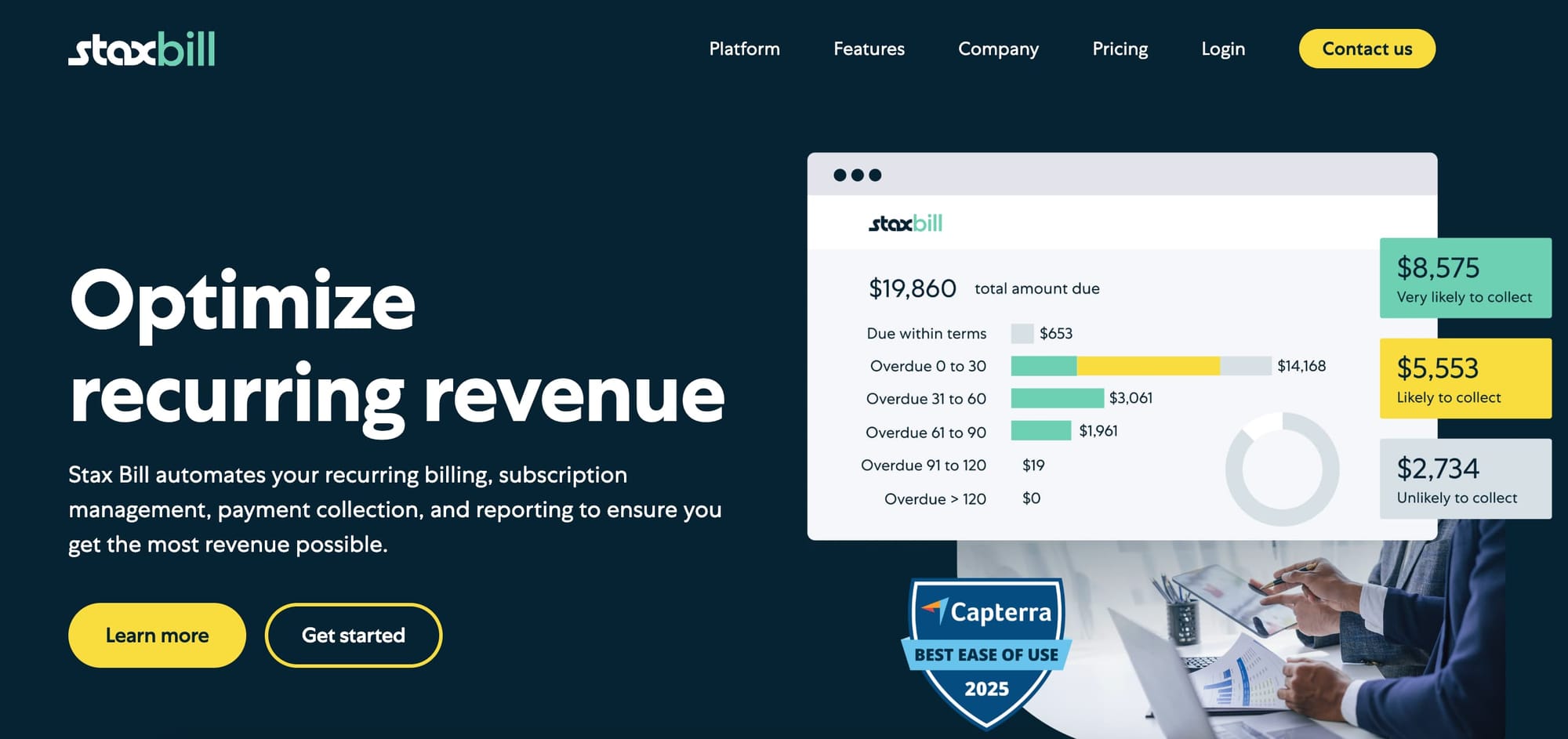

6. Stax Bill

Stax Bill, formerly known as Fuse Bill, combines subscription management with payment processing and automation. It’s designed for SaaS startups that need advanced billing workflows and scalability.

Fees

- Startup plan: $295/month.

- Growth plan: $895/month.

- Enterprise plans: custom pricing.

- No free trial currently available.

Pros

- All-in-one solution: subscription billing, merchant account, and payment gateway.

- Automates recurring billing and invoicing to save admin time.

- Self-service portals and branded checkout pages improve customer experience.

- Scales well for international and enterprise-level businesses.

Cons

- High monthly costs put it out of reach for small startups.

- Pricing transparency is limited beyond entry tiers.

Whop: The smarter way to sell, scale, and streamline payments

Whop isn’t just another checkout tool — it’s a complete payments stack for modern businesses.

From creators to global enterprises, Whop helps you accept more payment methods, reduce failed charges, and reach customers in over 195 countries.

- Zero monthly fees: Just 2.7% + $0.30 per transaction — no subscriptions or setup costs.

- Global reach: Accept 100+ payment methods, from cards and wallets to BNPL and crypto.

- Payment orchestration: Automatically routes each transaction for the highest success rate — increasing revenue by 6–11%.

- Global payouts: Get paid in 241+ territories via ACH, Crypto, Venmo, CashApp, and more.

- Flexible integration: Use checkout links, embedded checkout, or your Whop store page — whichever fits your workflow best.

- Scales with you: Manage affiliates, automate renewals, and get discovered on the Whop Marketplace.

Launching your first offer or processing millions in recurring revenue, Whop gives you the infrastructure to sell, scale, and get paid — all in one place.

Start selling with Whop today. We're built for modern businesses.