Explore the features, pricing, and integration capabilities of Chargebee and Paddle. Our comprehensive comparison can help you make an informed decision for your business.

Key takeaways

- Paddle handles taxes, compliance, and payments as Merchant of Record, ideal for businesses wanting simplicity over control.

- Chargebee offers deep customization and multi-gateway support, best for larger businesses needing granular billing control.

- Choose Paddle for hands-off simplicity at 5% per transaction, or Chargebee for flexibility starting free up to $250K.

If you rely on subscriptions for recurring revenue, you need a billing system that’s reliable, flexible and cost-efficient.

In this guide, we compare Chargebee and Paddle, two popular platforms offering payment processing and recurring billing features. We'll explore how they differ in features, pricing, and ideal use-cases.

By the end, you’ll be better equipped to pick the platform that fits your business.

Chargebee vs Paddle: What's the difference?

While both Chargebee and Paddle offer recurring billing and payment management, they take very different approaches.

Chargebee is built for flexibility and depth: it’s a subscription-management platform that connects with your preferred payment gateways (like Stripe, Braintree, or PayPal) to handle complex billing setups.

You can customize almost everything from trial periods and billing cycles to currency rules and dunning workflows. It’s a powerful tool for enterprise-level businesses that need granular control, but it does take some technical setup to get right.

Paddle, on the other hand, prioritizes simplicity: it’s an all-in-one platform that acts as a Merchant of Record (MoR), meaning it handles payments, taxes, and compliance for you.

Out of the box, it includes subscription management, automatic currency conversion, localized checkout, and built-in churn-reduction tools.

In short:

- Chargebee gives you more control, but requires more configuration.

- Paddle gives you less flexibility, but handles everything for you.

Let’s take a closer look at how each platform actually works — starting with Chargebee.

How does Chargebee work?

Chargebee is a subscription management and recurring billing platform that integrates with your existing SaaS or digital business infrastructure.

It lets you automate the entire customer billing lifecycle from signup and invoicing to renewals and revenue recognition, without needing to build these systems yourself.

You can choose how hands-on you want to be:

- No-code tools let you generate invoices, payment links, and checkout pages.

- Low-code and API options allow deeper customization for advanced billing models or integrations with your app.

Chargebee supports multiple billing methods (fixed, usage-based, or tiered) along with free trials, discounts, and add-ons. You can also use built-in dunning workflows to reduce failed payments and customer churn.

Who can use Chargebee?

Chargebee accepts businesses of all sizes, but the service is best suited to large or rapidly growing businesses that need a sophisticated set of tools.

It supports more than 100 different currencies and can integrate with a huge number of popular payment gateways, enabling it to support payments in 150+ countries. It also offers global tax compliance tools.

If you're a small business, you might find the service slightly overkill for your situation.

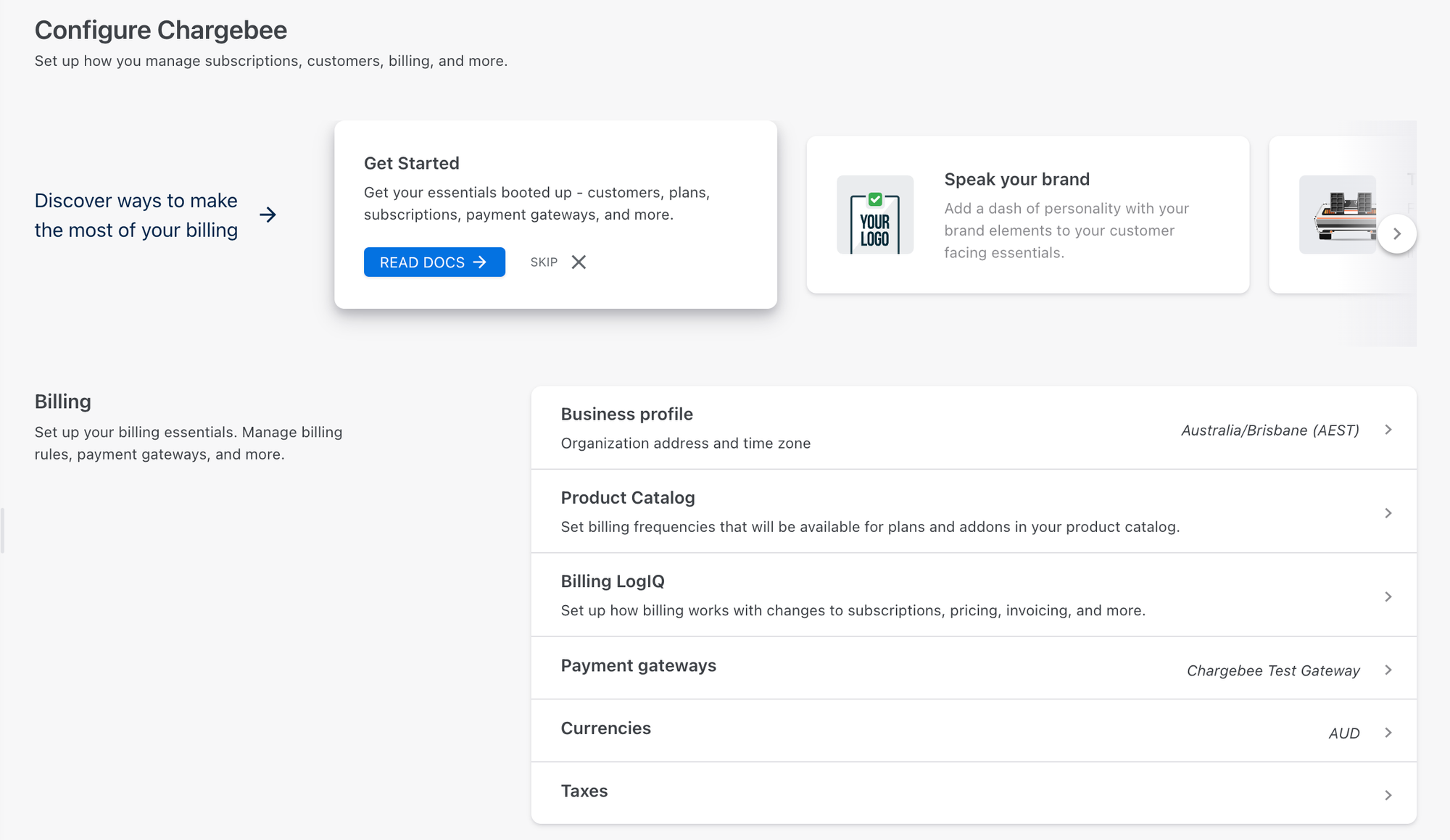

Getting started with Chargebee:

Setting up Chargebee begins with creating your account.

Head to the Sign up for free option on the Billing page. You’ll need a business email (personal addresses like Gmail or Hotmail aren’t accepted). Once submitted, Chargebee sends a verification link — click it to finish account setup.

Next, you’ll:

- Name your Chargebee site.

- Select your primary goal (e.g., “Streamline billing”).

- Describe your business type so Chargebee can recommend relevant features — for example, “Online services.”

- Choose your payment method, such as “Payment links.”

- Receive a suggested plan – New users often start with the free Starter Plan, which covers your first $250K in processed payments before fees apply.

Even free users must enter credit card details during setup. Once done, your admin dashboard will open, where you’ll configure currencies, billing, and products.

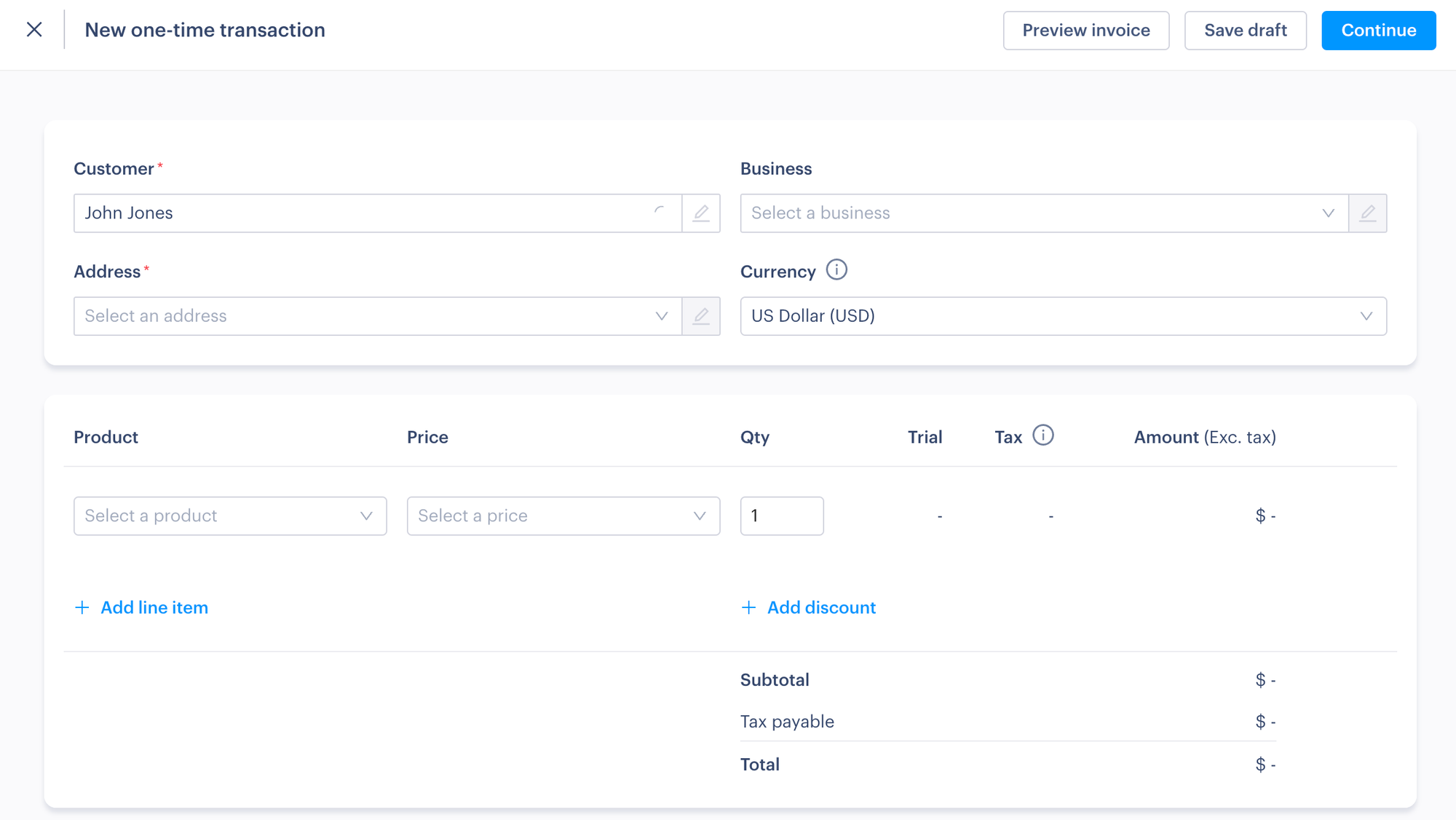

Configuring your billing setup:

From the admin panel, you can:

- Set billing currencies: Go to Settings → Configure Chargebee → Currencies → Add Currency to define your base and foreign currencies.

- Customize billing frequencies: Adjust billing cycles site-wide or per product via Billing → Product Catalog.

- Manage products and pricing: Chargebee organizes products into “families.” You can remove sample data under Test Site Data and then build your catalog under Product Catalog → Add Product.

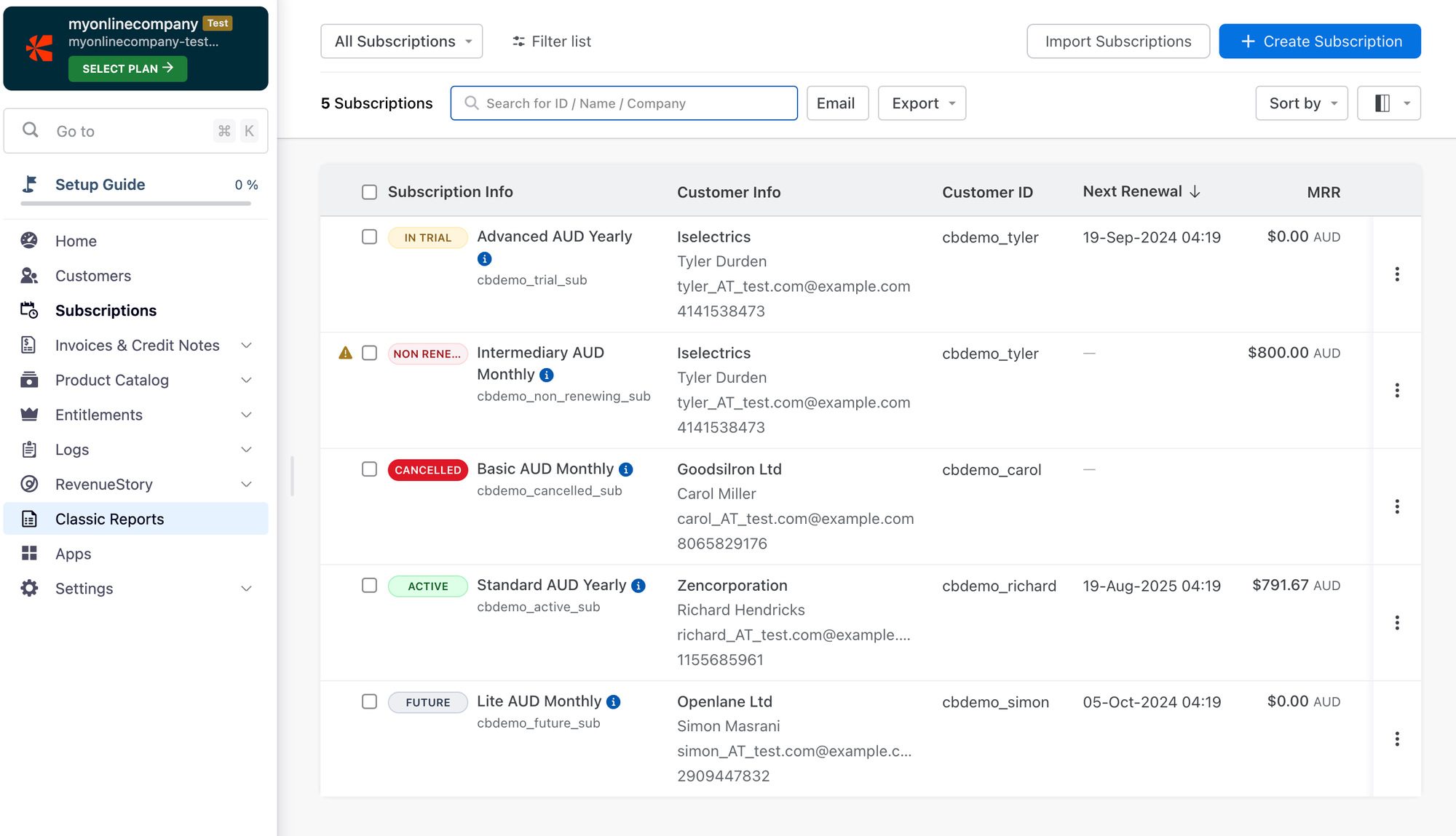

Managing subscriptions with Chargebee:

Before accepting payments, choose how customers will subscribe. The Chargebee Checkout is ideal for most users. It offers:

- No-code payment links

- Low-code drop-in scripts for your site or app

- Full API integrations for advanced onboarding

You can define whether all customers renew on a common billing date or on the date of signup. Billing can be fixed, usage-based, or hybrid.

If customers cancel mid-cycle or upgrade, Chargebee can apply prorated charges or credits automatically.

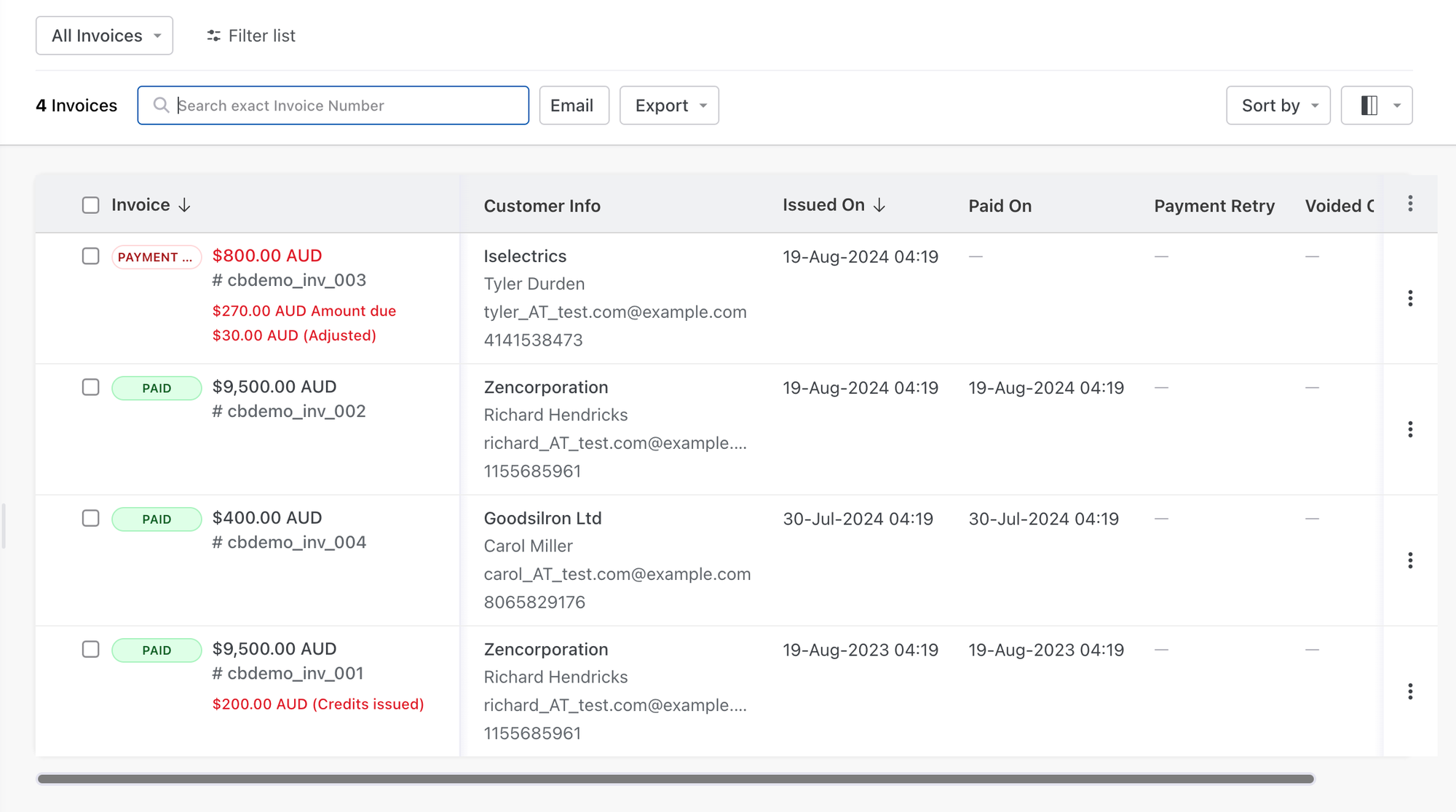

Invoicing customers:

Chargebee provides flexibility in how you bill and present invoices. For example:

- Consolidated billing lets you combine multiple subscriptions into one invoice.

- You can customize invoice design, rounding rules, and exchange rate visibility for foreign currency billing.

Invoices can be automated or sent on demand — ideal for SaaS, agencies, or multi-product businesses.

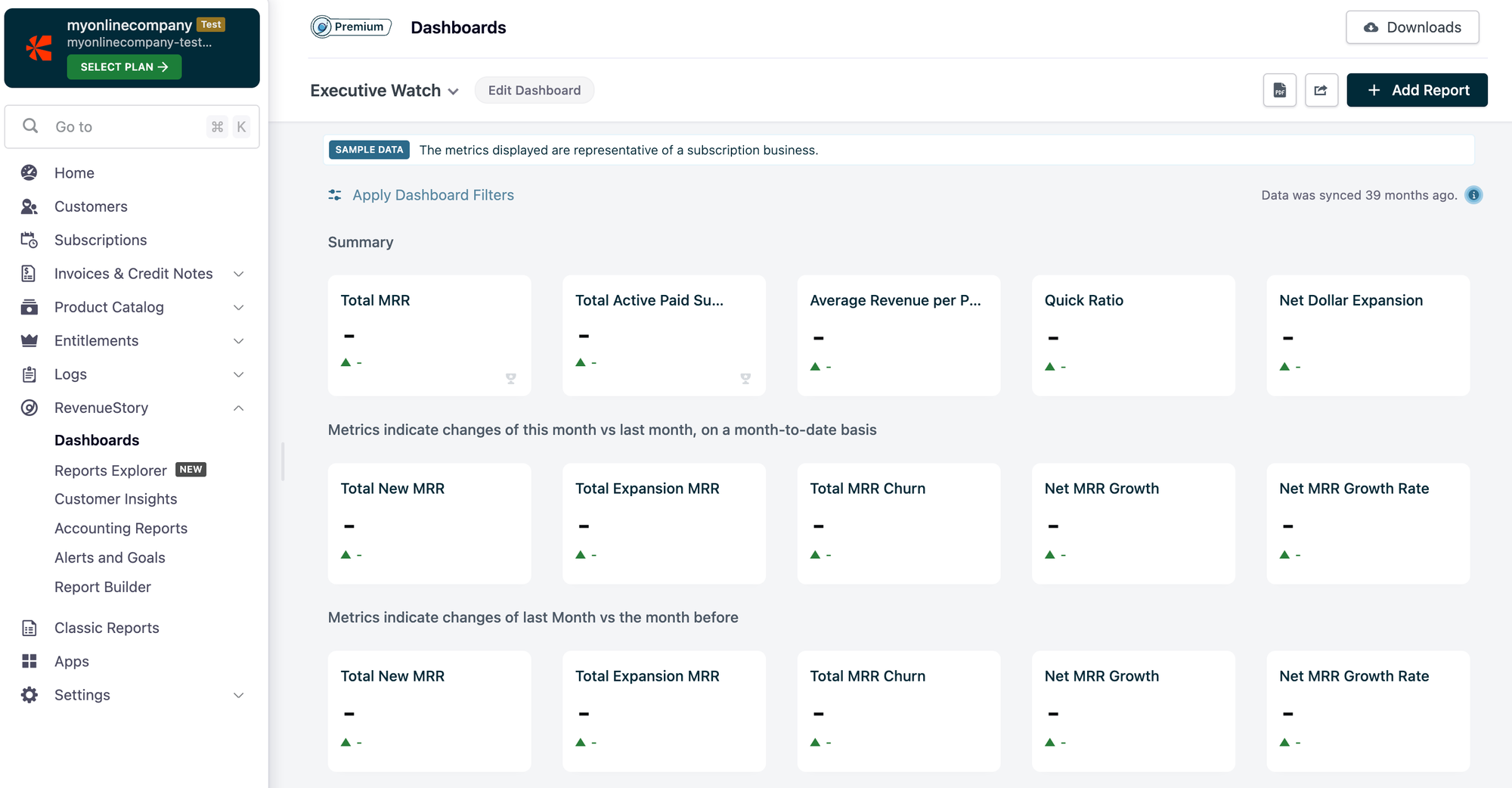

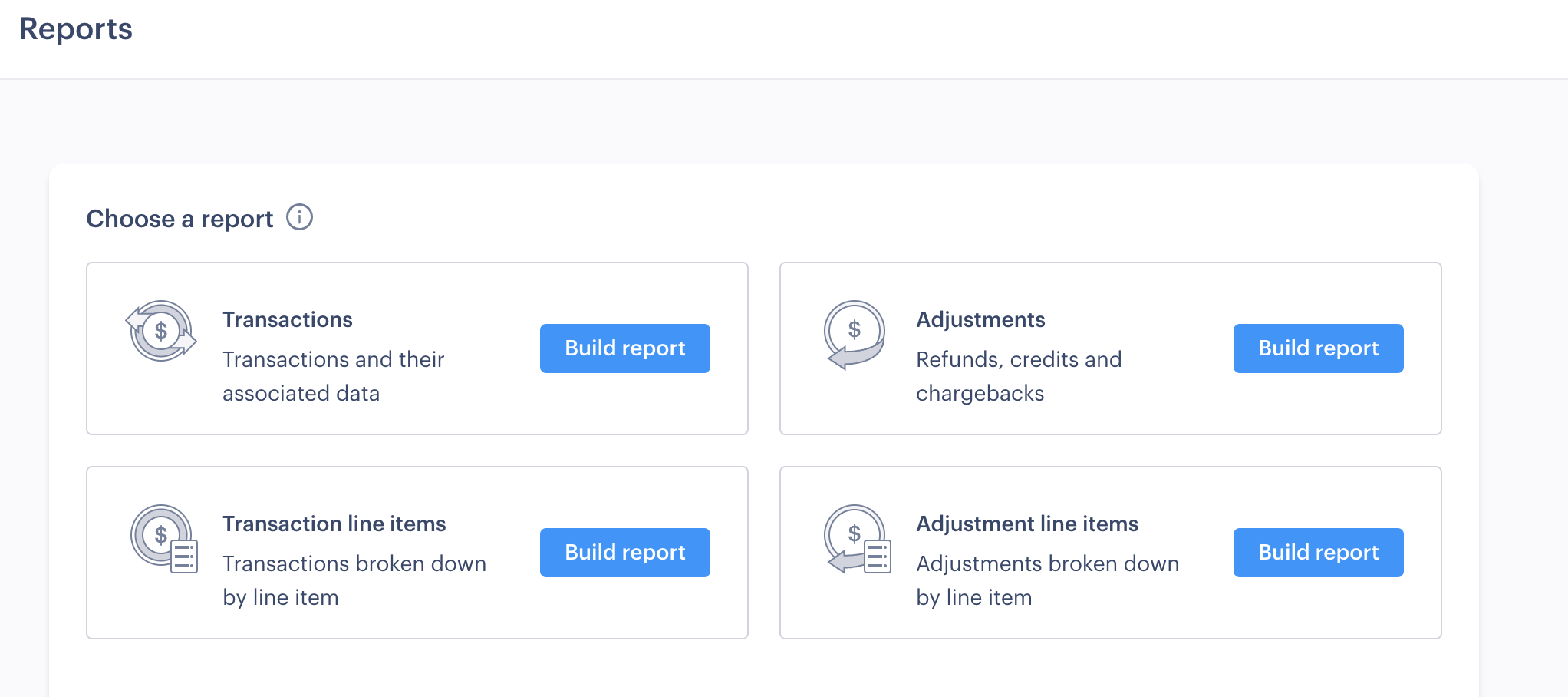

Revenue reporting:

Chargebee automatically calculates taxes and tracks invoice performance in real time. Its RevenueStory dashboard displays metrics like MRR, churn, collections, and failed payments.

You can also export all data to CSV for use in tools like Tableau or Power BI.

Payment gateways:

Chargebee doesn’t process payments directly — you’ll need to connect a gateway under Configure Chargebee → Payment Gateways. It integrates with 30+ major providers across 150+ countries, including:

- Stripe

- PayPal Express Checkout

- Braintree

- GoCardless

- WorldPay

How much does Chargebee cost?

| Plan | Monthly Fee | Limit | Overage Fee |

|---|---|---|---|

| Starter | Free | Up to $250K total billing | 0.75% per transaction thereafter |

| Performance | $599 | Up to $100K MRR | 0.75% overage |

| Enterprise | Custom | Unlimited | Negotiated |

Note: These rates apply only to Chargebee. Payment gateways charge separate transaction fees.

How does Paddle work?

Paddle is a Merchant of Record (MoR) platform that manages the entire subscription billing process for SaaS and digital product businesses.

Instead of just facilitating payments, Paddle handles everything end-to-end, from checkout and invoicing to tax compliance and fraud prevention, so you don’t need to juggle multiple providers or worry about regional regulations.

You can choose your level of control:

- No-code setup: Use Paddle’s hosted checkout and prebuilt invoicing tools to start accepting payments fast.

- Low-code or API integration: Customize your checkout flow, pricing logic, or renewal experience directly within your app or website.

Paddle automatically localizes currency, tax rates, and compliance for each customer region. It also supports one-time and recurring payments, free trials, upgrades, downgrades, and automatic dunning to recover failed transactions and minimize churn.

Who can use Paddle?

Paddle is aimed at online business owners and SaaS providers of all sizes. It offers easy integration with WordPress and WooCommerce through third-party plugins, and supports a large number of foreign currencies, making it suitable for international businesses.

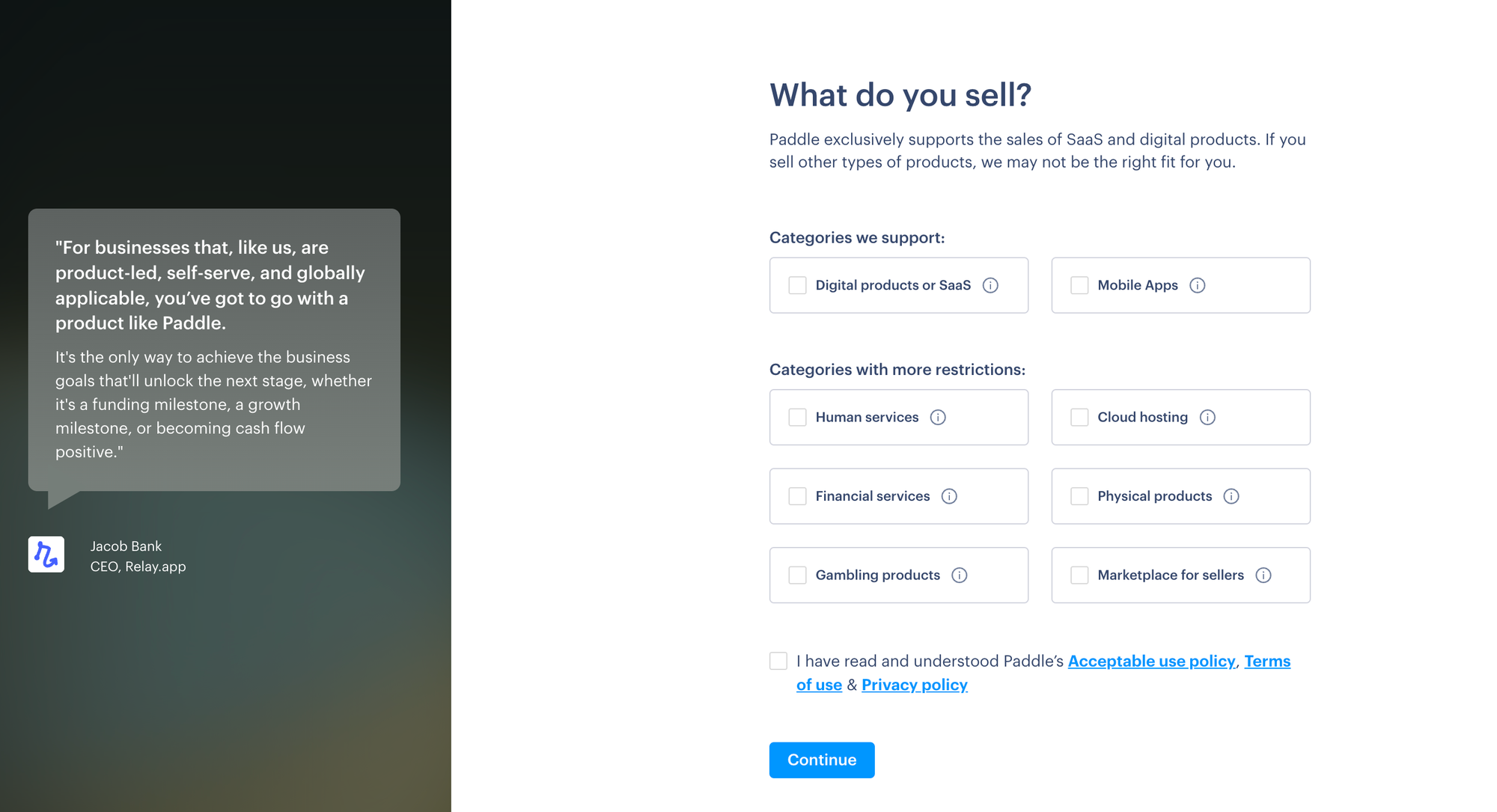

Getting started with Paddle:

Setting up Paddle starts with creating your seller account. Head to paddle.com and click Sign up for free. During onboarding, Paddle will ask for your business name, website, and the types of digital products or subscriptions you sell.

You’ll then:

- Verify your business email (personal addresses like Gmail or Hotmail aren’t accepted).

- Enter your business details, including company location and estimated annual revenue.

- Submit your website for review. Paddle uses this to confirm your products comply with its Acceptable Use Policy.

- Choose your default payout currency (USD, GBP, EUR, AUD, or CAD).

- Wait for Paddle’s manual account approval, which typically takes one business day.

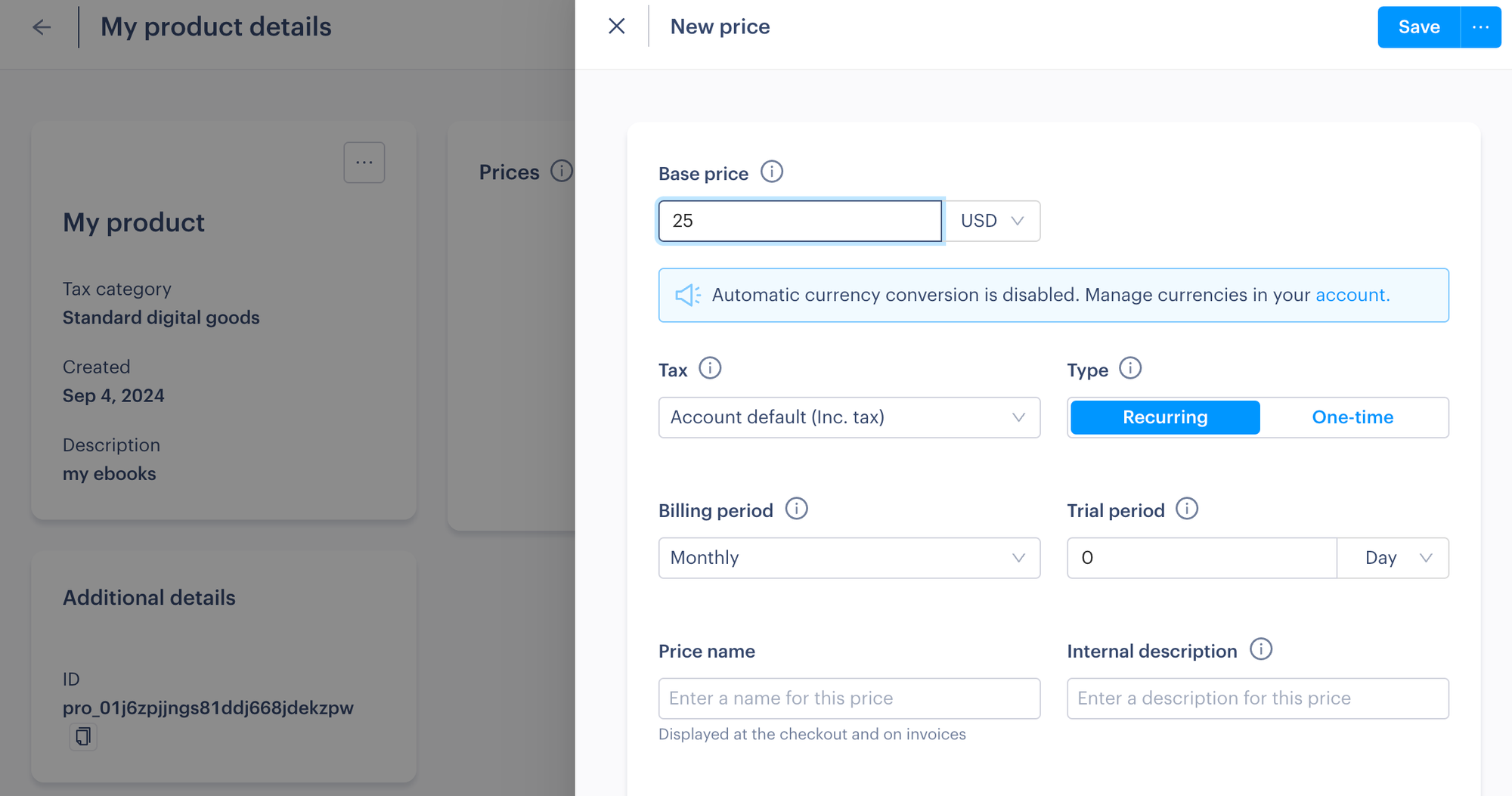

Configuring your billing setup:

From your admin dashboard, you can:

- Create subscription plans: Go to Catalog → Subscription Plans → New Plan. Set plan names, intervals (monthly, quarterly, annual), and pricing.

- Localize pricing: Enable regional pricing to charge different rates by country and currency.

- Set tax categories: Paddle automatically calculates and remits VAT, GST, and sales tax, but you’ll assign a taxable category when creating each plan.

- Define trial periods and coupons: Offer free trials or discounts using built-in promotion tools.

- Customize checkout: Choose between Paddle’s hosted checkout, inline checkout, or API-based flows.

Because Paddle is a Merchant of Record, it handles all billing, tax compliance, and fraud protection — meaning you don’t need to connect an external payment gateway or manage tax filings yourself.

Managing subscriptions with Paddle:

Before you can start accepting payments, you’ll connect your website or app to Paddle. Most businesses use one of three options:

- No-code hosted checkout: A prebuilt payment page you can link to from your site or marketing materials.

- Low-code inline checkout: Embeds Paddle’s checkout directly on your site with minimal configuration.

- API integration: Gives developers full control over subscription logic and payment handling.

Once live, you can manage all customer subscriptions in your Paddle dashboard under Customers → Subscriptions. You can:

- View active, canceled, and expired subscriptions.

- Adjust billing dates or plan tiers.

- Issue refunds and prorated credits automatically.

- Use Paddle’s Smart Dunning system to retry failed payments and reduce churn.

Invoicing:

Paddle automatically generates and emails invoices for every purchase or renewal. Each invoice includes:

- Purchase details and subtotal

- Local taxes (VAT, GST, etc.)

- Seller information (Paddle acting as MoR)

- Downloadable PDF copy

Invoices can be issued in USD, GBP, or EUR, and customers can pay using cards, PayPal, Apple Pay, Google Pay, or regional payment methods.

Revenue reporting:

Paddle’s built-in analytics dashboard shows real-time metrics for:

- Monthly recurring revenue (MRR)

- Refunds and disputes

- Churn and retention

- Country-level tax and sales breakdowns

Payment gateways:

Because Paddle acts as your Merchant of Record, you don’t need to connect any external payment gateways. Paddle supports over 20 global payment methods, including:

- Credit and debit cards (Visa, Mastercard, Amex, etc.)

- PayPal

- Apple Pay and Google Pay

- Local options (iDEAL, Giropay, Sofort, etc.)

How much does Paddle cost?

| Plan | Monthly | Transaction fee | Notes |

|---|---|---|---|

| Pay-as-you-go | Free | 5% + $0.50 per transaction | Includes tax, billing, fraud protection, and global compliance |

| High-volume Custom | Custom | Negotiated | For businesses processing over $1M annually |

| Micropayments Option | Custom | Reduced fee | Available for low-price items (under $10) |

Chargebee vs Paddle: Which is best?

Both Chargebee and Paddle have their strengths. Paddle is ideal for smaller businesses seeking simplicity, while Chargebee caters to those needing more control and customization.

Here’s how they stack up:

| Platform | Pros | Cons |

|---|---|---|

| Chargebee | Supports multiple gateways, advanced API integrations, competitive pricing, includes analytics with exportable reports. | Has a steep learning curve, limited tax compliance features, and requires third-party gateways that add extra fees. |

| Paddle | Simple to use, strong tax compliance, effective churn reduction tools, full Merchant of Record coverage for taxes and liabilities. | Charges higher fees on low-cost, high-volume sales, may take time for account approval, and offers limited third-party integrations. |

Whop Payments: The smarter alternative to Chargebee and Paddle

Chargebee and Paddle do the job, sure. But they’re built for a different era of online business.

They focus on complex setups, limited integrations, and clunky onboarding.

Whop Payments is built for the next wave of digital entrepreneurs. It combines everything you need to sell, manage, and get paid, without ever leaving your dashboard.

Running a subscription business, selling digital downloads, or managing a paid community? Whop handles payments, compliance, and payouts in one clean stack.

Here's why online creators choose Whop Payments:

- Built-in checkout links, store pages, and embedded payments

- 100+ global payment methods, including BNPL and crypto

- 190+ country payouts via ACH, Venmo, Cash App, and more

- Transparent fees: 2.7% + $0.30 per-transaction (no monthly cost)

- 99.9% uptime with multi-PSP orchestration for higher approval rates

- Merchant of Record protection: Whop handles taxes and liability for you

“We've built our own payments infrastructure that allows us so much more flexibility on everything, from what payment methods we accept, to which countries we can pay out, to which ways we can pay out.

I mean, you can now get paid out in Bitcoin or Stablecoin and in basically every single country in the world."

- Steven Schwartz, Whop CEO

Need an invoicing system? Read our guide to sending invoices with Whop Payments.

Streamline your subscriptions and boost retention with Whop Payments

Selling subscriptions shouldn’t slow you down. With Whop Payments, you can launch and manage recurring billing in minutes: no plugins, no coding, and no extra fees.

Automate renewals, reduce churn with built-in dunning, and accept payments globally across 100+ methods.

As your Merchant of Record, Whop handles everything behind the scenes, from taxes and compliance to chargebacks and fraud protection, so your revenue stays predictable and your focus stays on growth.

Start using Whop Payments today and make subscription revenue feel effortless.

FAQs

Is Chargebee or Paddle better for small businesses?

Paddle is generally better suited for small businesses due to its simpler setup process and all-in-one merchant of record capabilities. With a straightforward 5% + $0.50 transaction fee and no monthly costs, it's easier to get started without technical expertise. Chargebee, while more customizable, has a steeper learning curve and requires integration with external payment processors, making it better suited for businesses with more complex billing needs or technical resources.

Can I use Chargebee or Paddle for international sales?

Yes, both platforms support international sales. Chargebee supports over 100 currencies and integrates with payment gateways covering 150+ countries, giving you flexibility in how you process payments globally. Paddle also offers multi-currency support and handles tax compliance automatically across different regions as a merchant of record. However, Paddle's default currency options are limited to USD, GBP, EUR, AUD, and CAD for your balance, with other currencies being converted.

What fees should I expect with Chargebee vs Paddle?

Chargebee's Starter Plan is free for the first $250,000 in cumulative billing, then charges 0.75% per transaction. The Performance Plan costs $599/month for up to $100,000 in billing. Keep in mind you'll also pay separate payment processor fees (like Stripe or PayPal). Paddle charges 5% + $0.50 per transaction with no monthly fee, and since they act as the merchant of record, there are no additional payment processing fees. For high-volume businesses, both platforms offer custom enterprise pricing.

Does Whop offer better features than Chargebee and Paddle?

Whop offers a more comprehensive all-in-one solution compared to Chargebee and Paddle. While Chargebee and Paddle focus primarily on payment processing and subscription management, Whop provides an entire ecosystem including course creation, community building, a digital marketplace, file hosting, and video capabilities. With just a 2.7% + $0.30 transaction fee and no monthly costs, plus merchant of record features, Whop is particularly attractive for content creators, course sellers, and digital entrepreneurs who want everything in one platform rather than piecing together multiple services.