Top subscription billing software includes Whop, Stripe Billing, Recurly, Chargebee, and Zuora. I reviewed 20 subscription billing tools to identify the top options based on features, pricing, and real-world use cases.

Key takeaways

- Choose your subscription billing platform based on technical resources: Whop for simplicity, Stripe for customization, Chargebee for automation.

- Enterprise-grade platforms like Zuora cost $50,000+ annually but handle complex global billing, tax, and revenue recognition needs.

- Modern subscription platforms now automate the entire revenue lifecycle, from billing and dunning to compliance and analytics.

The best subscription billing platforms in 2026 go beyond just processing payments, they help businesses automate recurring revenue, manage subscriptions, and grow efficiently.

From creators to enterprise SaaS, tools and platforms like Whop, Stripe Billing, Recurly, Chargebee, and Zuora offer features that simplify operations and boost cash flow.

I’ve taken a deep-dive into twenty subscription billing software solutions, exploring features, pricing, integrations, and customer feedback, to identify the best options for businesses in 2026.

My top 5 subscription billing picks (a snapshot)

| Platform | Best for | Pricing |

|---|---|---|

| Whop | Creators, platforms & marketplaces | 2.7% + $0.30/tx, no monthly fee |

| Stripe Billing | SaaS & Tech teams | 2.9% + $0.30/card |

| Chargebee | SaaS, digital products | Fees vary by payment processor + monthly costs |

| Recurly | Growing SaaS | From ~$249/mo + transaction fees + ~0.9% |

| Zuora | Enterprise | Custom; typically $50k+/yr |

20 subscription billing software solutions for 2026

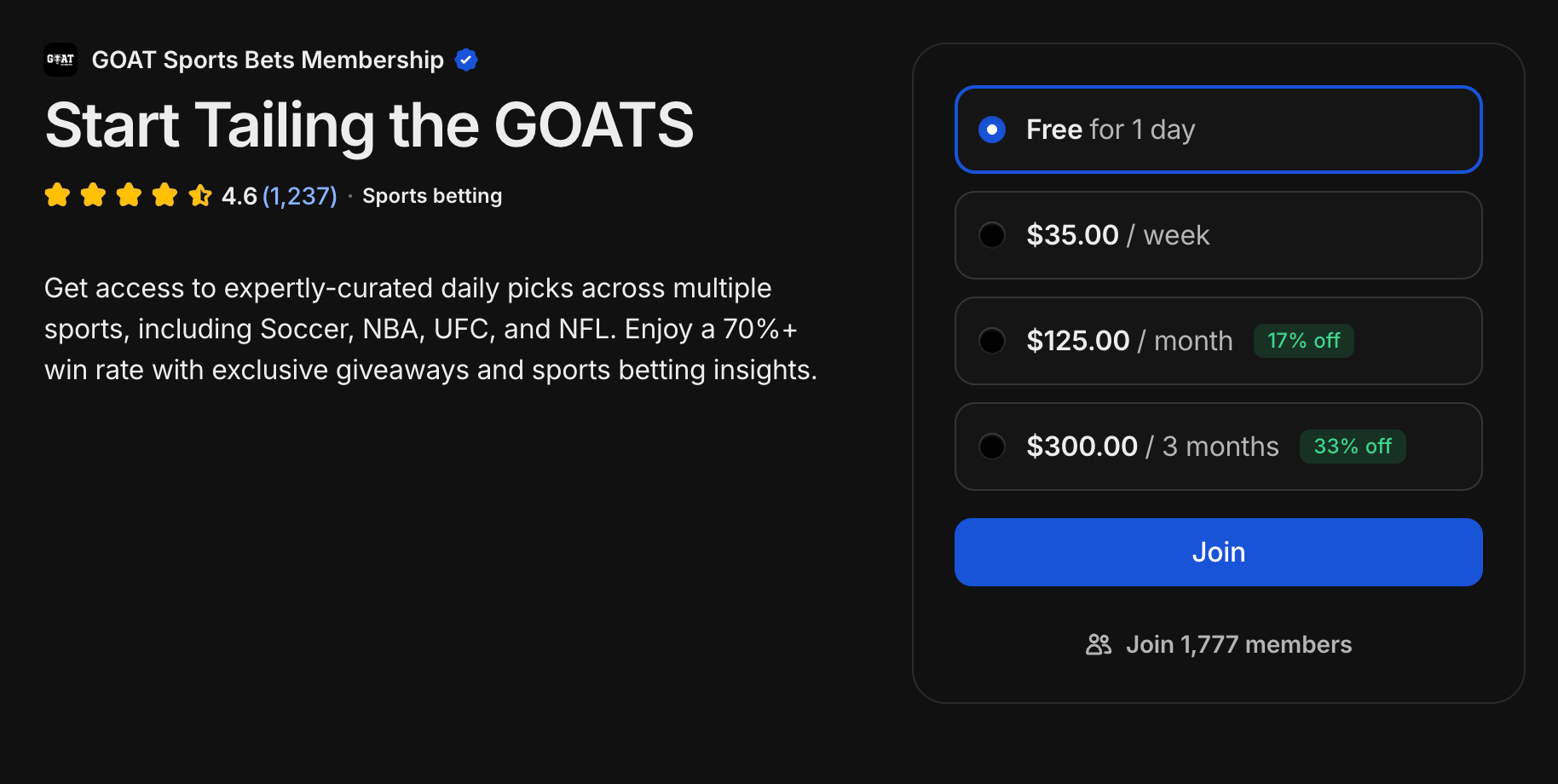

1. Whop: my top choice for subscription billing

Whop is an all-in-one business platform that combines payments, product delivery, access control, and analytics - making it a strong choice for a wide range of businesses, from creators and service providers to agencies and platforms.

Rather than acting as just a billing layer, Whop manages the full monetization workflow: product creation, storefronts, subscription setup, customer access, and payouts.

With Whop, you can sell memberships, subscriptions, one-time products, or bundles, with automated renewals and built-in payment processing.

Because billing, product management, and customer access all live in the same system, businesses can launch quickly using a single platform, without using (and paying for) multiple tools.

This combination of simplicity and flexibility is why I’ve ranked it as my top choice.

Key features:

- Subscription and membership billing (monthly, annual, custom cycles)

- Built-in payment processing (cards, ACH)

- Automated renewals, failed payment handling, and access control

- Customer analytics and revenue tracking

- Dispute and chargeback management

- No-code setup for products, offers, and pricing

Pricing:

- Whop does not charge a fixed monthly platform fee

- Fees start at 2.7% + $0.30 per transaction

2. Stripe Billing

Stripe Billing is a powerful platform for businesses that need complete control over subscriptions, invoices, and usage-based charges. It’s especially well suited for SaaS and technology-driven companies that want a flexible, customizable solution.

It supports fixed, tiered, and metered pricing models, along with trials, coupons, proration, and automated tax calculations. Being API-driven, it allows teams to fully tailor billing logic and integrate it directly into their product.

What stands out is the flexibility. You can handle almost any subscription scenario with Stripe Billing.

But, the trade-off is that it usually requires engineering resources to get the most out of it, so it’s better suited for technical teams than non-technical operators.

Key features:

- Subscription and usage-based billing

- Automated invoicing and proration

- Global payments and multi-currency support

- Tax calculation and compliance tools

- Extensive APIs and developer documentation

- Dunning and retry logic for failed payments

Pricing:

- Recurring billing fee: ~0.5% of recurring charges

- Payment processing: ~2.9% + $0.30 per card transaction (varies by region)

- No monthly subscription fee

3. Chargebee

Chargebee works really well for SaaS, digital products, and service businesses that rely on recurring revenue. It covers the entire subscription lifecycle - from billing and invoicing to revenue recognition and compliance - all without needing multiple tools.

Chargebee supports recurring, usage-based, tiered, and hybrid pricing models, and you can automate trials, coupons, proration, and renewals. Integrations with CRM, accounting, and analytics tools make it easy to keep workflows smooth and revenue accurate.

What impressed me is the reporting - Chargebee gives you clear insights into MRR, ARR, churn, and other key subscription metrics. Its global tax and compliance features also make it a strong option if you’re scaling internationally.

Key features:

- Recurring, usage-based, and tiered billing

- Automated invoicing, proration, and renewals

- Revenue recognition and compliance tools

- Global tax handling and multi-currency support

- Customer self-service portals

- Integrations with CRM, accounting, and analytics tools

Pricing:

- Chargebee offers a free starter plan for small businesses

- Paid plans start at $249/month + a percentage of billing volume

- Enterprise pricing is custom

4. Recurly

Recurly is a robust subscription billing platform for growing SaaS companies and other businesses with recurring revenue. It handles the full lifecycle of a subscription - from sign-up to renewal - while helping reduce churn and maximize revenue.

The platform supports recurring, usage-based, and hybrid pricing models. I noticed that you can also automate invoicing, proration, retries, and dunning, so fewer payments are lost and customer management is smoother.

Plus, Recurly integrates with accounting, CRM, and analytics tools, making it easier to track revenue and customer behavior.

Recurly is flexible enough for complex subscription models while still approachable for teams that want to automate billing without building everything from scratch.

Key features:

- Recurring, usage-based, and tiered billing

- Automated invoicing, proration, and renewals

- Smart dunning and failed payment recovery

- Multi-currency and global tax support

- Integrations with accounting, CRM, and analytics tools

- Revenue analytics and reporting

Pricing:

- Recurly’s pricing depends on your subscription volume and the features you need, so you have to contact their sales team for a quote. Based on what I’ve seen in reviews, smaller businesses often start around $249/month plus about 0.9% of what you bill, and it goes up from there for bigger companies.

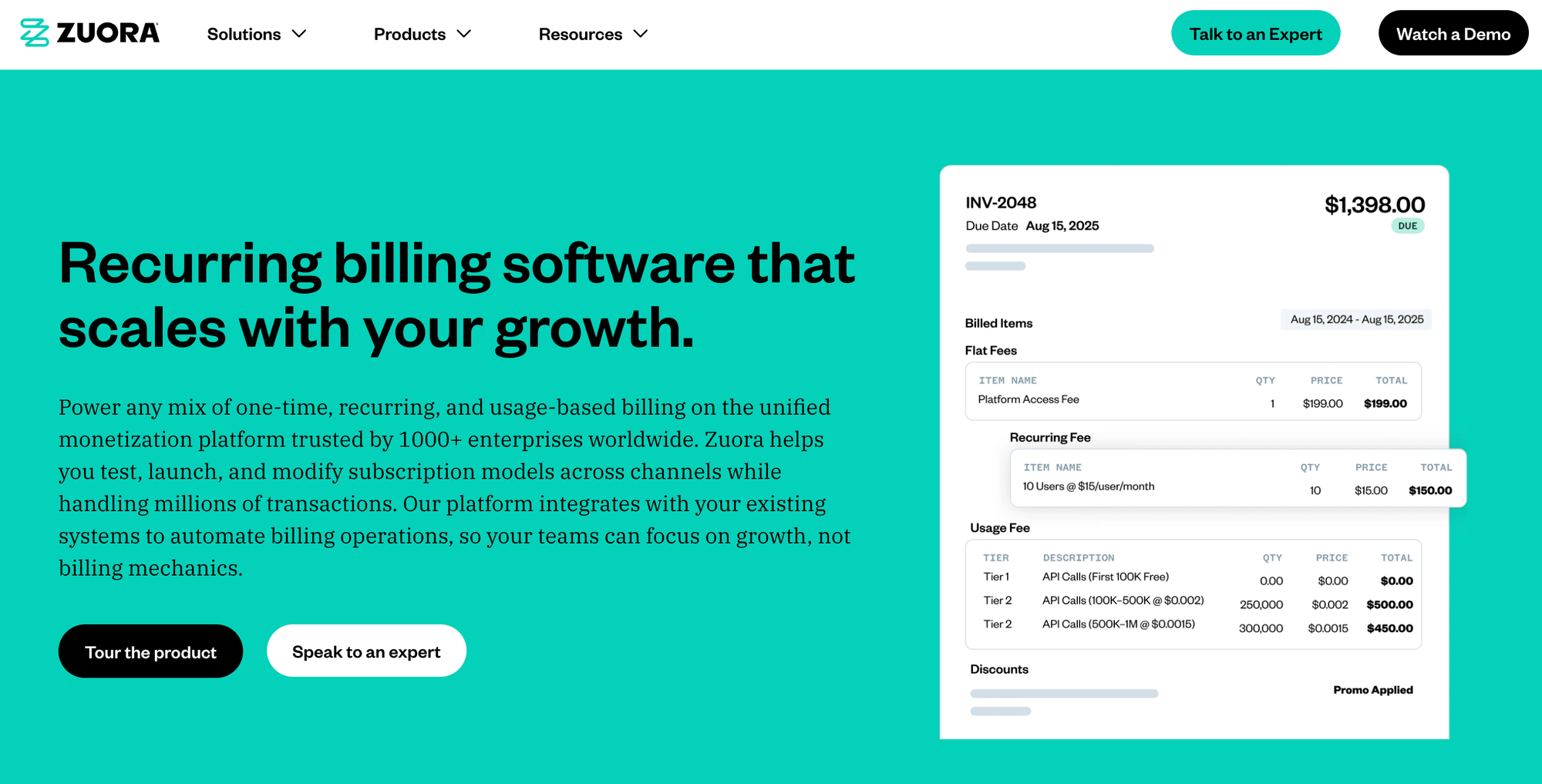

5. Zuora Billing

Zuora Billing is built for enterprises that need full control over complex subscriptions and recurring revenue. If your business has tiered plans, usage-based charges, or operates globally, Zuora makes managing all of that much easier.

It handles recurring and usage-based billing, automated invoicing, revenue recognition, and compliance, all in one platform. Multi-currency support, global tax handling, and integrations with ERP, CRM, and analytics systems give teams a complete picture of revenue and customer activity.

For me, Zuora stands out for its ability to manage complex enterprise needs at scale, from billing and revenue recognition to reporting and analytics.

Key features:

- Recurring, usage-based, and tiered billing

- Automated invoicing and revenue recognition

- Global tax and multi-currency support

- Integrations with ERP, CRM, and analytics systems

- Advanced reporting and dashboards

- Enterprise-grade security and compliance

Pricing:

- Zuora is custom-priced for each enterprise, so you’ll need to reach out for a quote. From what people report, most enterprise setups end up costing $50k+ per year, depending on the modules and how many subscriptions you’re managing.

6. Maxio (Chargify)

Maxio (formerly Chargify) is another subscription billing platform that goes beyond just processing recurring payments by blending billing with SaaS financial insights.

Maxio supports recurring, usage‑based, and hybrid pricing models, so you can structure plans exactly how you need them.

The dashboard shows key metrics like MRR, ARR, churn rate, and customer lifetime value, which makes it easier to spot trends and make decisions quickly.

Maxio also handles revenue recognition so your books stay accurate, and it integrates with accounting and analytics tools to keep things in sync.

In my opinion, the Maxio interface strikes a good balance: powerful enough for complex SaaS billing, but still approachable if you want insights without building dashboards yourself.

Key features:

- Recurring, usage‑based, and tiered billing

- SaaS metrics and financial dashboards (MRR, ARR, churn, LTV)

- Revenue recognition support

- Automated invoicing and renewals

- Dunning and failed payment handling

- Integrations with accounting and analytics tools

Pricing:

- Maxio doesn’t list flat pricing online, so you'll need to get a quote. Based on user feedback and industry guides, plans often start in the mid‑hundreds per month, and scale up based on volume and features.

7. OneBill

If you're a B2B business, then OneBill may be the solution for you.

OneBill is a subscription billing platform built with B2B businesses in mind, especially ones that have a mix of recurring, usage‑based, and one‑time revenue. The platform can also handle quotes, contracts, pricing tiers, and everything in between, in one place.

A feature that stood out for me is that OneBill brings quote‑to‑cash workflows together. That means you can manage pricing, generate quotes, automate billing, and track revenue all in the same system.

It’s the kind of tool that works well for companies with complex billing needs, especially where manual processes are slowing teams down.

Keep in mind that it's not as plug‑and‑play as some simple SMB tools, but if your business needs flexibility and you want to unify your monetization stack, it’s worth a look.

Key features:

- Subscription and usage‑based billing

- Quote‑to‑cash automation

- Contract and pricing management

- Automated renewals and invoicing

- Revenue reporting and analytics

- ERP/CRM integrations

Pricing:

- OneBill doesn’t list pricing publicly, so you’ll need to contact their sales team. From industry discussions, pricing tends to vary widely based on features and company size, so it’s best to get a tailored quote.

8. Zoho Billing

If your business needs flexible subscription billing with recurring, usage‑based, and tiered pricing models, Zoho Billing is a strong choice. It goes beyond recurring payments by supporting metered billing, usage addons, and configurable plan structures.

Zoho Billing automates invoicing, retries payments through dunning management, and takes care of subscription lifecycle events like upgrades, downgrades, and renewals.

The platform also provides a customer portal for self‑service, letting subscribers update payment methods, view invoices, and manage subscriptions without extra support work. Advanced reporting and analytics help you track key metrics and monitor performance.

Zoho Billing integrates seamlessly with Zoho CRM, accounting, and other tools, so your billing data stays connected. Revenue recognition features are available when enabled, helping with compliance and financial reporting.

Key features:

- Recurring, usage‑based, and tiered billing

- Automated invoicing, payment retries & dunning

- Multi‑currency and global tax handling

- Customer self‑service portal

- Integrations with CRM, accounting, and analytics tools

Pricing:

- Zoho Billing has tiered plans with transparent pricing, starting around $29–$39/month for basic features and going up to about $69–$79/month for more advanced subscription billing

- Enterprise/custom pricing for high‑volume or deeply configured setups

9. BillingPlatform

BillingPlatform is built for businesses that need full control over complex subscription and billing scenarios.

Instead of just processing recurring payments, it lets you manage tiered plans, usage-based billing, hybrid models, and more, all in one system.

BillingPlatform has a good level of customization: you can automate invoicing, renewals, dunning, revenue recognition, and reporting to match your exact business workflows. It also integrates with ERP, CRM, and analytics tools, so all your subscription data stays connected across your tech stack.

This platform is best suited for larger organizations or companies with complicated billing requirements, but teams that need flexibility and detailed control over subscriptions tend to find it invaluable.

Key features:

- Recurring, usage-based, and tiered billing

- Automated invoicing, dunning, and renewals

- Revenue recognition and compliance tools

- Multi-currency and global tax support

- ERP, CRM, and analytics integrations

- Advanced reporting and dashboards

Pricing:

- BillingPlatform has custom pricing based on your business size and feature needs. Industry sources suggest enterprise costs typically start in the tens of thousands per year and scale up.

10. Younium

Younium is another subscription billing platform built specifically for B2B SaaS and businesses with complex pricing and revenue workflows.

Instead of only handling recurring charges, Younium gives you a central system to manage subscriptions, billing automation, usage charging, revenue recognition, reporting, and more.

With Younium, you can model virtually any pricing structure - flat fees, usage‑based, tiered, hybrid, contract milestones, etc - and automate the billing rules behind them.

On top of that, multi‑entity support and multi‑currency billing also make it a practical fit for international teams.

Younium comes with reporting and analytics that help you track key subscription metrics (like MRR/ARR), monitor churn, and simplify financial reporting.

It also integrates with CRM, ERP, accounting, and payment systems so your revenue data stays connected across tools.

Key features:

- Flexible subscription pricing models (flat, tiered, usage, hybrid)

- Automated billing and invoicing with dunning automation

- Revenue recognition compliant with accounting standards

- Multi‑currency, multi‑entity support

- Self‑service customer portal for subscription management

- Real‑time metrics and reporting dashboards

- Integrations with CRM, ERP, and finance systems

Pricing:

- Younium doesn’t publish flat pricing you’ll need to request a quote. But according to industry listings and user review sites, plans start around SEK 500/month (~$50–$60 USD), however, the final cost depends on your usage and needs.

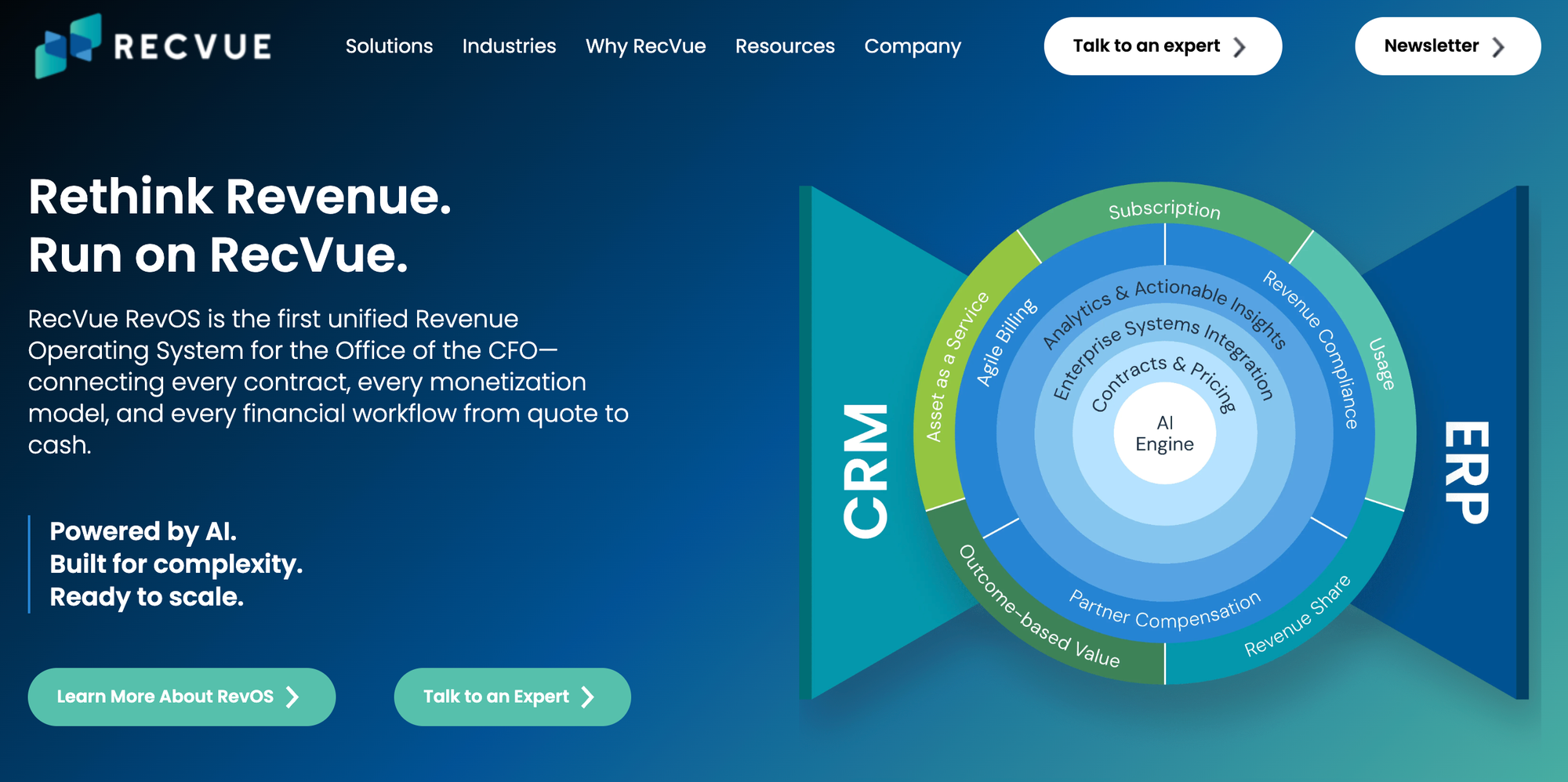

11. RecVue

When you need a platform that can handle complex subscription billing and revenue ops at scale, RecVue is one of the options worth a close look.

It’s more than just recurring billing - it’s built as a unified revenue operating system that connects billing, revenue recognition, contract changes, usage billing, and more all in one place.

RecVue supports subscription, usage‑based, tiered, and hybrid pricing models, and it’s designed to deal with complicated scenarios like large contract changes, partner settlements, and regulatory compliance (ASC 606/IFRS 15 -accounting standards that define when and how revenue is recognized).

RecVue also integrates with ERP and CRM systems so your financial and customer data stays connected, which is crucial for bigger teams and enterprise workflows.

One thing to be aware of: RecVue is built for complexity, so it’s usually best for larger businesses with demanding billing and revenue needs rather than small startups. And because of that, pricing reflects that enterprise focus.

Key features:

- Subscription, usage‑based, and hybrid billing support

- AI‑assisted billing automation and revenue ops

- Automated revenue recognition and compliance with ASC 606/IFRS 15

- Contract lifecycle and billing event management

- Multi‑currency and global support

- ERP/CRM integrations and real‑time analytics

Pricing:

- RecVue doesn’t publish pricing publicly, you have to talk to their team for a quote. Based on industry references and review sites, many companies cite a starting ballpark of around $50,000+ per year for enterprise usage, though the final price varies based on volume and complexity.

12. Aria Systems

Aria Systems is an enterprise-grade subscription and monetization platform built to handle very complex billing and pricing models.

It supports recurring, usage-based, and hybrid subscriptions, making it a popular choice for large tech, telecom, and media companies that need flexible automation and integrations.

What sets Aria apart is its ability to manage the full billing lifecycle, including invoicing, proration, dunning, and revenue recognition, while connecting seamlessly with ERP and CRM systems.

Users also appreciate the reporting and analytics features, which provide insight into revenue trends, churn, and customer behavior.

Aria is designed for scale, so it’s better suited for enterprises rather than small startups. That focus on complexity is reflected in its pricing.

Key features:

- Recurring, usage-based, and tiered billing

- Automated invoicing, proration, dunning, and payment orchestration

- Integrations with ERP, CRM, and analytics systems

- Revenue recognition and compliance reporting

- AI-assisted billing workflows for complex scenarios

Pricing:

- Aria Systems doesn’t publish pricing publicly, but based on industry reviews and references, smaller enterprise deployments typically start in the tens of thousands per year, while larger, full-scale implementations can reach hundreds of thousands annually.

13. Frisbii (formerly Billwerk+)

Frisbii is a European‑focused subscription management and billing platform that helps businesses automate their recurring revenue workflows.

It covers everything from plan setup and billing cycles to automated dunning, invoicing, and customer self‑service, with strong compliance and security features tailored for EU markets.

Frisbii impresses me with it's flexibility and depth: you can configure complex pricing models (flat, tiered, add‑ons, usage), automate revenue processes, and integrate with CRM, ERP, and accounting systems.

It’s well suited for SaaS and other subscription businesses that want a scalable platform without building their own billing stack.

Key features:

- Subscription lifecycle management (plans, trials, renewals)

- Recurring billing and automated invoicing

- Automated dunning, retries, and payment workflows

- Customer portal and self‑service subscription management

- Integrations with payment gateways, CRM/ERP, and accounting tools

Pricing:

- Frisbii doesn’t publicly list flat pricing, but review sites show flexible pricing starting at around €19/user/month for basic plans, with more fully featured tiers (e.g., professional automation) up to the mid‑hundreds per month, and custom enterprise pricing for larger customers.

14. FastSpring

FastSpring is an all‑in‑one subscription billing and ecommerce platform that acts as a merchant of record, meaning it handles payments, global tax compliance (VAT/GST), invoicing, and subscription management on your behalf.

It’s a solid choice if you’re selling digital products or SaaS globally and want to offload the complexity of tax management and compliance across regions.

I've found that users like FastSpring because it supports flexible billing models, branded checkout pages, multiple currencies, and global payment methods - but reviews also note that support responsiveness and some UX quirks can be inconsistent.

Key features:

- Subscription and recurring billing with flexible billing models (prorations, upgrades, downgrades)

- Merchant of Record model (global tax/VAT compliance, fraud prevention, chargebacks)

- Branded checkout and localized payment experiences

- Integrated reporting and analytics

- Multiple payment methods and multi‑currency support

Pricing:

- FastSpring doesn’t publish flat pricing. Instead, it uses a custom revenue‑sharing or flat‑rate model based on your transaction volume and business needs, and you work with sales to get a tailored quote.

15. Sage Intacct

Sage Intacct is an enterprise-grade accounting platform with powerful subscription billing built in. It’s designed for finance and operations teams that want recurring revenue management tied directly to their accounting workflows.

If your business needs both solid billing and accurate financial reporting, this platform keeps everything connected and compliant.

What I like about Sage Intacct is how it treats subscriptions as part of the financial operations stack rather than just a payment tool. It tracks MRR, ARR, churn, and deferred revenue while staying compliant with ASC 606/IFRS 15.

This makes it a strong option for larger B2B SaaS or service companies that want a single source of truth for revenue.

Key features:

- Automated recurring billing and invoicing

- Revenue recognition and compliance (ASC 606/IFRS 15)

- Subscription metrics and reporting (MRR, ARR, churn)

- Multi-entity and multi-currency support

- Integrations with CRM and ERP systems

Pricing:

- Sage Intacct doesn’t list flat pricing publicly. Based on reviews, enterprise subscription billing setups typically start in the tens of thousands per year, scaling higher for multi-entity or global deployments.

16. Sticky.io

Sticky.io is a subscription management platform designed for companies that want flexible recurring billing with advanced automation.

It handles recurring, usage-based, and hybrid pricing models, and it’s particularly popular with merchants that need custom workflows, multi-gateway support, and partner commissions.

Sticky.io balances complexity and usability. It’s powerful enough to automate complicated billing scenarios, but doesn’t require building everything from scratch.

Key features:

- Recurring, usage-based, and tiered billing

- Automated proration, dunning, and retries

- Multiple payment gateway integrations

- Partner management and commission tracking

- Real-time revenue dashboards and analytics

Pricing:

- Sticky.io doesn’t publish flat pricing publicly, however, based on review sites, SMB plans often start around $300–$500/month, while enterprise plans can reach $2,000+/month depending on volume and complexity.

17. Paddle

Paddle is a Merchant of Record platform that handles subscription billing, payments, taxes, and compliance for you.

It’s perfect for SaaS or digital product companies that sell internationally, because Paddle automatically manages VAT, GST, and sales tax, reducing administrative headaches.

I like Paddle because it lets businesses focus on growth instead of worrying about tax compliance or legal complexities. Users also appreciate the flexible subscription models and branded checkout experience, making it easy to sell globally without building a custom payment infrastructure.

Key features:

- Subscription and recurring billing (monthly, annual, custom cycles)

- Merchant of Record for global tax compliance

- Branded checkout and localized payment experiences

- Revenue analytics and reporting

- CRM and analytics integrations

Pricing:

- Paddle doesn’t use flat fees. Industry references report a ~5% revenue share per transaction, with enterprise deals negotiable for high-volume sellers.

18. Stax Bill

Stax Bill is a subscription billing platform built for growing SaaS and service businesses.

It handles tiered, usage-based, and hybrid billing while automating invoicing, dunning, and revenue tracking. What I like is that it’s flexible without being overwhelming, so you get advanced features without needing a developer-heavy setup.

It’s particularly useful for companies that run complex plans or frequently change subscriptions mid-cycle, because the platform keeps billing accurate and predictable.

Key features:

- Recurring, usage-based, and tiered billing

- Automated invoicing, dunning, and proration

- Subscription analytics (MRR, churn, LTV)

- Multi-currency and tax handling

- Integrations with CRM, ERP, and payment gateways

Pricing:

- Stax Bill doesn’t publish flat pricing. Based on reviews, small businesses often start around $200–$300/month, while larger or enterprise subscriptions can reach the low thousands per month.

19. Wave

Wave is a free or low-cost invoicing and accounting platform that also supports recurring payments. It’s ideal for freelancers, creators, and small businesses that need simple subscription management without a complex enterprise tool.

With Wave, you can quickly set up recurring invoices and accept payments, even if your business is just starting out.

While it doesn’t offer advanced usage-based billing or global compliance features, it covers the basics well, making it a practical choice for straightforward recurring revenue.

Key features:

- Automated recurring invoices

- ACH and credit card payment support

- Simple dashboards for revenue tracking

- Accounting and bookkeeping integration

- Customer management and payment reminders

Pricing:

- Wave is free for core invoicing and accounting

- Payment processing fees are 2.9% + $0.30 per card transaction, with no monthly subscription fee

20. JustOn

JustOn is a subscription billing automation platform built on Salesforce, perfect for businesses that already rely on Salesforce CRM.

It manages recurring, usage-based, and hybrid billing while keeping invoicing and revenue recognition in the same system.

JustOn removes the need for manual billing spreadsheets or separate tools, especially if your team is already embedded in Salesforce. It’s particularly strong for B2B SaaS or service companies with complex subscription terms.

Key features:

- Recurring, usage-based, and tiered billing

- Automated invoicing, proration, and dunning

- Revenue recognition compliant with ASC 606

- Full Salesforce CRM integration

- Multi-currency and tax handling

Pricing:

- JustOn doesn’t publish flat pricing. Based on reviews, plans typically start in the low thousands per year, scaling with Salesforce licenses and subscription volume.

Other platforms with recurring payments

Not every business needs a full subscription billing system. Sometimes you just need a simple way to charge customers repeatedly.

The difference is that subscription billing manages the entire lifecycle of a recurring revenue stream - with features like automated plan changes, customer self-service, and revenue tracking - while recurring payments are just fixed charges that happen automatically at regular intervals (like monthly invoices).

My honorable mentions for recurring payment solutions are:

Other mentions:

- PayPal: automatic recurring payments for invoices or services

- Square: recurring invoices and payments for small businesses.

- Wave: free invoicing and accounting with recurring payment support

- QuickBooks Online / QuickBooks Payments: recurring charges tied to accounting workflows

- Stripe (basic payments): can accept recurring charges, but without full subscription management

- Chargely / BoxPay: lightweight recurring payment tools for creators and small businesses

How to choose the right subscription billing software for your business

I've covered twenty subscription billing solutions, so I understand if you're feeling overwhelmed.

Here’s how I look at it when helping businesses pick the right one:

Pricing that suits your business

Not all billing platforms use the same pricing structure. Some charge flat monthly fees, others take a cut of transactions, and some have usage-based pricing. And hidden costs like per-customer or per-invoice fees can quickly add up as you grow.

Look for clear, transparent pricing.

Ask yourself:

- Will costs stay reasonable as I grow?

- Does the platform scale without surprise charges?

Integration with your existing tools

You don't want to add another tool that overcomplicates your processes. Strong integrations and APIs mean your data flows automatically and your dashboards stay accurate.

So look for subscription software that integrates with your:

- CRM

- Accounting software

- Payment gateways

Bonus points for webhook support or prebuilt connectors.

Customer support and onboarding

Customer support is everything. Even the best platform is only as good as the help you get when things go wrong.

Check for:

- Personalized onboarding or account management

- Tutorials, docs, and responsive support

- Clear guidance for setup and troubleshooting

Scalability and flexibility

The last thing you want is to outgrow your billing system in a year. No matter how small your business starts, think about whether the software can handle more customers, more plans, and more complex pricing as your business grows.

Look for platforms that allow you to easily add tiers, adjust billing cycles, or handle new usage-based models without major migrations.

Reporting and analytics

I've already explained the importance of paying attention to details. Metrics drive decisions. If your platform can’t tell you how much recurring revenue you have, where churn is coming from, or what your LTV looks like, you’re flying blind.

Must-haves:

- Real-time dashboards

- ARR/MRR reporting

- Churn, retention, and expansion insights

- Revenue recognition automation

- Exportable data for BI tools

Subscription billing mistakes I see all the time (and how to avoid them)

Even experienced businesses trip up when it comes to subscription billing. I’ve seen recurring issues across small businesses, SaaS, and creator platforms, and most of them are completely avoidable.

Here’s what to watch out for:

Overcomplicating your pricing

I've seen businesses try to create a “perfect” pricing model with dozens of tiers, add-ons, and usage-based rules.

Unfortunately, this ends in confused customers and abandoned carts.

What to do instead:

Start simple. Offer a clear monthly and annual plan, and only add complexity when your audience demands it.

Ignoring failed payments

Failed payments happen, and that's completely normal. Many subscriptions fail due to expired cards or banking errors.

But ignoring them or not having a retry strategy is leaves money on the table. In fact, subscription businesses lose around 9% of revenue thanks to failed payments - but recover around 60% of failed charges with automated retries and dunning.

What to do instead:

Implement smart dunning: automated retries, friendly payment reminders, and an easy way for customers to update payment info. Tools like Whop, Recurly, or Chargebee handle this out of the box.

Relying on manual billing

I've seen some businesses try to manage subscriptions with spreadsheets or generic invoicing tools. It can work at first, but once you start scaling, it all becomes a mess. Manual processes lead to errors, missed payments, and frustrated customers.

What to do instead:

Automate your subscription workflows from day one, no matter how small your business is.

Not tracking key metrics

If you’re not measuring MRR, churn, LTV, or ARR, you’re not paying enough attention. To make more money, you need to know what your current revenue is doing.

What to do instead:

Use platforms that give you real-time dashboards and analytics. Even a simple view of churn or monthly recurring revenue can prevent small problems from becoming big ones.

Why businesses choose Whop for recurring revenue

If you want a subscription billing platform that actually simplifies your life, Whop is it.

Whop is an all-in-one business solution handling payments, product delivery, access control, and analytics.

Whether you sell memberships, subscriptions, one-time products, or bundles, Whop automates renewals, manages failed payments, and ensures payouts reach you on time.

Customers get a self-service billing portal where they can update payment methods, view invoices, cancel or transfer subscriptions, and manage their memberships without contacting support.

This means less support requests for you and more control for your customers.

Pricing is straightforward: 2.7% + $0.30 per transaction, with no monthly platform fee.

Everything from product creation to customer access lives under one roof, saving time, reducing errors, and letting you focus on growth.

Whop isn’t just a billing tool - it’s the backbone of your subscription business.

FAQs

What is subscription billing software?

Subscription billing software is a tool that automates recurring payments for memberships, services, or products. It handles invoicing, payment processing, renewals, dunning, and reporting, reducing manual work and improving cash flow for businesses of all sizes.

How does subscription billing software help businesses?

It helps businesses by automating recurring revenue, reducing failed payments, tracking key metrics like MRR and churn, and simplifying customer management. This allows companies to scale efficiently without relying on manual processes.

What types of subscription billing models exist?

Common subscription billing models include recurring (fixed), usage-based, tiered, and hybrid. Most modern platforms support multiple models, allowing businesses to offer flexible pricing that matches customer needs.

How do I choose the right subscription billing software?

Consider your business size, pricing models, integration needs, and automation features. Look for platforms that support recurring and usage-based billing, provide analytics, and integrate with your CRM, accounting, and payment systems.

Can subscription billing software handle global payments and taxes?

Yes, many platforms support multi-currency payments, international tax compliance (VAT, GST), and automated revenue recognition. This ensures your business can sell subscriptions globally without manual tax calculations or compliance issues.

Subscription billing glossary

ARR (Annual Recurring Revenue): Total revenue expected from subscriptions over 12 months. Key metric for subscription businesses.

MRR (Monthly Recurring Revenue): Revenue generated each month from active subscriptions. Helps track growth and cash flow.

Churn: The rate of subscription cancellations or non-renewals. High churn can hurt recurring revenue.

LTV (Customer Lifetime Value): Total revenue a customer brings during their subscription lifetime. Critical for forecasting.

Dunning: Automated follow-ups for failed payments, including reminders and retries, to recover revenue.

Proration: Adjusting subscription charges when customers upgrade, downgrade, or change billing mid-cycle.

Revenue recognition: Accounting process to record earned subscription revenue in compliance with ASC 606/IFRS 15.

Self-service billing portal: Online portal where subscribers can manage payments, invoices, and cancellations without support.

Tiered billing: Pricing model offering multiple service levels or feature tiers at different prices.

Usage-based billing: Charging customers based on their actual consumption or activity instead of a fixed fee.

Hybrid billing: Combining fixed subscription fees with usage-based charges in one plan.

Merchant of Record (MoR): The entity handling payments, tax compliance, and chargebacks on behalf of the business.

No-code setup: Platform configuration without programming, letting users launch subscriptions quickly.

Multi-currency support: Accepting payments in multiple currencies with automated conversions and tax handling.

Global tax compliance (VAT/GST): Ensuring subscriptions include correct taxes based on the customer’s country or region.